BTC will break $70,000 very soon

Bitcoin hit a new record high today before trading down swiftly afterwards. BTC futures are trading at $64,545 as of 5 PM EST, after achieving a high just below $70,000 at $69,355. The fast-paced decline was not an unusual occurrence, Bitcoin and most markets do retrace after making new record highs. But it may have taken some by surprise due to the CPI numbers for last month being released and showing that inflation has reached 6.2% year over year, which is a level not seen in the last 30 years.

For that reason, we hold the belief that the dip in Bitcoin’s price is a temporary one and that we will see a comeback in the following days. Our target price that was raised recently from $70-$75k to $75-$80k has not changed and neither has our timeline of reaching that price point by the end of November.

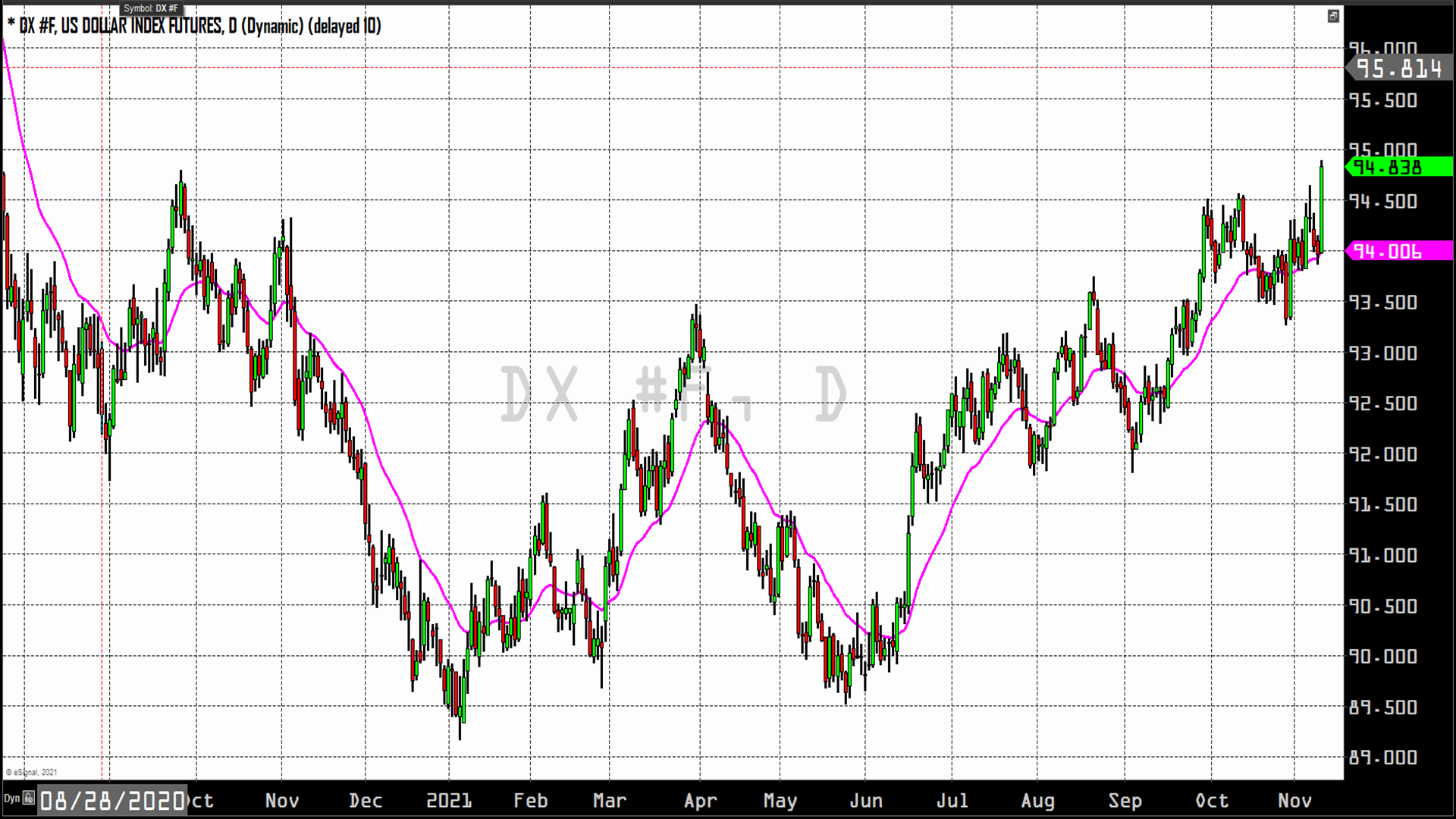

Cryptocurrencies and in particular Bitcoin have been seen as a tool to hedge against inflation. That idea has been gaining traction simply because it has outperformed the traditional tool used to preserve wealth which is gold, gaining 130% compared to gold loosing 4% in the past year. Today’s big moves in the financial industry were not so much driven towards inflation hedges as they were towards safe-haven assets. This can be witnessed by looking at the U.S. dollar index which actually matched the near 1% gains seen in gold as the dollar climbed to 94.87 a level not seen in over a year.

Now trading for tomorrow’s candle has begun overseas opening (after hours in America) around the mid-point of Nov 10th’s trading range at $65,210. This puts pricing well off the lows at around $63,000 seen on Wednesday and Monday and a case can be made that the post ATH re-testing of support has concluded. This would mean that BTC has effectively turned $63,000 into an area of support and is poised now poised to trade higher towards our target of $75-$80k.