Frequently asked questions

Service / account

The Gold Forecast is a paid subscription service for traders and investors.

Paid subscription service includes daily videos, trade alerts, in-depth technical analysis, and other tools that traders and investors can use to make informed decisions when trading or investing in gold and other markets.

The Gold Forecast also offers free newsletter providing analysis and forecasts for the price of gold based on market trends, political and economic events, and other factors that may affect the price of gold and other markets.

The Gold Forecast's service is video based, our data, advisements and results are there for the world to see. Anyone can look at the past signals we issued and watch our daily show to cross check each trade. We take pride in the fact that we are as transparent or more transparent than any other service.

Moreover, Gary our host has 35 years of experience in the field and often appears on popular financial networks.

We also post all of our trades to our private Twitter. All trades are timestamped.

Yes.

In fact, more than half of our subscribers are from countries other than the U.S.

We accept Visa, MasterCard, American Express, Discover, and PayPal.

Other less common options are Bitcoin or Check.

Please email us and we will try to arrange lower pricing.

Moreover, we provide a free version of our newsletter that is released Monday through Friday. It covers only fundamental news and commentary across main markets.

Please note that the free newsletter does not include our premium technical video analysis, nor any trade signal that we provide to our paid members.

You may also watch free all of our premium content 14 days after the date it first appeared to our paid members by viewing our archive.

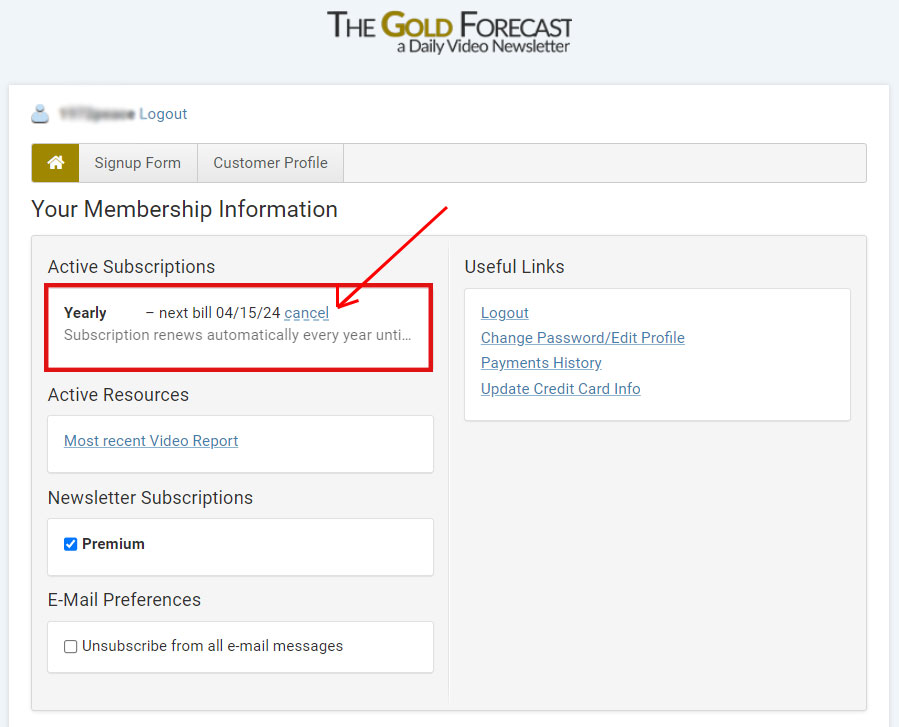

If you used Credit Card go to My Account -> Billing . Enter your login information. Click Cancel next to your subscription (see screenshot below).

If you used PayPal follow the instructions on wikiHow.

You may also e-mail us and we will cancel the subscription for you.

No.

Just like all major subscription services we do not provide any refunds.

Subscription needs to be canceled prior to automatic renewal date.

Word "subscription" means: an arrangement to receive something, typically a publication, regularly by paying in advance.

If you do not wish to be auto billed, subscriptions can be cancelled immediately after signing up process. This way user will not inquire automatic charges (recurring payments) and subscription will automatically run out.

Trading

No.

We don't day trade. We issue approximately 20 to 50 signals per year. You may refer to our track record table to see how many trade alerts we issued for particular year.

We are considered swing traders. Swing trading seeks to capture short-term gains over a period of days or weeks.

Our trade alerts are usually sent out during the US market open (9.30am-4.30pm EST).

Yes. Less than 50% of our subscribers trade futures.

Others utilize vehicles like XAUUSD (forex/spot), physical bullion, GLD (ETF), GDX, GDXJ, NUGT, individual mining stocks and other.

Please note however, that we only provide prices derived from futures data.

Please use external website https://www.investing.com/commodities/real-time-futures to calculate difference between futures entry price and stops and other markets.

There are some reputable resources for learning about futures trading:

CME Group: Provides educational resources on futures and options trading, including webinars, podcasts, and in-depth courses. Below are external link to get started:

Introduction to Futures

Course Catalog

Investopedia: Provides comprehensive education on futures trading, including futures contracts, strategies, terminology, and risk management.

The minimum amount one requires to trade gold futures depends on the broker and the exchange where the trading is taking place. However, most brokerages require a minimum deposit of $5,000 to $10,000 to trade gold futures. It's important to note that trading gold futures involves high risk, so traders should only trade with money they can afford to lose.

There are also mini and micro contracts which are 1/3 or 1/10 of regular Comex contract that require much less margin typically .

No, we don't offer personal financial recommendations. We send out trade alerts to all members.

Our annual subscription however does include two 20 minutes private conversation with Gary.

The following are some popular online brokers to trade gold futures:

StoneX

Tradovate (ease to use)

Interactive Brokers (more advanced)

TD Ameritrade

E*TRADE

Charles Schwab

It's always best to compare fees, minimum deposit requirements, and other features to find the best broker for your needs.