Gold has respectable gains, but still based on dollar weakness and not buying

Video section is only available for

PREMIUM MEMBERS

Golf futures basis the most active December 2022 Comex contract is currently up $11.20 and fixed at $1669.70. Noteworthy was today’s intraday high of $1679.40 which came in just below the first level of resistance at $1680. However, once again we can see that while gold’s gains are respectable, they are based entirely upon dollar weakness. Furthermore, market participants bid the precious metal lower.

According to Reuters, “Gold prices rose to a two-week high on Wednesday as the dollar and U.S. bond yields slipped on expectations the Federal Reserve will temper its aggressive rate-hike stance starting December.”

As of 4:05 PM EDT, the dollar index is down 1.290 points or 1.16% and fixed at 109.54. The lack of market participants bidding gold higher can be seen through the eyes of the Kitco Gold Index (KGX). The screen print above of the KGC was taken at 3:53 PM EDT and shows spot gold was currently fixed at $1665 with a net gain of $11.90. However, as we have seen on multiple occasions recently it was dollar weakness that moved spot gold pricing up by $17.20, and selling pressure taking gold lower by $5.30.

This clearly shows that market participants continue to have their primary focus on the pace and magnitude at which the Federal Reserve continues to raise interest rates. It is widely accepted that the Federal Reserve will raise rates by 75 basis points in November and for the most part, has already been factored into current market pricing. It is also widely believed that the Federal Reserve will continue to raise rates at the December FOMC meeting.

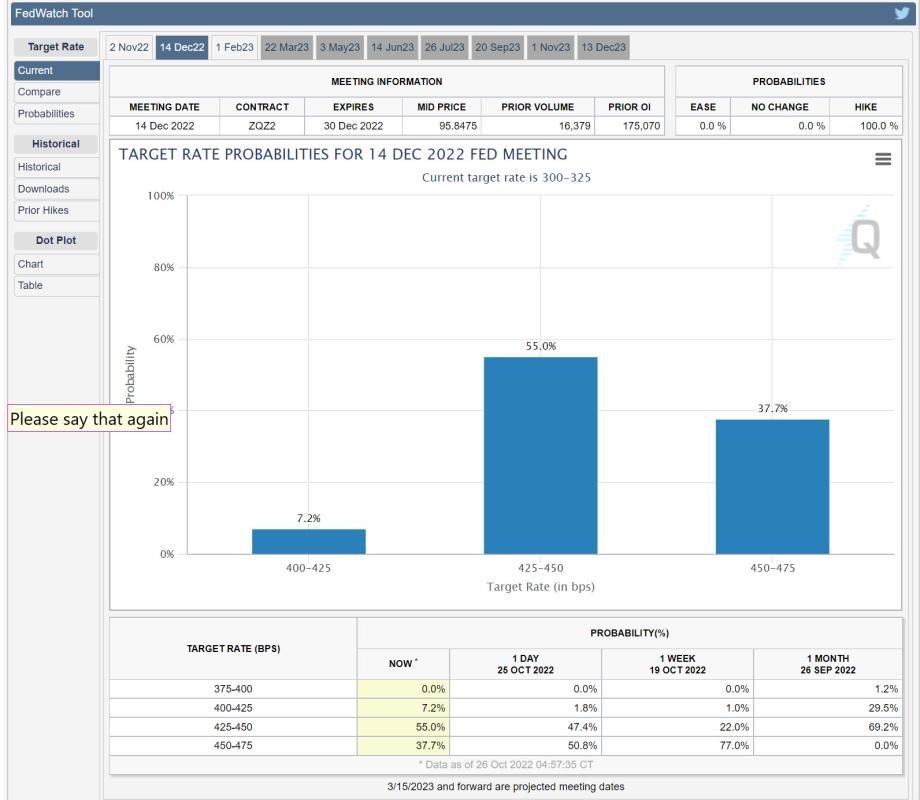

According to the FedWatch tool there is a 55% probability that the Federal Reserve will raise rates to between 425 and 450 basis points, and a 37.7% probability that they will raise rates to between 450 and 475 basis points in December.

