Bitcoin Plummets to 6-Month Low Amidst Global Sell-Off

At the start of the week, A market-wide sell-off ensued. It was the product of economic and geopolitical that came together to drag down nearly every tradable asset. The cascading decline was felt across sectors, causing a flood of liquidations as traders rushed to sell off their positions in one market to cover their losses elsewhere. This led to every sector posting substantial losses on the day, but this market crash was foreshadowed last week.

First you need to understand the carry trade that has been a hugely popular investing strategy for traders and governments alike.

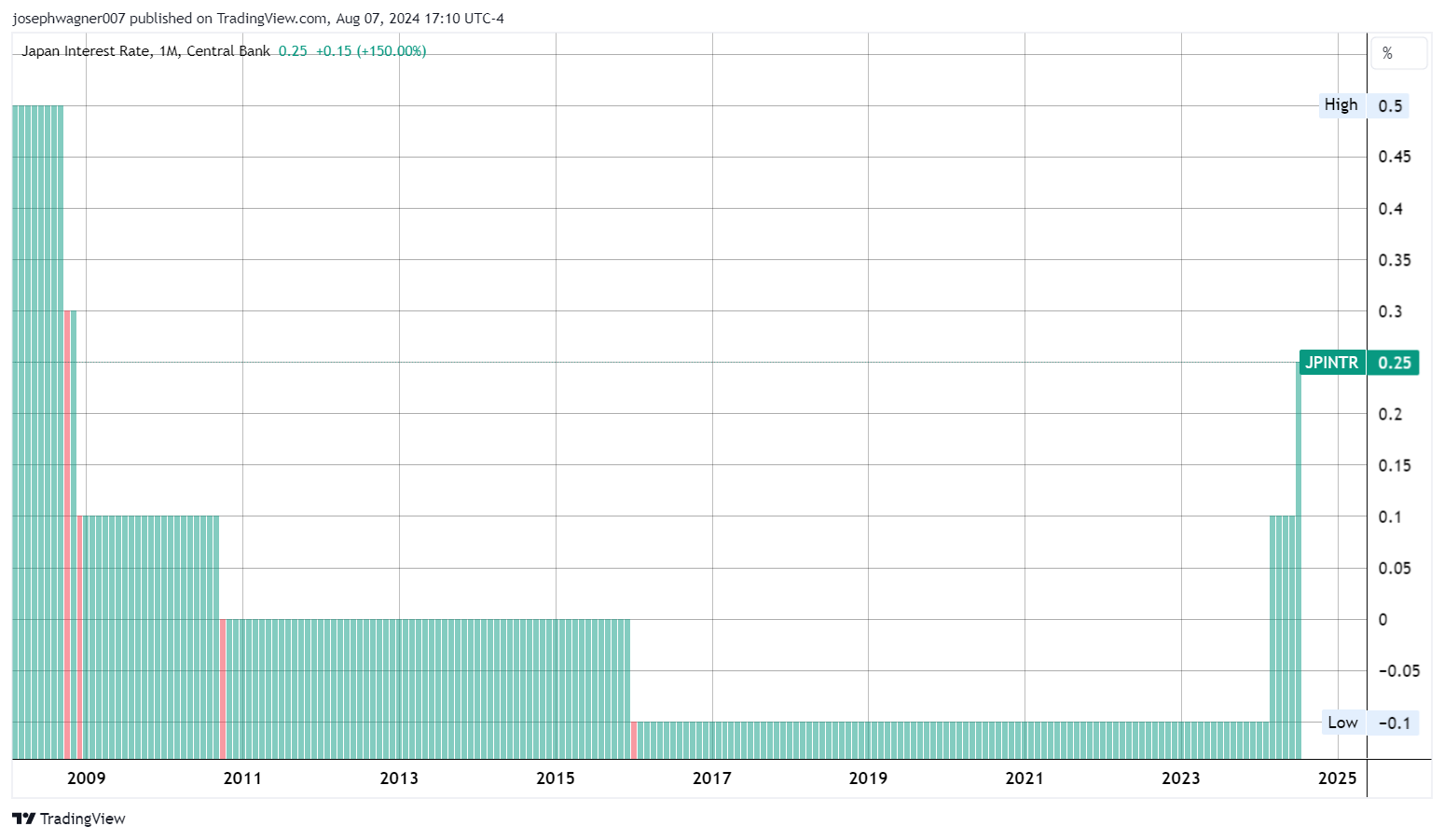

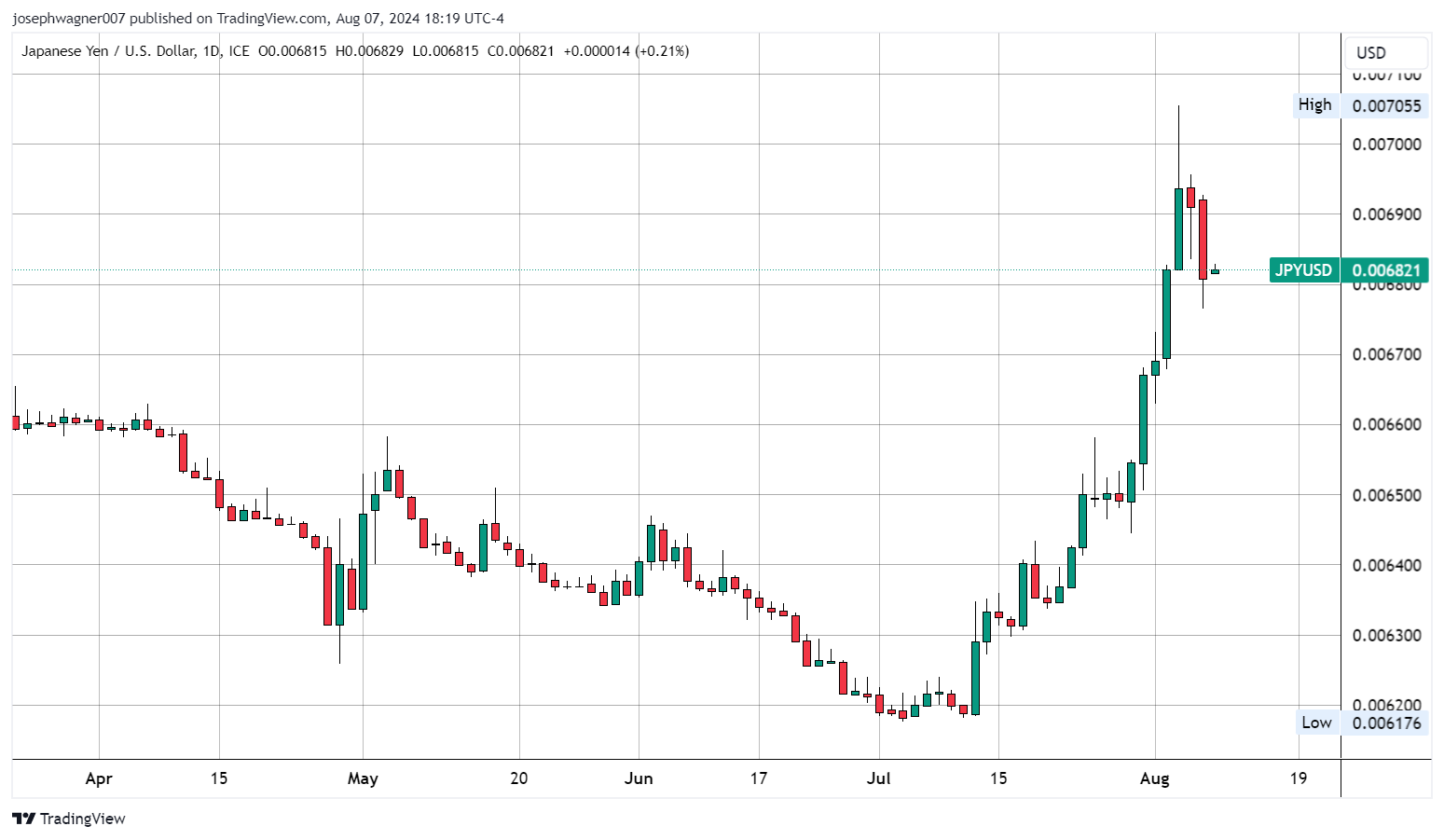

The Japanese yen carry trade, long favored by investors due to Japan's historically low interest rates, is facing significant disruption. This trade strategy, which relies on borrowing in low-interest currencies to invest in higher-yielding assets, has been upended by recent developments in both Japan and the United States. The Bank of Japan surprised markets by raising its policy rate and planning to slow bond purchases, signaling a shift away from its ultra-loose monetary policy. Simultaneously, the US Federal Reserve has hinted at potential interest rate cuts, further complicating the carry trade landscape. These factors have led to a substantial strengthening of the yen against the dollar since early July, prompting a rapid unwinding of carry trade positions…

