1st Quarter of 2025: Crypto Reform Foundation Laid

Bitcoin shows promising signs of recovery that could potentially propel the world's premier cryptocurrency back toward six-digit valuations. However, market participants remain cautious about whether President Trump's economic policies will be implemented as aggressively as his rhetoric suggests.

Market Impact of New Trade Policies

The administration's crusade to rebalance global trade relationships—specifically targeting what it perceives as unfair tariff structures disadvantaging American manufacturers—has triggered significant market turbulence. While the White House maintains these measures will yield long-term economic benefits, the immediate market reaction reflects concern over near-term consumer impact and potential inflationary pressures.

This uncertainty has sparked a broad risk-off sentiment, with cryptocurrency markets suffering disproportionately:

- Dow Jones Industrial Average: Down 8.67% since January 31

- S&P 500: Declined 8.95% in just 29 days

- Bitcoin: Plummeted 22% since the inauguration of America's self-described "first Bitcoin President"

Price Action Analysis

The 71-day period since Trump's return to office reveals a nuanced market narrative rather than a continuous decline. The most severe damage occurred during the first 39 days of his second term, with Bitcoin surrendering nearly 30% of its value. However, the past three weeks have offered glimmers of optimism, with prices recovering approximately 12% from the March 11 lows—the nadir since inauguration day.

Regulatory Renaissance

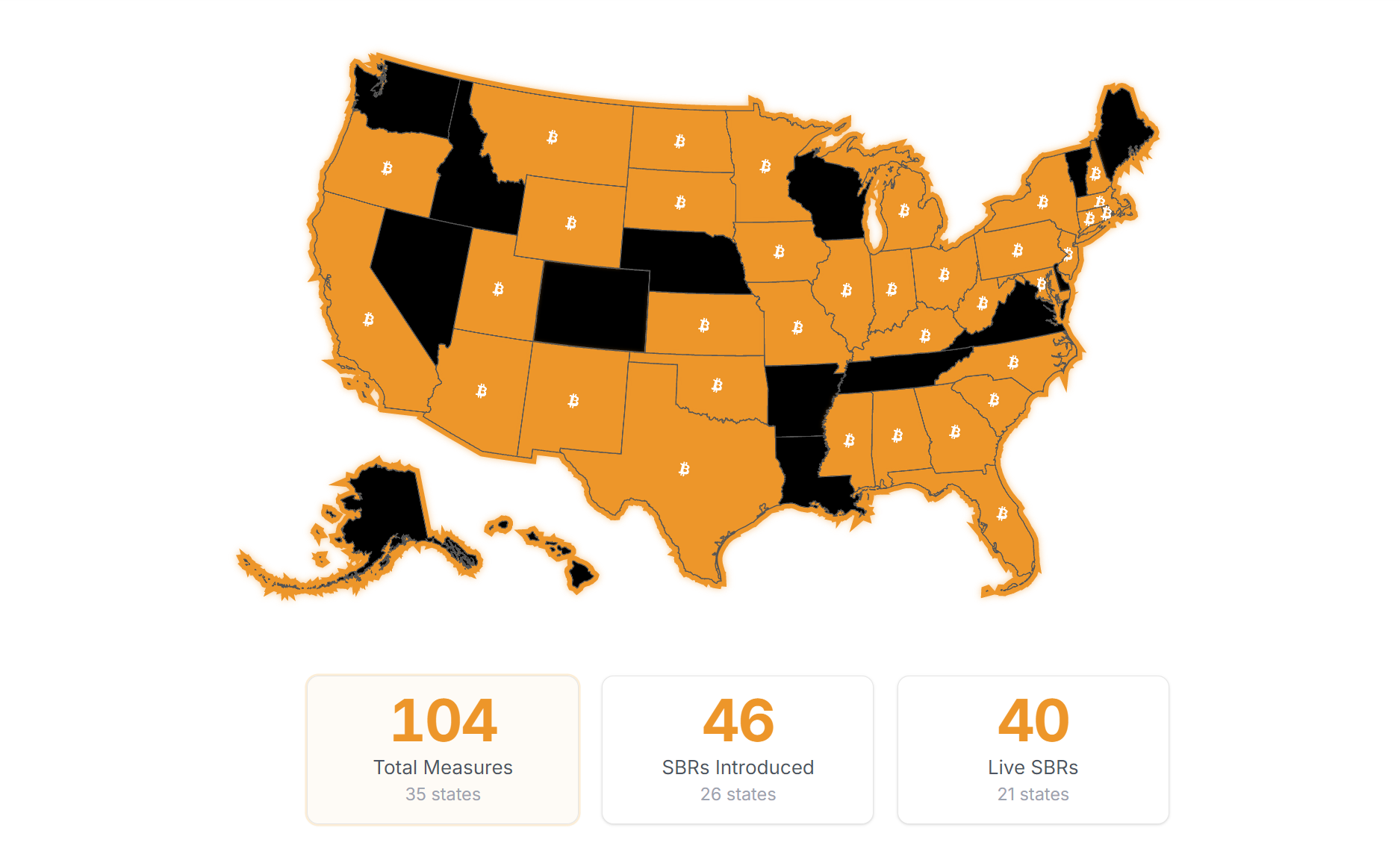

Despite the price volatility, the administration has delivered on its promise of regulatory reform for digital assets. The resulting legislative environment has fostered remarkable initiatives across state legislatures, with Arizona emerging as a particularly progressive jurisdiction. Three breakthrough bills currently advancing through Arizona's legislative chambers could fundamentally strengthen cryptocurrency adoption and infrastructure:

Cryptocurrency Payment Acceptance Framework

The legislation establishes clear protocols for state agencies to accept major cryptocurrencies (Bitcoin, Ethereum, Litecoin, and Bitcoin Cash) for governmental obligations. The framework includes mandatory service provider agreements, conversion specifications, and liability protections, with implementation scheduled for December 2025.

Blockchain Budget Initiative

This forward-thinking program allocates $1 million to deploy blockchain technology for governmental fiscal transparency. The initiative will select three state agencies to pioneer real-time, public blockchain-based budget reporting, with a structured evaluation timeline concluding in 2029.

Residential Node Infrastructure Protection

Perhaps most significantly for network decentralization, this legislation prohibits local governments from imposing restrictions or taxation on residential blockchain node operators. By designating node regulation as a statewide concern, Arizona creates consistent operating conditions that could significantly enhance network participation.

Technical Outlook

From a technical perspective, Bitcoin currently finds support at $80,590—representing a 50% retracement from September's lows to the all-time high of $109,350. Initial resistance appears at the 200-day simple moving average ($86,300), with more significant resistance at $87,655, the 38.2% Fibonacci retracement level from the same price range.

These legislative developments, particularly when considered alongside similar initiatives in other states, may provide the fundamental catalyst needed for Bitcoin to overcome these technical barriers and resume its upward trajectory as the regulatory landscape continues to mature.