Bitcoin has yet to hit rock bottom

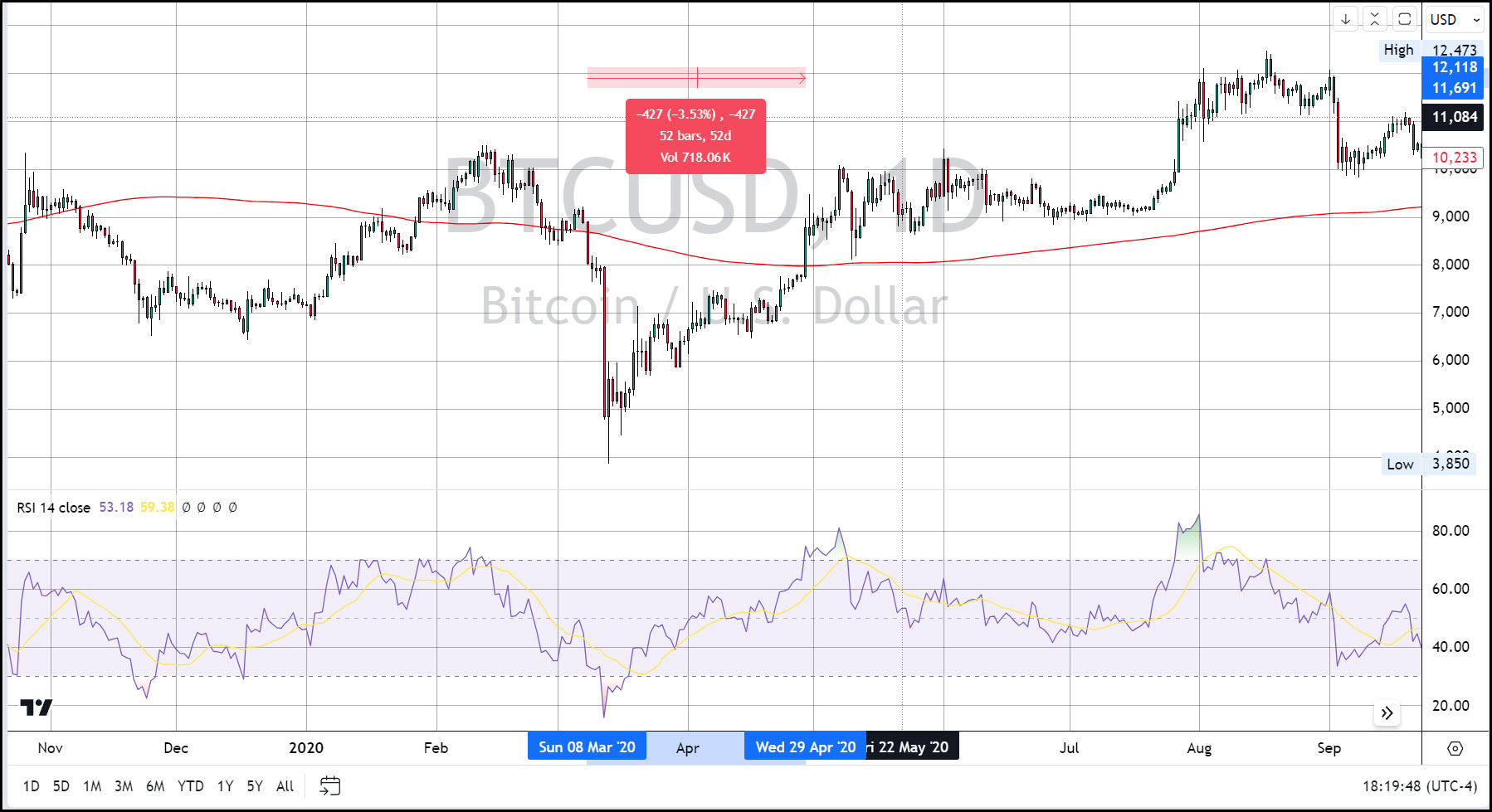

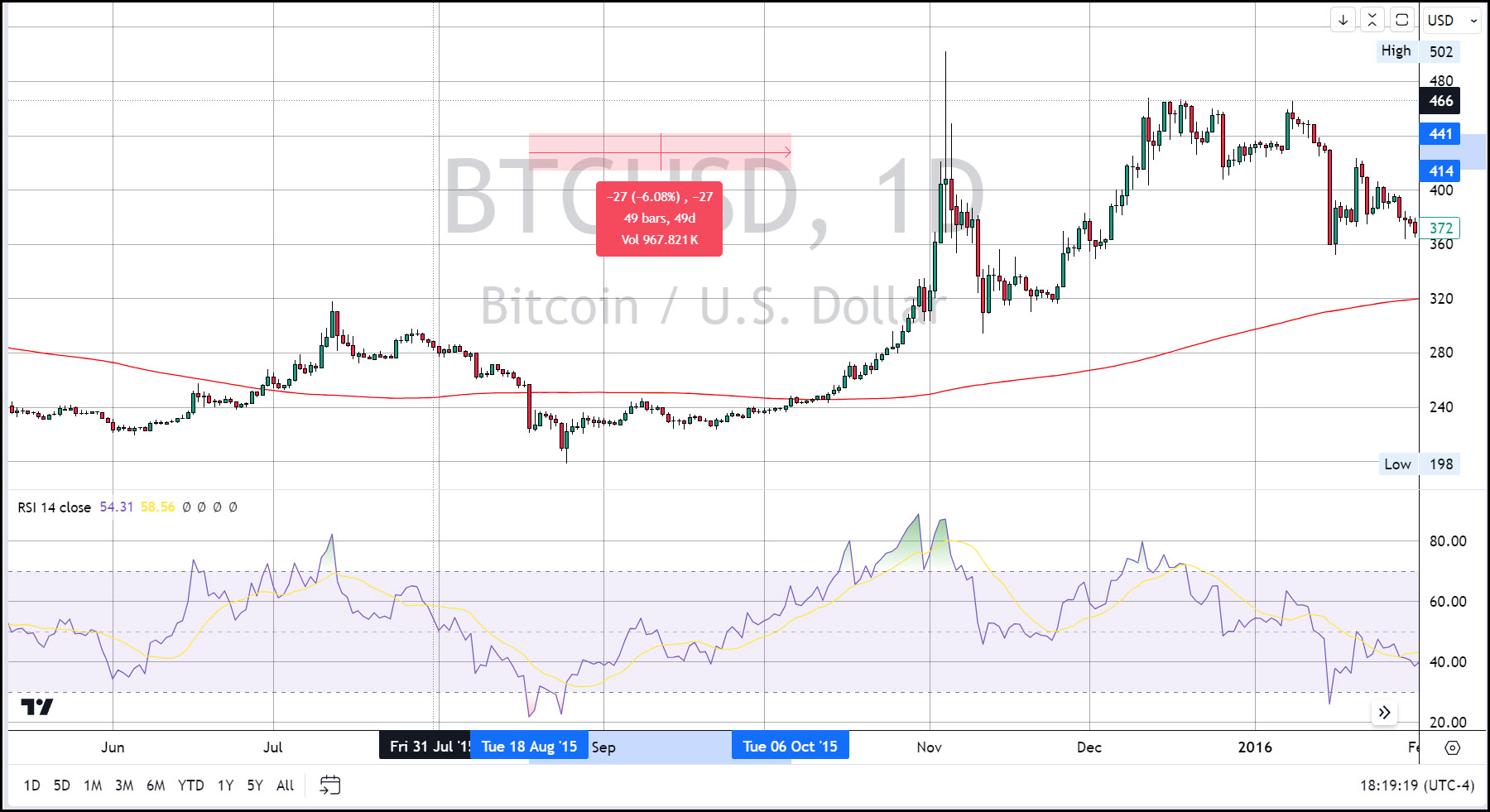

In our previous episode of The Bitcoin Minute, we predicted the breach of the 200-day moving average as a support level, noting its historical significance as a precursor to substantial rallies in Bitcoin's four-year cycles. This forecast proved accurate when Bitcoin dipped below this average on Thursday, July 4th, and has yet to move back above it after several attemps.

Historical trends suggest this phenomenon typically lasts about 50 days before Bitcoin breaks back above the moving average. Given this pattern, we anticipate the 200-day moving average may continue to act as resistance for approximately another month.

The Relative Strength Index (RSI) provides additional context to this technical picture. In previous cycles, the dip below the 200-day Simple Moving Average (SMA) coincided with the RSI entering oversold territory. The RSI then typically recovered to near-overbought levels (70+) as Bitcoin reclaimed territory above the 200-day SMA.

