The New “State” of The Blockchain

Bitcoin has yet to experience a deep correction since reaching prices above $100,000. Traders have likely exhausted most if not all the upside excitement in this cycle. The reason it does not look like a typical cycle top with a swift retracement of 80% or more, is because Bitcoin has matured more in the past year than ever before; the investor base of Bitcoin has evolved even more. Recent regulatory changes and the growth of ETF’s has led to more sophisticated, patient investors entering the space that are changing the market dynamics of Bitcoin. Now other large entities with diamond hands are paving the way for their own entry into the best performing asset of the last 15 years, and they are growing number of states that have put forth legislation to create their own Bitcoin strategic reserve.

₿ureaucracy IN BTC

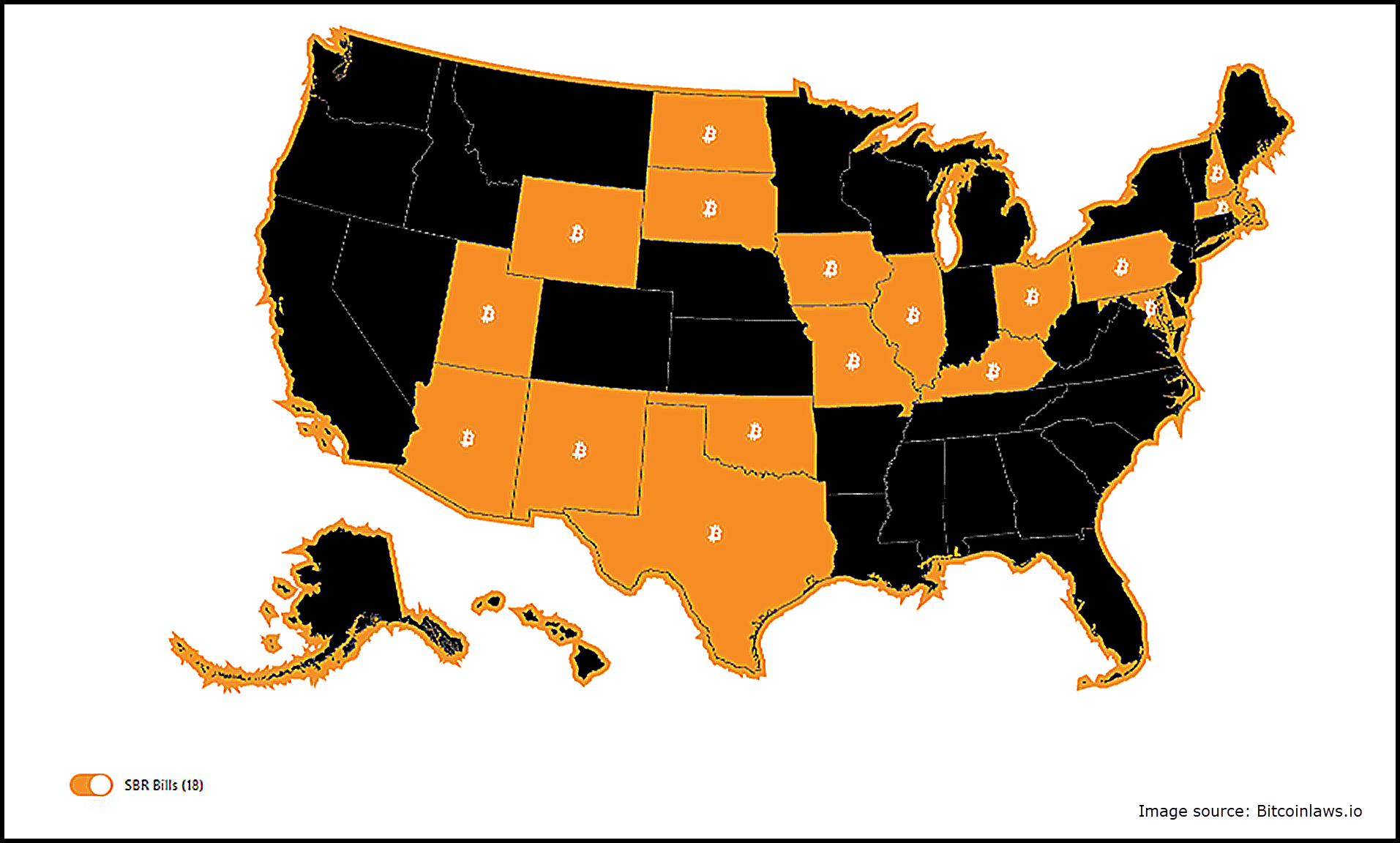

A significant wave of state-level cryptocurrency legislation is sweeping across the United States since the Trump administration essentially “removed the red tape” on Digital assets. While he has yet to establish a Bitcoin Strategic Reserve (BSR), Trump has made headway towards that goal, reversing legislation that kept Bitcoin from entering the banking system. While A BSR on the Federal level has yet to emerge, things are changing fast at the State level.

So far since the start of 2025 nineteen states have introduced bills related to digital asset investment of public funds. Most notably, these bills typically authorize state treasurers to invest between 5-10% of various state funds in digital assets, primarily Bitcoin and cryptocurrencies with market capitalizations exceeding $500-750 billion.

While some states like Arizona and Texas are specifically focused on creating Strategic Bitcoin Reserve funds, others such as Ohio and Utah have drafted broader legislation encompassing various digital assets. New Mexico's approach stands out with its comprehensive SB275, which includes provisions for Bitcoin lending and management of tax payments received in cryptocurrency.

These state-level initiatives appear to follow the conceptual framework established by Senator Lummis's federal BITCOIN Act of 2024, which proposed creating a national Strategic Bitcoin Reserve of 1 million BTC accumulated over a five-year period. While this federal legislation did not advance beyond committee, Senator Lummis's recent appointment as Chair of the Digital Assets Subcommittee suggests potential for renewed consideration at the federal level.