Alt coins sell off boosting Bitcoins dominance and the .618% Fib. level

Recently there has been a shift in the cryptocurrency markets as Altcoins have seen an outflow of capital much of which has flowed into Bitcoin. This is why today we are witnessing Bitcoin rise as Ethereum and others simultaneously are on the decline. Bitcoin’s value has jumped as macro assets have also been declining such as U.S. equities and even gold.

According to Cointelegraph, “Bitcoin (BTC) hit seven ounces of gold for the first time in over a year this week as the precious metal comes off all-time highs.

Data from CoinGecko showed BTC/XAU returning to the pivotal 7 ounce mark on Oct. 25, continuing to edge up to press-time levels of 7.02 ounces.”

The BTC/XAU has not been at this level since September of 2019 and although Bitcoin’s total market volume is a fraction of gold’s as gold comes off its all-time high money will start to flow into Bitcoin and out of gold if this trend continues which I see likely.

As far as trade recommendations are concerned our last article mentioned that BTC not only hit our target but that target was based on a long-term Fibonacci retracement from Bitcoin futures all-time high and the inception of Bitcoin derivatives. Our chart shows how BTC hit the .618% Fib. retracement level ($13,581) on October 27th. Intraday it traded to a high just above this retracement point before backing off and closing a few hundred dollars above it.

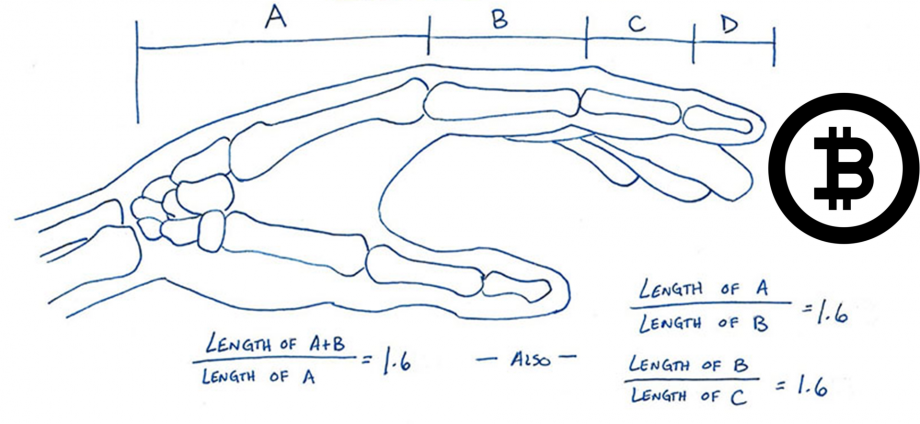

Out of all Fibonacci numbers, .618 is the only true Fibonacci number, the ratio of any number in the Fibonacci sequence is exactly 1.618% of the next. All other Fib. numbers such as 23.6% and the 78.2% are merely derived from the true Fib. ratio of 61.8%. As a believer in Fibonacci retracements and extensions to predict possible points of support or resistance existing in any market, and the fact they are found in every living thing on earth from the number of fingers on tree leaves to the relationship from one segment of your finger to the next, I hold this number in high regard.

It is for that and other reasons that I see a re-test of support between $11,900 and $12,600 the most logical and likely move for Bitcoin futures. I don’t expect a break out above the .618% retracement to occur in any lasting way at least not until 2021. However, when this level of $13,581 is sufficiently taken out and becomes effective support Bitcoin will indeed be on a rocket to much higher pricing.