What the ₿? Is this the beginning of the end?

Bitcoin is down substantially today, trading lower in BTC futures by just over 4% ($2,455). This is the second-largest daily decline this week. On Tuesday, BTC fell $4,000 and broke and closed beneath $60,000 for the first time in over two weeks. The question on traders’ minds right now is, “Is this the beginning of a bear market or just a retracement before returning to rally mode?”

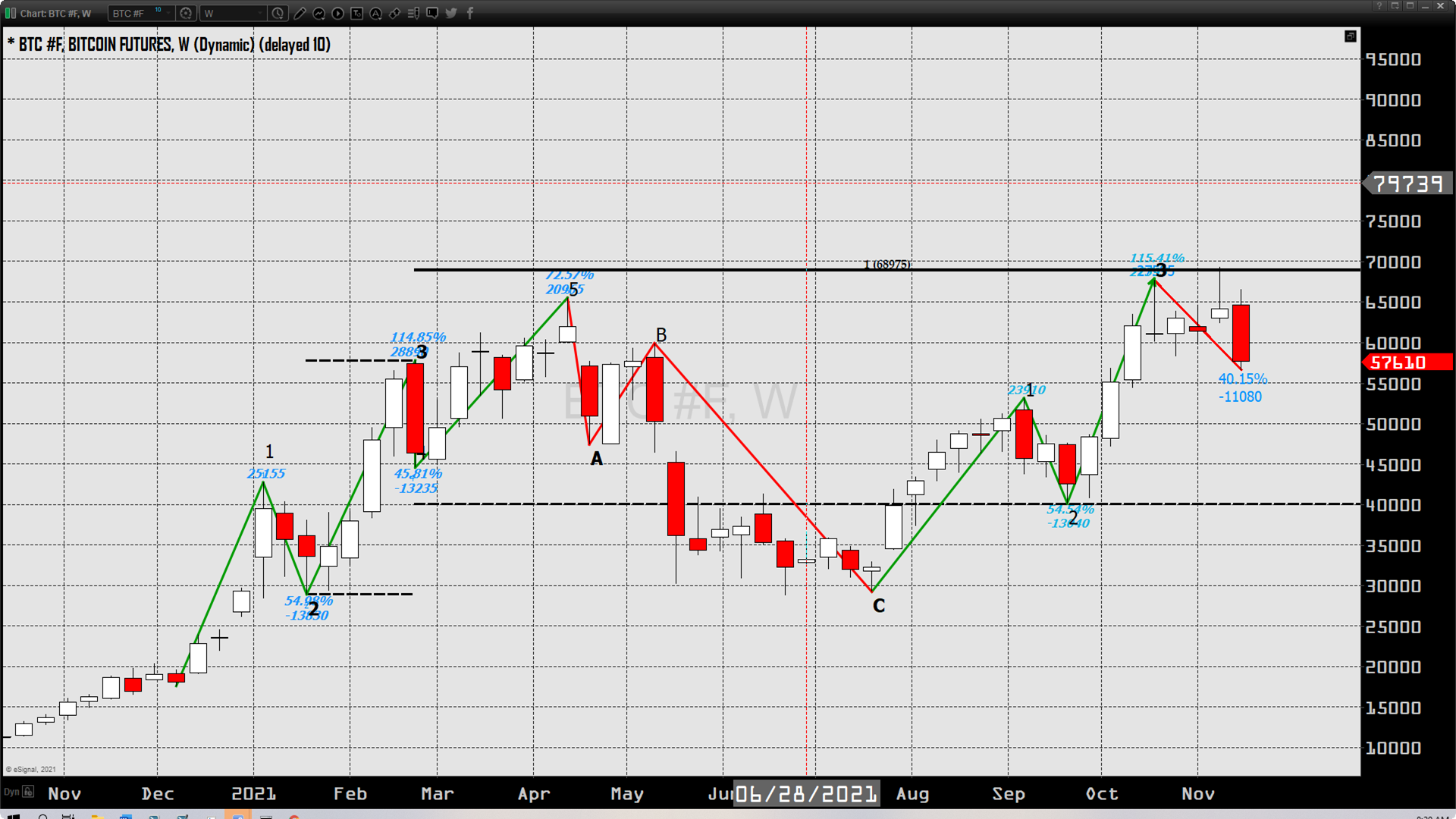

Let's revert to our wave count with the added data we now have to answer that question.

On Thursday, October 28th, I came out stating that the third wave had concluded. If the symmetry in the wave counts continued as they so elegantly have for nearly two straight years, we will see a $13,000 corrective wave four before entering the final Fifth impulse wave. If we didn’t hit a higher high at $69k last week, we would be looking for support to come in and a bullish reversal at $54,000 which is a very logical point for this to occur. However, with the higher high that came in last week at $69k, our price point for a conclusion of this fourth wave would be $56,000.

The reasoning behind this theory is simply comparing all the corrective waves of the last two impulse cycles (not corrective waves A, B, C) have all been approximately $13,000 in length. This level also corresponds with a 50% extension of this current cycle when compared to Spring’s impulse cycle.

We are now trading about $2,000 above that price point at 2:30 PM EST. If we were to drift below $56k, then $53k would have to hold for this count to be correct. If we break below approximately $53k, then the bull run has likely concluded however, if we hold that level especially if we hold $56K, then our forecast from Oct. 28th utilizing our wave count from Oct. 20th is still in play.

“As long as BTC follows this model and does not break below $54k, then there is every reason to believe that BTC, following this wave four correction, will rally to a new ATH of around $75,000.”

If I was incorrect and we break through the above-mentioned levels, a swift correction down to $44,000 is very possible.