Today, the U.S. Bureau of Labor Statistics released its most current report on inflationary pressures via the March CPI (Consumer Price Index) report. Concurrently, the Federal Reserve released the minutes from last month's FOMC meeting.

Recent Reports

As of 5:30 PM EDT, gold futures hit a new record high of $2,384.50 per ounce, with the most active June contract closing up $11.40 at $2,362.40.

Pagination

- First page

- Previous page

- …

- 3

- 4

- 5

- 6

- 7

- …

- Next page

- Last page

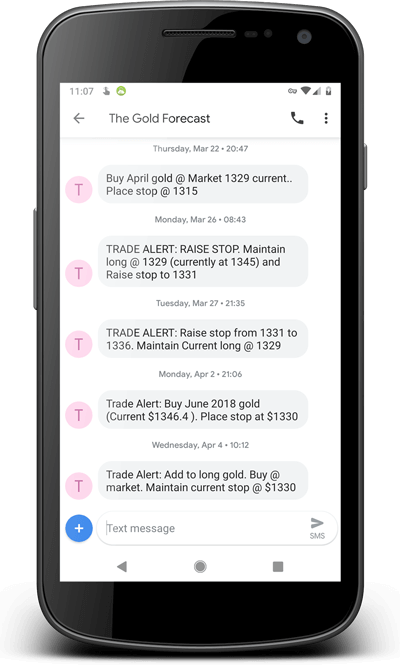

Trade Alerts

With our timely trade alerts sent via e-mail and text message (SMS), you won't miss an opportunity to make a trade. Moreover, these alerts will eliminate having to constantly monitor the markets and your trades.

We offer Trade Alerts for Gold Futures (GC), XAUUSD (forex), GLD, Silver Futures (SI), XAGUSD, and SLV.

SMS feature is available in 150+ countries

Money Managment

Money management is an essential component of a successful trading strategy. We use stops to define risk, and maximize profits.

- Stops limit loss exposure to a redefined amount & lock in profits by trailing them tighter when a trade moves favorably

- Defines risk and reward, thereby removing any emotional influences.

Example trade alert:

Gold Futures:

Buy June Gold (GC M21) at the market (current 1744). Place stop at 1704.

Endorsements of Confidence

Gary is one of the most skilled technicians I have met during my time covering the markets. Dedicated, reputable and skilled…

Editor-in-Chief, Kitco News

Our Team

Gary S. Wagner

CEO & executive producer

Joseph M. Wagner II

Editor & technical analyst

Konrad Urbanowicz

CTO / trader

Beata Szczeblowska

Sales / tier 1 supportWAGNER FINANCIAL GROUP IS THE PRODUCER OF THE GOLD FORECAST.

Based in Honolulu, Hawaii, our company is comprised of a dedicated group of trading, technology, and finance professionals who apply their experience, teamwork and innovation towards a common goal - helping traders succeed.

About our

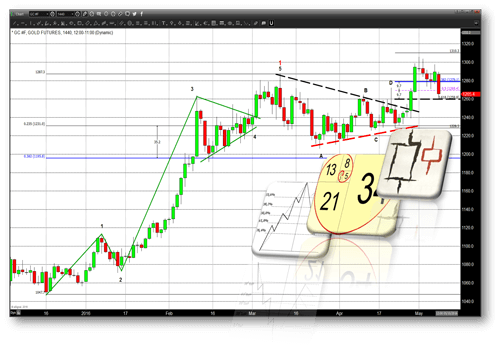

Trading System

The system that we use for trade recommendations is a hybrid method in which we combine fundamental data with three primary technical studies. We look at fundamental data for the "big" picture, which we weave into our technical studies. These studies help us identify key pivot points. They also provide us with the timing for entrance and exits of trades, as well as stop placements.

The three technical methods we combine are Japanese Candlesticks, Elliot wave theory and Fibonacci retracement.

More about trading system

Paid subscription features

Below sections of the website are available only to paid subscribers and are not part of our free newsletter

DAILY VIDEO

A 5-10 minute technical analysis presented by Gary Wagner published around 5 PM EST. Includes studies incorporating Elliot wave models, Fibonacci retracement and candlestick patterns.

TRADE ALERTS

Buy and Sell signals with stops, sent via e-mail, text message (SMS), and posted to private Twitter.

PROPER ACTION

Defines current active trade and stop placement suggestion.

MARKET FORECAST

Tells subscribers where we think prices will go over the short and interim term.

CHART GALLERY

HD images of our most current charts. These charts include all of the technical studies used to create the show and other current models and studies.

BITCOIN ANALYSIS

Briefings about Bitcoin futures, pertaining to the cash settled, 5-coin contracts offered by the CME, (BTC). Joseph Wagner goes over the recent technical data behind the first and largest CFTC regulated Bitcoin exchange.