Last week on Wednesday the Fed concluded its July FOMC meeting leaving rates unchanged as widely anticipated. The same day another central bank, the Bank of Japan also held a meeting and decided to raise interest rates for the second time this year. They set the interest paid out on their government bonds at 0.25%, higher than they had been in the last 16 years.

This caused an earthquake in the financial markets but under the surface a tsunami was formed. The giant wave traveled under the surface and traders rebuilt after the earthquake that affected both governments and traders that held large amounts of debt to the BOJ unaware of the true devastation had yet to occur and was heading their way.

The Tsunami made landfall when the U.S. released weak employment data on Friday, exacerbating the dilemma. This new data caused a recession indicator called the Sahm rule to signal an imminent recession for the United States. The Sahm rule states that the initial phase of a recession has started when the three-month moving average of the U.S. unemployment rate is at least half a percentage point higher than the 12-month low.

Another popular rule is that when the total number of unemployed people rises by 10% a recession will occur. The scary thing is unemployment has risen by 30%.

Analysts estimate that the unwinding of the carry trade is roughly halfway complete, with its future trajectory likely dependent on the U.S. economy's performance and Federal Reserve actions. Any signs of further U.S. economic downturn could accelerate this process, potentially leading to more significant shifts in currency values and global financial markets, which in turn will bleed into Bitcoin.

