Mass adoption by Mastercard will propel BTC to yet another ATH

Today Bitcoin had a fundamentally bullish breakthrough in the form of Mastercard’s announcement that it soon will allow cryptocurrency services to its network of 20,000 financial institutions and 388 million cards in circulation, according to wallethub.com. The Intercontinental Exchange’s own Bakkt will provide the custodial service or the backend for this new feature. Bakkt (BKKT) officially became a publicly listed company on the NYSE last week and was flat at the end of its first trading week. Today, however, the company surged upwards by 234.43% on the news of this partnership.

According to CNBC, Sherri Haymond, executive vice president of MC’s digital partnerships, said in an interview, “Our partners, be they banks, fintechs or merchants, can offer their customers the ability to buy, sell, and hold cryptocurrency through an integration with the Bakkt platform.”

According to Bakkt CEO Gavin Michael, the agreement implies that businesses and restaurants may give bitcoin incentives instead of standard points. Existing points may be turned into cryptocurrency at rates determined by the participating firms, allowing users to earn a return.

“We’re lowering the barriers to entry, allowing people to take something like your rewards points and trade them into crypto. It’s an easy way to get going because you’re not using cash, you’re putting something that’s an idle asset sitting on your balance sheet, and we’re allowing you to put in to work.”

After hitting a new ATH last week, BTC has come off of the newly achieved close above $66,000 but found support at $60,000 and today is trading up 2.72%, helped by the mass adoption development with the world’s second-largest credit card company.

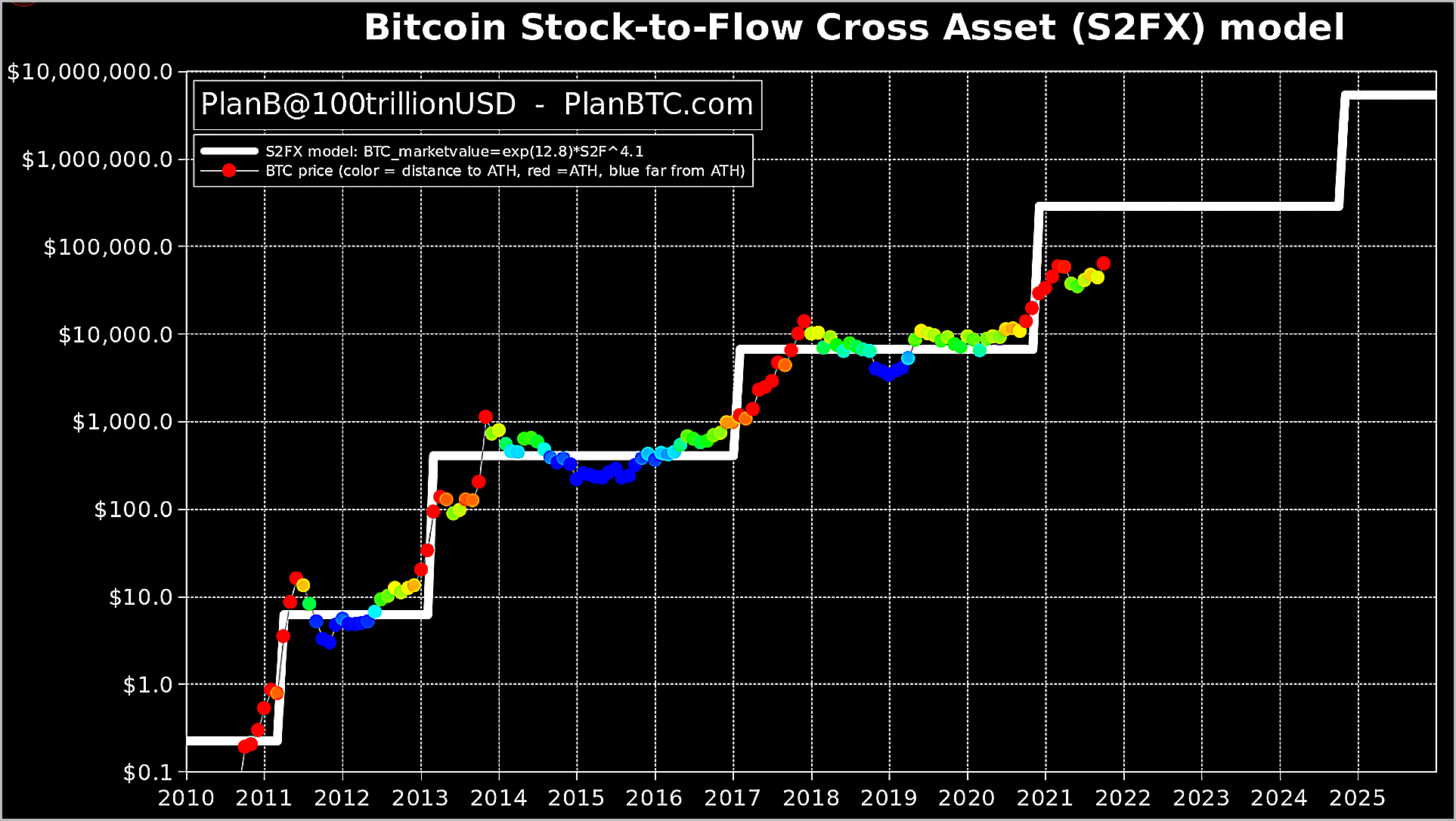

A rule of thumb for traders is that a stock or commodity tends to retrace or correct after hitting a new ATH, but this rule does not cross over to the world’s number one cryptocurrency. A model that tracks and forecasts the stock-to-flow ratio for Bitcoin going back to 2011 shows the opposite is true for Bitcoin.

Our studies show similar findings. Back in 2017, when it broke above the previous ATH at around $1,100, it went on to make three more significant new highs before a correction entered into the market. On Dec.16th, according to Bitstamp, Bitcoin achieved a new record high and during its ascent to $65,000 in April of this year, made another four significant new highs before correcting. This current rally has just achieved its first significant new price high, and I am willing to bet it will make a few more before correcting. History seems to agree with that assumption.