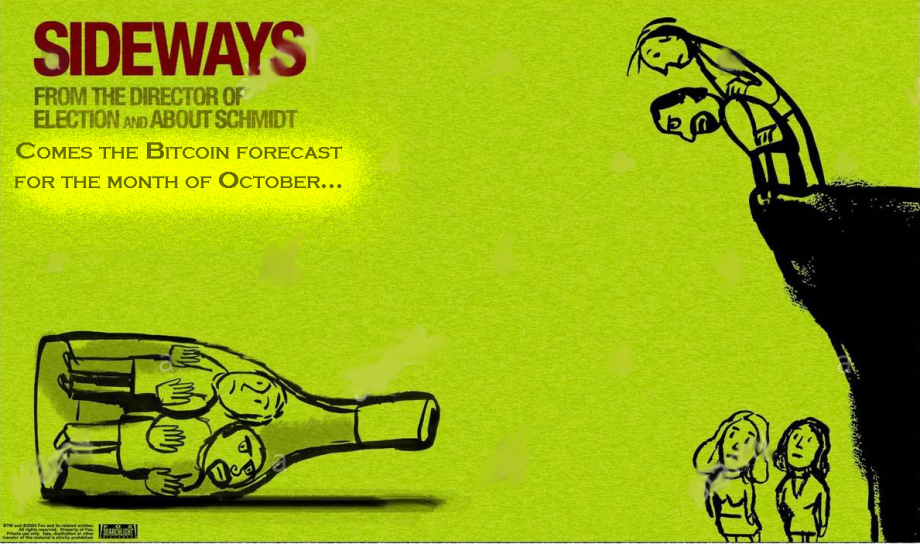

All signs point sideways

Bitcoin futures have been as high as the 50-day moving average and as low as the 100-day moving average. They have dropped from the top of this $900 range and are back towards the high point of the range after bouncing off the bottom at the 100-day M.A. Currently, as of 4:30 PM EST BTC futures most active contract is up just over 1% ($115) at $10,840.

Similar to gold and silver which experienced the same price moves this week as far as moving averages and price action is concerned. They both bounced off their perspective 100-day with resistance near their 50-day moving averages.

Not only has this correlation between these precious metals been astonishingly similar, but BTC has been able to overcome U.S. dollar strength better than the metals. With the U.S. dollar index almost 3 points higher from the start of the month after bottoming at 91.75 on the first of the month, we could see it find resistance at current pricing which is pegged at 94.64. Technical resistance seemed to have come in earlier this week when pricing backed off slightly to just below the 23% Fibonacci retracement at 94.612. Next week will tell us if this will serve as a ceiling on a historical basis it is more likely to climb higher to around the 38% retracement at 96.39.With the U.S. dollar set to possibly continue to gain ground as the Euro is set to continue to fall it is promising that Bitcoin seemed to have no problem overcoming it.

But as far as Bitcoin is concerned its lackluster volume is seemingly composed of equal long and short positions it is likely that it will remain in its current band of approximately $9,900 - $11,100 for the foreseeable future. Looking back on a longer-term chart reveals this is indeed BTC’s favorite point of congestion and what is only starting to resemble consolidation. For that matter, BTC is “sitting sideways”.