In the current cycle, we briefly touched oversold territory on the same day Bitcoin broke below the 200-day SMA. However, as of 6:20 PM ET, the RSI remains relatively low at 39.6, suggesting potential for further bearish pressure.

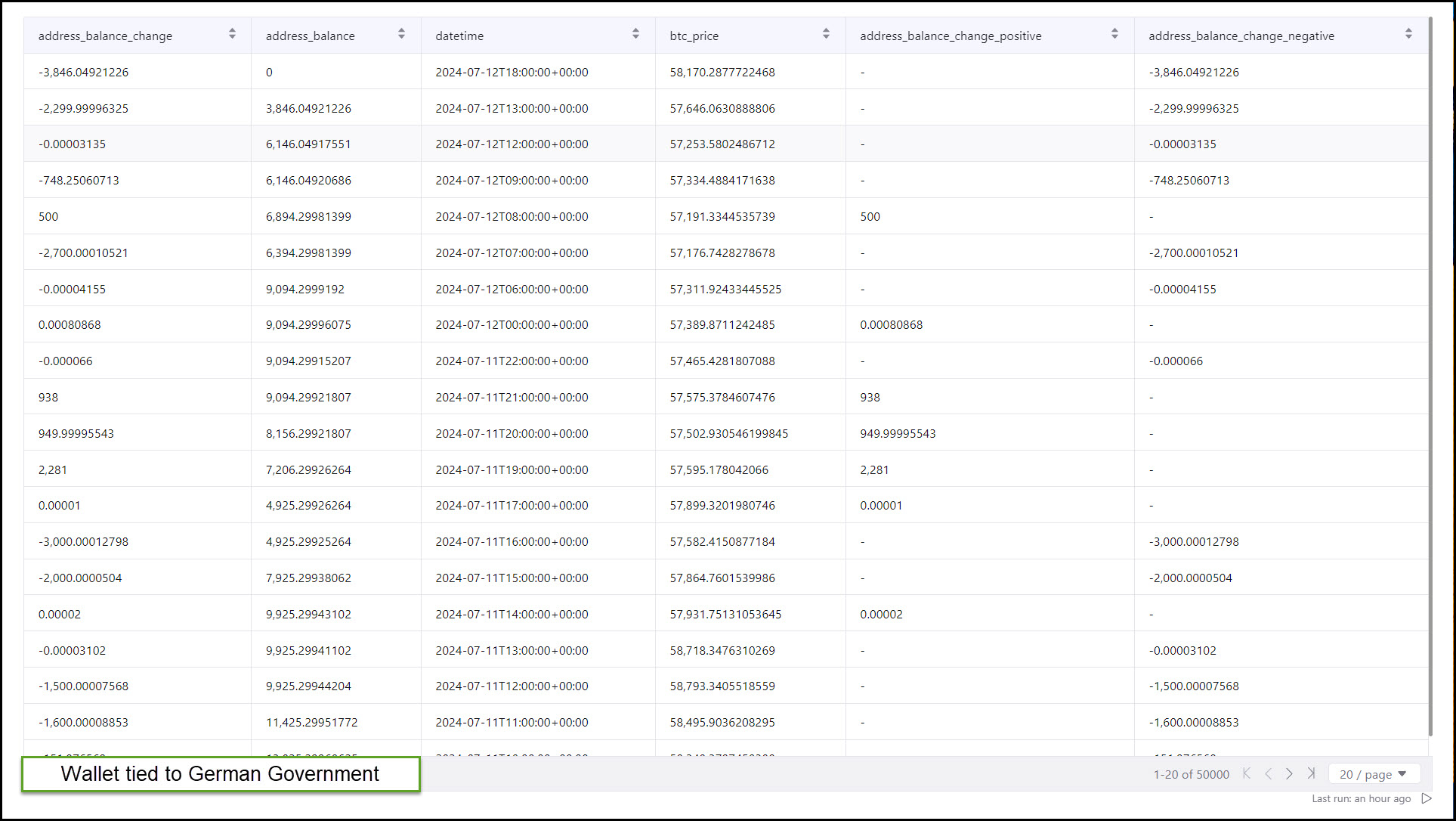

A significant market development is the completion of Bitcoin sales by the German government. The wallet associated with these sales, which contained nearly 50,000 BTC on June 18th, has now been fully liquidated. This aggressive selling pressure, which saw over 4,000 BTC liquidated daily, has now been removed from the market.

Despite these mixed signals, our analysis suggests that the downside action for this cycle is not yet over, and we have likely not established a bottom.