IT Ain’t Over till the Fib. level fails

Black Friday lived up to its name, bringing darkness to the crypto sector. However, our line in the sand for Bitcoin either continuing to rally to our target of $75-$80,000 or correcting to $44,000 was held; therefore, the bullish scenario prevails.

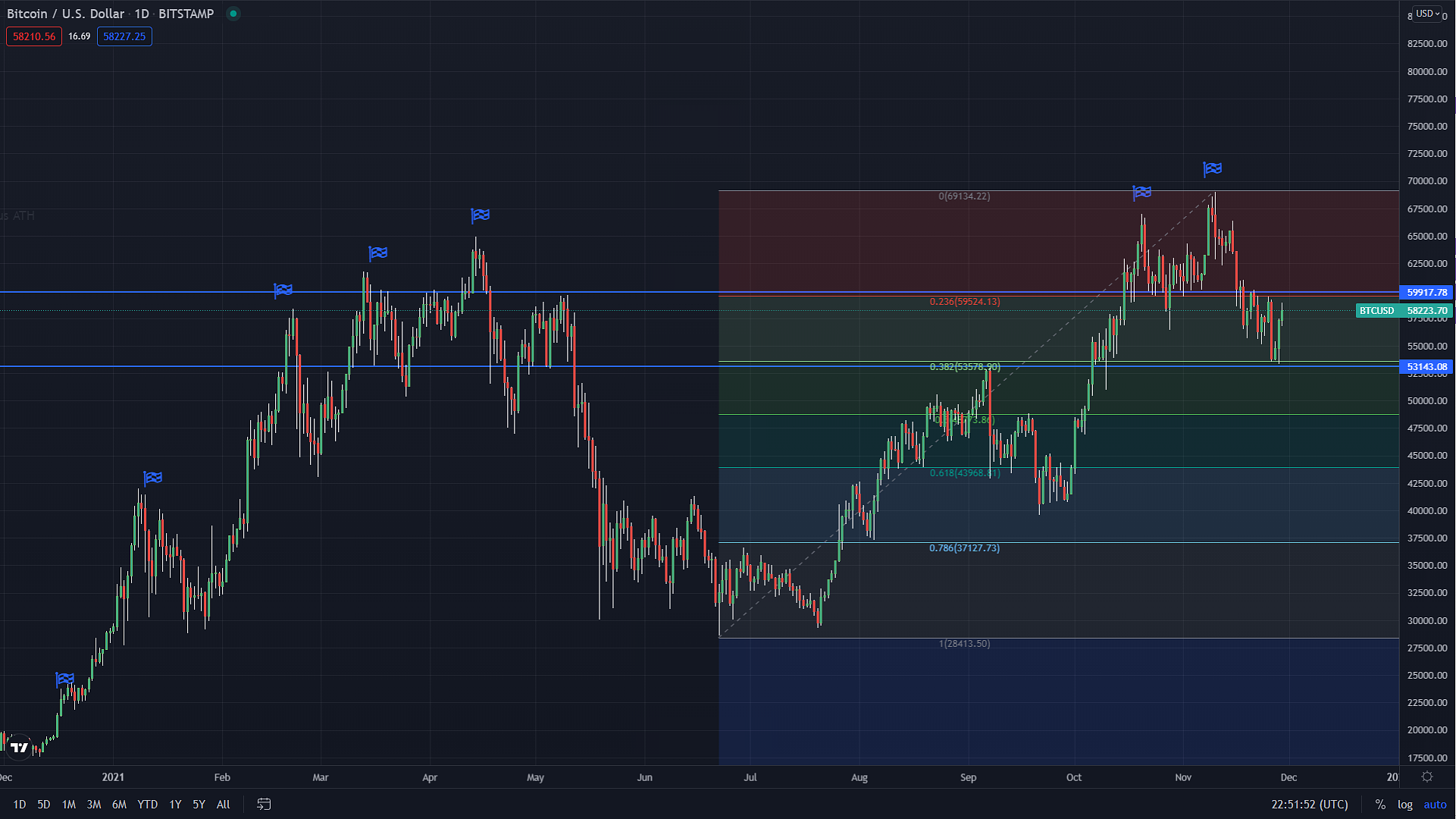

“As long as BTC follows this model and does not break below $54k, then there is every reason to believe that BTC, following this wave four correction, will rally to a new ATH of around $75,000.” - Nov.18 article.

There was another holiday last week and that was Fibonacci Day, which took place on November 23rd to celebrate Leonardo Bonacci (Fibonacci), possibly the most influential mathematician of the Middle Ages. This week, as much as every week, it is the sequence he discovered that highlighted the most important levels to look for a pivot in BTC, or any market for that matter.

We have spoken about the support level that was critical for this rally to continue at approximately $53,000 was tested on Black Friday when the price of Bitcoin dropped by almost $6000. On that day BTC opened up at around $59,000 to close just above our key support level, and the lowest price seen since October 21. Since then (November 26), we have seen three consecutive days containing higher highs and higher closes. Today’s price at the time of writing (approximately 5 PM Eastern Standard Time) is trading at $58,330, according to Bitstamp. BTC futures closed approximately $500 above spot pricing at around $58,880.

Following the decline on Black Friday pricing continued to test this essential support level; today that changed with a low above $56,700. We have yet to test resistance sitting at $60,000. It is my belief that this resistance will be taken out and when it breaks above $60,000, we should see a rigorous search to the upside.

These areas of support and resistance also harmonize with Fibonacci levels of this entire rally starting at just beneath $30,000. The support that $53,000 is synchronized with the 38% Fibonacci retracement level. And that resistance at $60,000 matches up to the 23% Fibonacci retracement level. A key aspect of why our line in the sand was at $53,000 was that if it broke below that level, it would render our current wave count flawed and incorrect. An essential rule of Elliott wave theory is that wave four cannot surpass the third wave in any instance. So, for those who thought Black Friday was the beginning of a bear market should remember one thing, it ain’t over till the fib. level fails.