Bitcoin down on the day but higher on the week

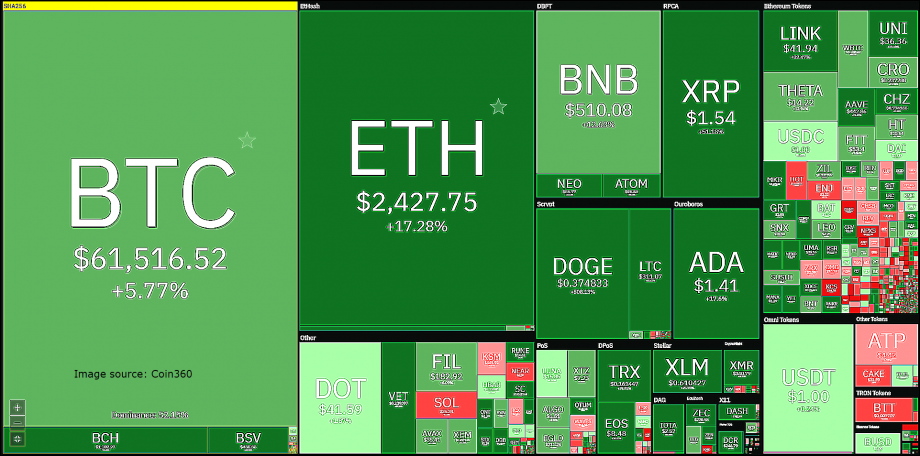

Today we saw a decline in BTC of 2.88% bringing Bitcoin futures down to $62,000 on the close. This puts Bitcoin down on the day, while on the week BTC is still posting positive gains of approximately 6% in the spot markets. I will say one potentially bearish technical factor is the weekly candlestick chart. By that I mean BTC’s weekly candle forming a shooting star, which when found after an uptrend could indicate that a market has reached an apex and could be entering into a downturn. So, we have to tread carefully over the next few days and watch for any break below $60,000 signaling that is indeed what is happening.

Ethereum is also down on the day but substantially higher on the week gave a great performance over the last seven days. Posting gains of 17% over that time period and actually hitting our target yesterday at $2,500. Ether’s weekly candlestick chart looks a lot more bullish than Bitcoin’s. However, the two tend to move in tandem, either higher or lower and that relationship has yet to come undone.

Both of the top two cryptos by total market cap have undoubtedly gained positive exposure through the IPO of Coinbase earlier in the week. I don’t think this will be a temporary bump and see this as more of a snowball of recognition that has come to Cryptos in particular over the last year. Coinbase, one of the world’s largest crypto exchanges, is set up to benefit even if prices enter a downturn or remain positive.

The investor enthusiasm towards the nearly decade-old cryptocurrency exchange was enormous, driving the price above $400 per share before settling at around $320 the first day of trading. The launch not only further validifies Cryptocurrencies as a whole but also shows the Investor appetite for new ways to speculate and participate in the fastest growing industry in the world (my world, if not everyone’s).

Traders that took our call to buy Ethereum last week on Tuesday, April 6th, should have pulled profits by now as it hit the upper level of our target area ($2,400 - $2,500) yesterday in trading. If you took our call and have not done so already, don’t panic, you can still liquidate now at current pricing ($2,465) for a profit of $365 per coin. Traders taking our call to enter BTC should hold their positions and keep stops at $59,000.