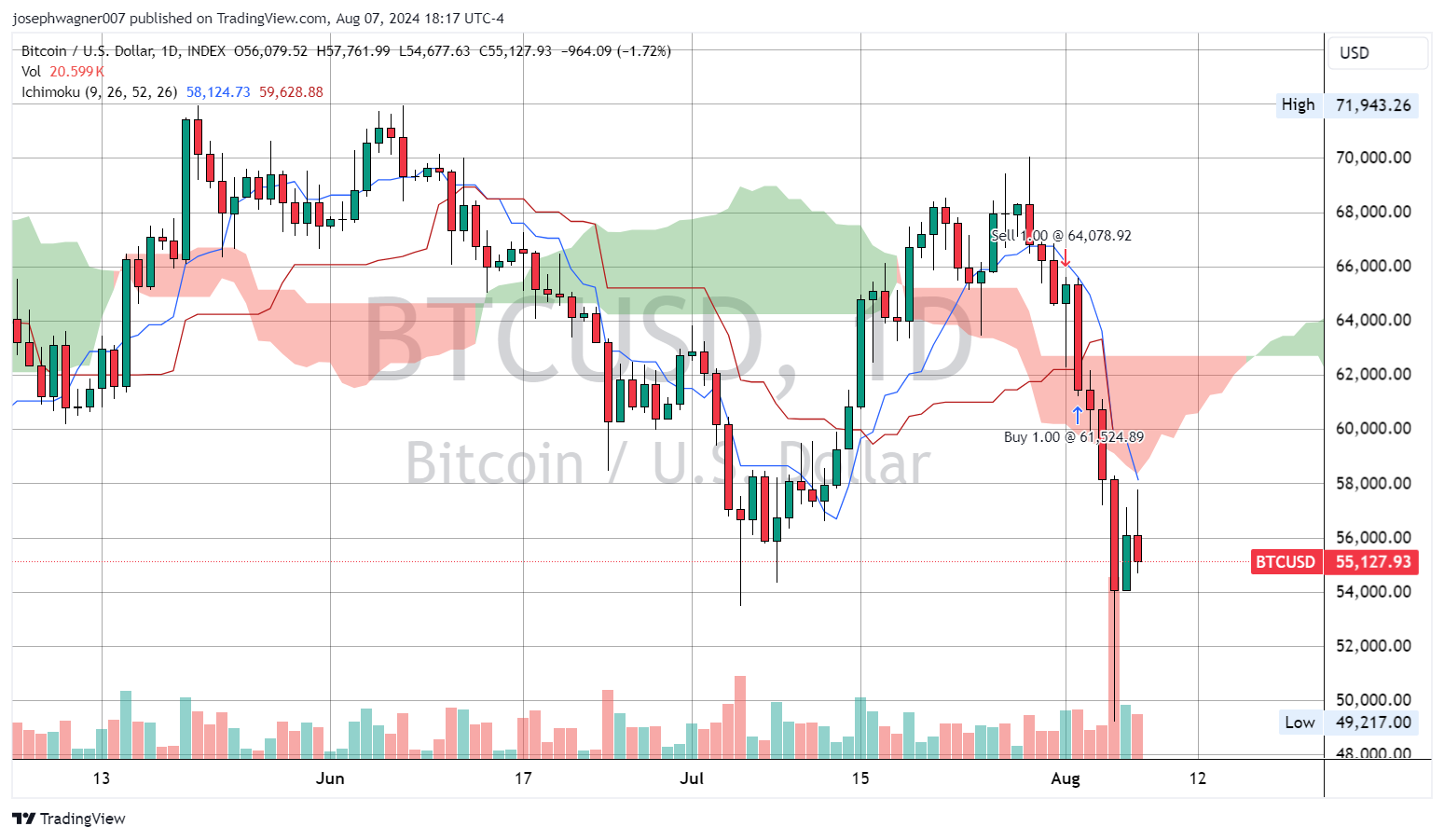

The severe decline was witnessed in the major indices beginning last Thursday on the first day of August following the BOJ rate increase. By Friday the unraveling of stocks that brought widespread liquidations had moved into Bitcoin and the wider crypto market as the problem accelerated. Since Bitcoin is tradable 24/7 and therefore never closes, it continued to free fall throughout the weekend and made an exaggerated low at the start of the week.

From the open on Friday to the lows seen Monday, Bitcoin had fallen by $16,350 or roughly 25%. However, following this on Tuesday Bitcoin experienced a strong recovery gaining 3.77% and closing above $56,000.

So, while this recent downturn in crypto was not related to crypto at all, the issue has yet to resolve itself and could get worse before it gets better. Bitcoin’s daily candle on Monday also hints at further depreciation. Even with a recovery the following day creating a two-day candlestick pattern known as a piercing line, the bullish reversal pattern is unlikely to be confirmed and we most likely will see pricing dip beneath $50,000 in the coming weeks.

When the dollar-Yen dilemma finally sorts itself out we should finally see Bitcoin reach new all-time highs as the halving narrative comes into full focus, and we should see prices reach beyond $80,000 by November elections.