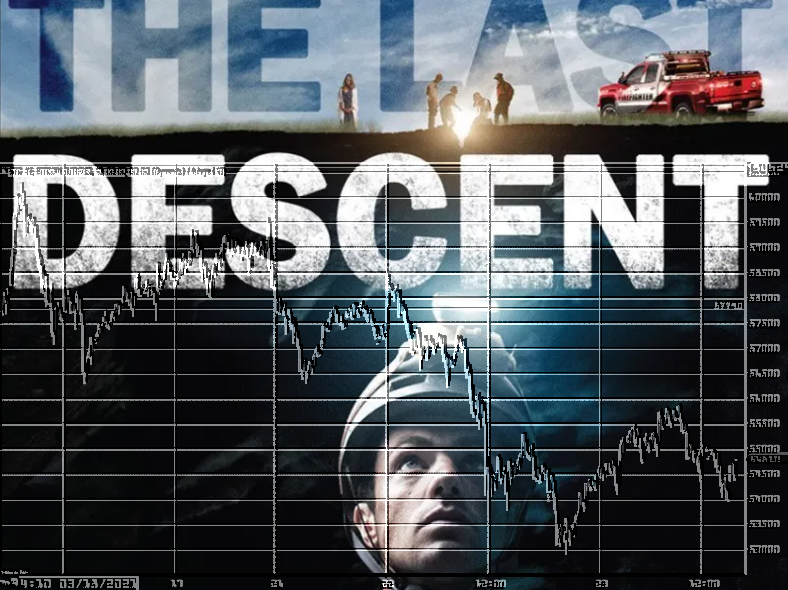

The descent continues

Bitcoin continued its descent today, falling to a low of $55,820 in CME futures, a few dollars lower at $55,660 in the spot market (Bitstamp). This marks a return of futures leading the cash market that was absent or reversed for the last month. Interestingly enough, pricing on cash exchanges was above pricing in CME futures ever since breaking above $40,000. This could be interpreted as buyers purchasing from online exchanges rather than buying futures contracts because they plan on hodling (holding long-term) rather than simply trading the asset.

This reveals that much of the luster of Bitcoin has temporarily faded from the cryptocurrency, and we may be exiting a period of frantic buying where the number of coins purchased exceeds the number of coins mined each day. This is certainly hinting towards further price decline at the very least a period of consolidation at or below $50,000 before Bitcoin will rally to new highs above $61,000.

Another recent development in the cryptocurrency markets is that while Bitcoin’s market cap still remains well above the $1 trillion threshold that it broke through in the last 30 days, its dominance of the total crypto ecosystem is on a decline. Since the beginning of the year, Bitcoin accounted for approximately 70% of the entire cryptocurrency market. Since the start of the year, it has lost some of its dominance over the digital asset ecosystem and today broke below 60% of the total market cap for all cryptocurrencies.

Ethereum has also been losing some of its hold over the crypto markets while still firmly in second place. Overall, it has lost some of its dominance as well, falling from 17% last month to 12% of the total market cap of well over $1.5 trillion. This has given a few of the alt. coins a chance to play catchup.

Traders that took our call to go short last Monday should exit half of their positions at $53,000 and the remaining positions exit at 51,000.