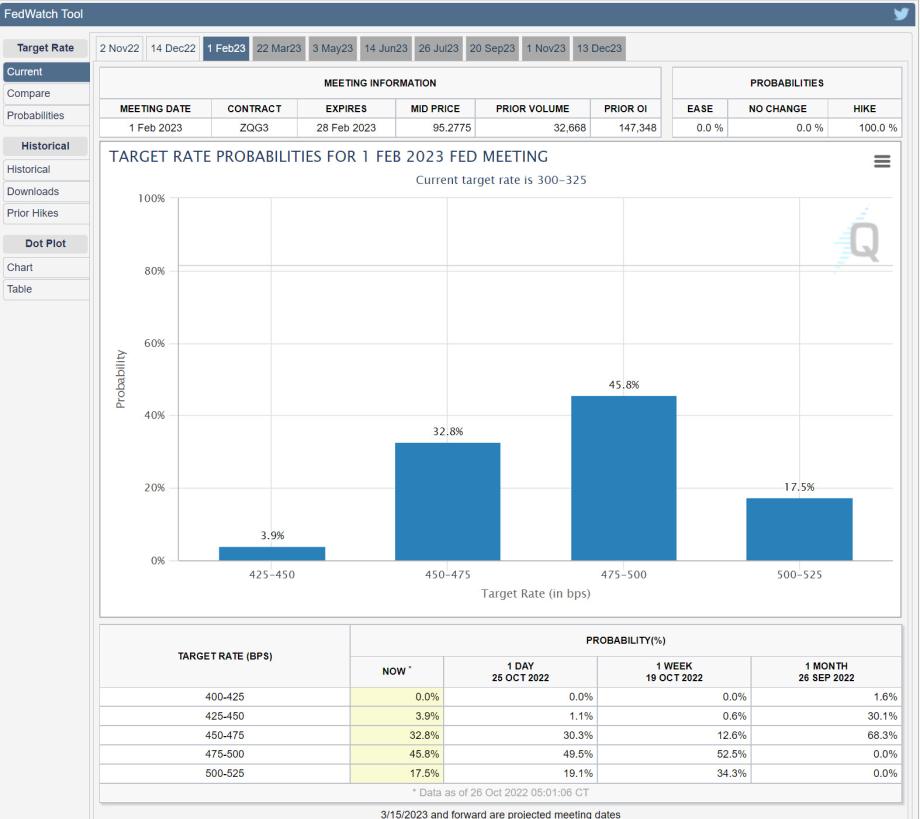

In February 2023 there is no decisive consensus about the size of the rate hike. According to the CME’s FedWatch tool, there is a 26.8% probability that the Federal Reserve’s benchmark rate will be between 450 and 475 basis points, a 42.4% probability that the fed funds rates will be between 475 and 500 basis points, and a 23.7% probability that by the end of the year the benchmark rate will be between 500 and 525 basis points.

The uncertainty in regard to the magnitude of upcoming rate hikes is directly related to anticipating how the Federal Reserve’s will be modified as more data becomes available to them. This week there will be critical reports that will help shape the Federal Reserve’s decision on rate hikes in both November and December.

On Thursday the government will release its data on the third quarter GDP as well as updated figures on the national debt of the United States. On Friday the government will release its report on the core inflation numbers or PCE. This could provide key and important data that will guide what upcoming actions of the Federal Reserve might be.

The most important question is while economists and analysts are expecting to see an economic contraction based upon the rapid rate hikes that began in March. However, how inflationary pressures will react if we don’t see a reduction in inflation following five consecutive rate hikes by the Federal Reserve this year?

The fear remains that after all of the rate hikes by the Federal Reserve Friday’s report reveals it had only a nominal effect on lowering inflation.

Wishing you as always good trading,

Gary S. Wagner - Executive Producer