Bitcoin's Resilient Week and Transformative Political Developments

In a display of market resilience, Bitcoin concluded the week with a flat performance despite earlier volatility. As of 4:45 PM ET, the leading cryptocurrency traded at $67,550, marking a 2.5% increase ($1,650) for the day. This represents a significant recovery of over $4,000 from Thursday's low, although Bitcoin still registered a marginal 0.9% decline for the week.

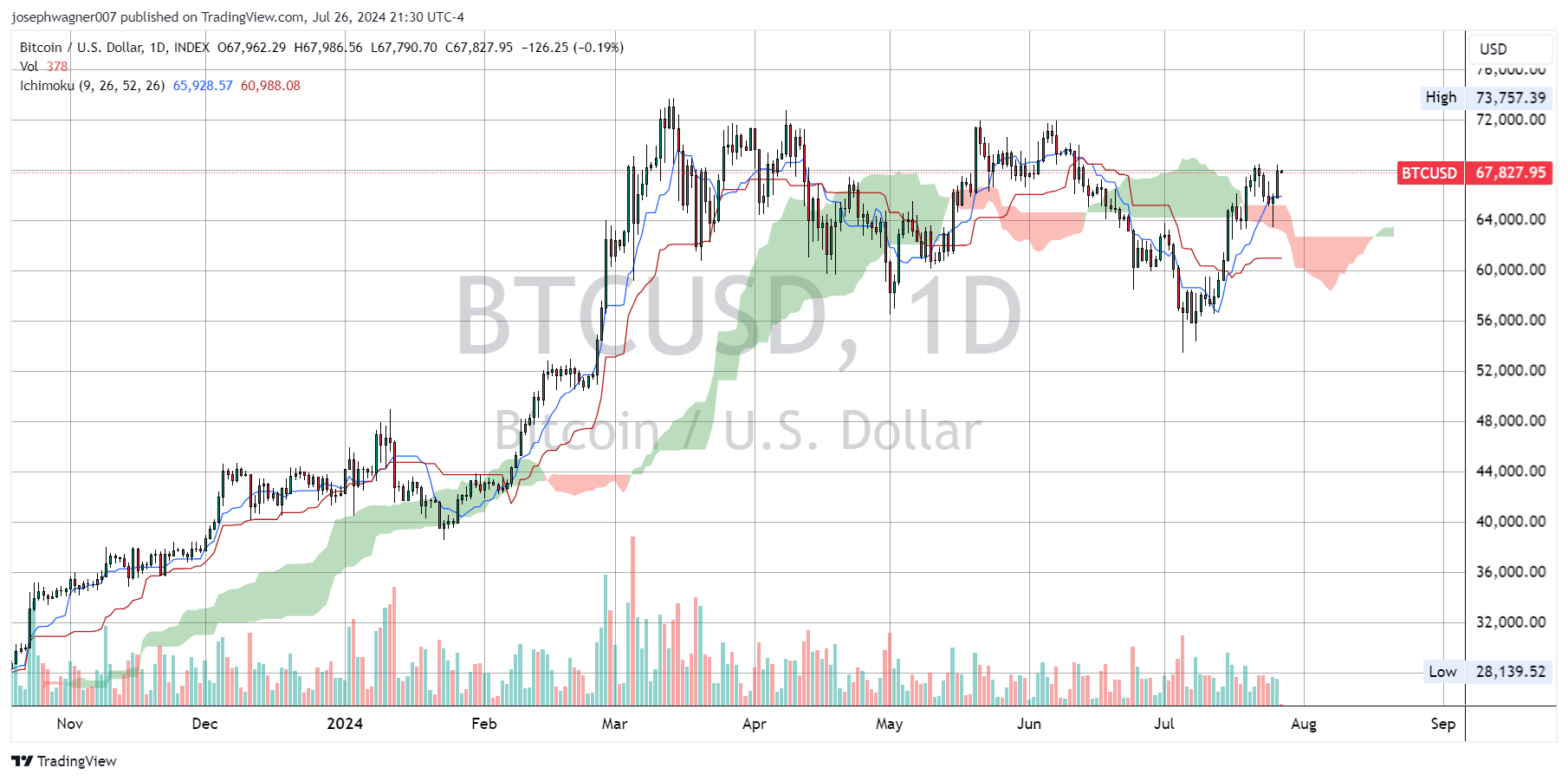

From a technical perspective, Bitcoin's price action since its all-time high on March 14th has formed a series of lower highs and lower lows, with four distinct peaks and troughs. This pattern excludes the equal highs observed on May 21st and June 7th, suggesting a potential shift in market dynamics.

The Bitcoin 2024 Conference emerged as a focal point for political discourse surrounding cryptocurrency. Historically a platform for major industry announcements, this year's event saw prominent political figures making bold statements about Bitcoin's future role in the U.S. economy and governance.

Robert F. Kennedy Jr.'s speech at the conference garnered significant attention due to his ambitious campaign promises. These included eliminating capital gains taxes on Bitcoin by reclassifying it as property, pardoning high-profile figures like Ross Ulbricht and Edward Snowden, and perhaps most notably, proposing that the U.S. Treasury adopt Bitcoin as a strategic reserve. Kennedy's plan involves daily purchases of 550 BTC until the United States accumulates 4 million Bitcoin, mirroring the country's approximate 19% share of global gold reserves.

The conference's political dimension is set to intensify with former President Donald Trump's scheduled appearance. Trump's participation marks a significant shift from his previous stance on cryptocurrencies, presenting a challenge for him to convincingly articulate his newfound support for Bitcoin. This change in position contrasts sharply with his administration's policies and past criticisms of cryptocurrency.

The presence of these political figures at a Bitcoin-centric event signifies a broader shift in the perception of cryptocurrencies within the political sphere. Just a year ago, advocating for Bitcoin was considered politically risky. Now, it appears to be a potential vote-winning strategy, highlighting the evolving public sentiment towards digital assets.

This transformation in political attitudes towards Bitcoin represents a crucial development for the cryptocurrency ecosystem. As public opinion continues to favor Bitcoin, the potential for supportive policies and mainstream adoption grows, potentially paving the way for a new era in the relationship between traditional finance, governance, and digital currencies.