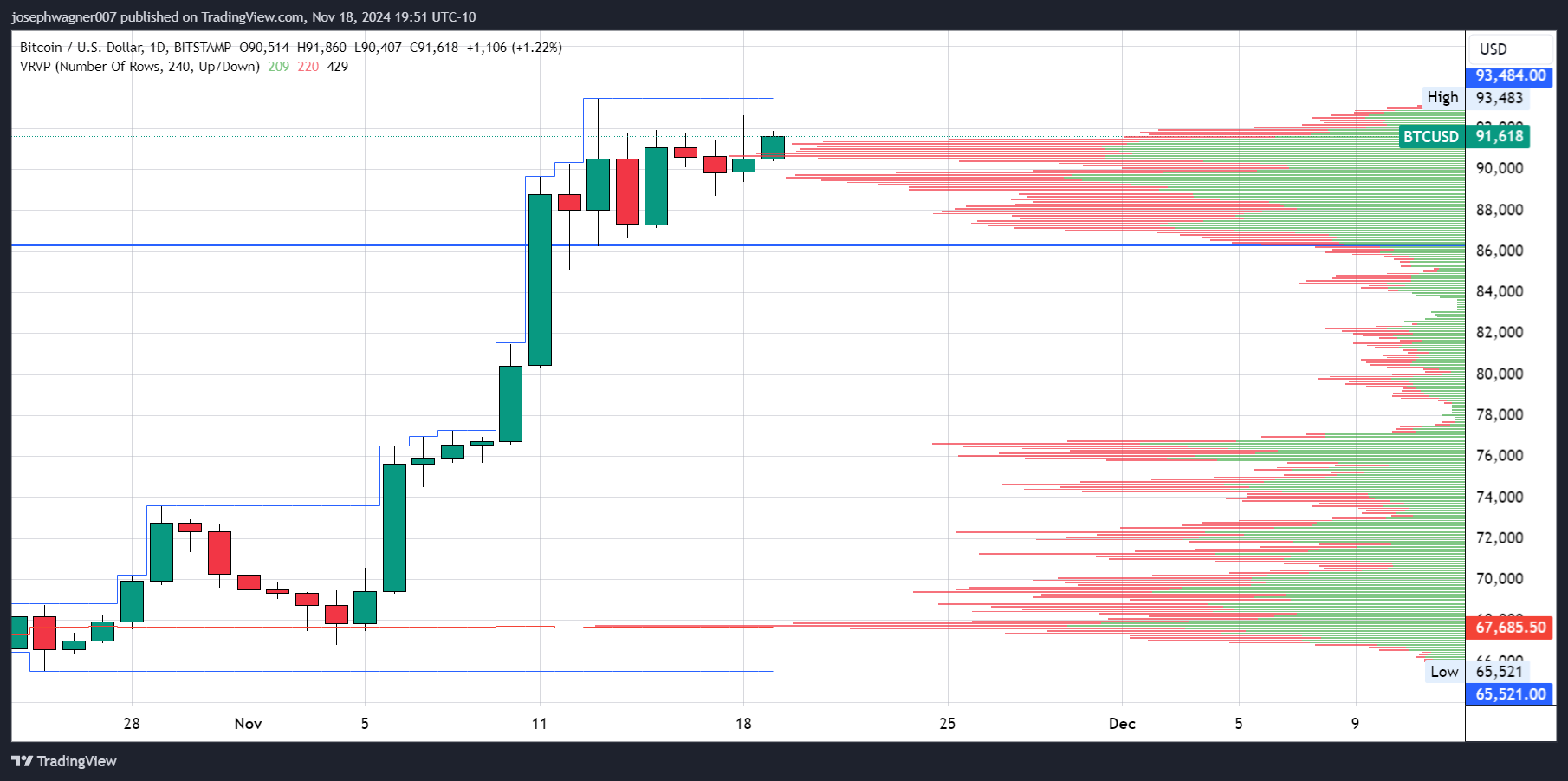

Bitcoin builds base before next move

Bitcoin continues to break ground and break records, oscillating around Friday's historic close of $91,070. The original cryptocurrencies resilience above $85,000 over the past six days paints a picture of strength, particularly following the November 11th surge that saw prices rocket $8,345 higher (10.38%).

Recent price action speaks volumes about market sentiment. Notably, volatility has cooled across the last three sessions, indicating a healthy consolidation at these elevated levels.

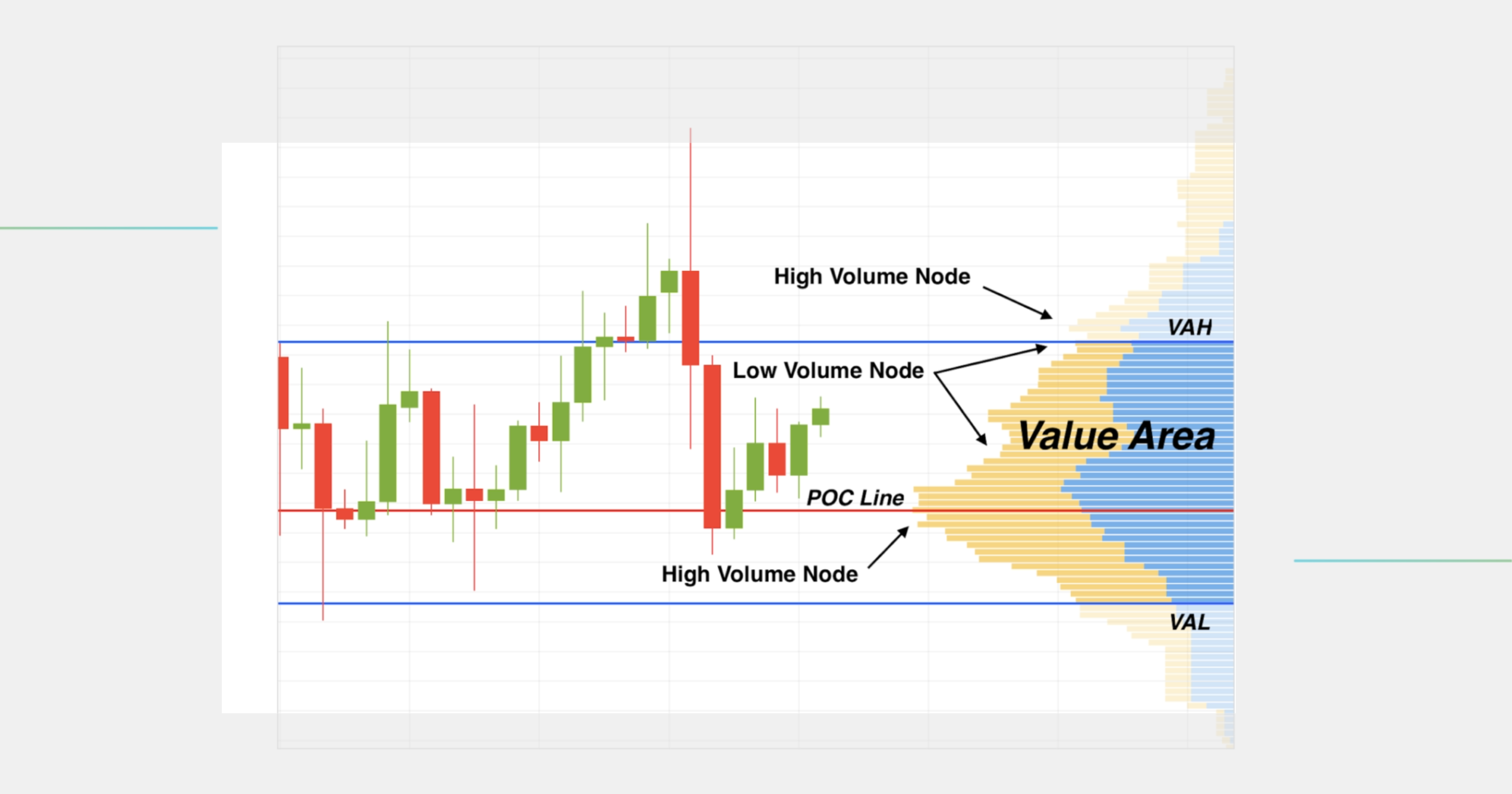

The VRVP shows us how many buyers and sellers there were at every given price point for any predetermined period. This tool is often used to spot potential support or resistance areas which appear as the longest sections of a histogram which is overlayed on the chart horizontally, unlike traditional volume histograms that often are drawn at the bottom of the chart stretching vertically.

Other than its sideways appearance, it functions like a traditional volume histogram except the length of the sections is determined by the total trading volume at each individual price shown on the price axis instead of the time axis.

Volume Profile analysis over the past month reveals critical market structure. The Point of Control sits near $67,600, with robust buying interest extending up to $77,000. A significant volume gap emerges above this level before reconnecting with heavy trading activity around $87,000, culminating in a secondary volume peak at $90,000.

This paints a clear picture, Bitcoin has established meaningful support at $90,000, suggesting a springboard for potential moves toward $98,000. While a breakdown could trigger a retreat to $77,000, the market's structural footprint favors upside momentum.

The bearish scenario appears less probable given the volume structure and price action characteristics. The path of least resistance points toward $98,000, supported by decreasing volatility and healthy volume profiles at current levels.