What can we glean from uber-wealthy Bitcoin backers?

As many analysts and pundits across financial news have noted, this current bull run in Bitcoin and Ethereum is similar to the rally in Spring 2020 because it is fueled by institutions and wealthy individuals (whales) piling into the sector.

This kind of attention has in the past catapulted prices to new all-time highs. This spotlight is often accompanied by large corporations making public statements in favor of Bitcoin and or Ethereum. Not only supporting the asset with words of confidence but also providing new use cases for the world’s top two cryptos.

One such billionaire, Barry Sternlicht, a co-founder of Starwood Capital Group, told CNBC’s Squawk Box on Wednesday that gold is “worthless” and that he is hoarding Bitcoin because every country in the “western hemisphere” is printing unlimited amounts of money.

His worries that the dollar is a lousy store of wealth were echoed in the words and actions of founder and CEO of Strike, Jack Mallers. “You simply cannot save by holding dollars,” Mallers wrote in a blog post. They are following behind Coinbase, which offers a similar service to allocate all or a percentage of your paycheck into cryptocurrency with zero fees. Strike now offers the same ability to convert your earnings, although, unlike Coinbase, Strike users in the U.S. can only convert in Bitcoin. Individuals can use Strike’s conversion tool regardless if their employer embraces Bitcoin or carries it on their books. The Bitcoin conversion option, according to Mallers, is a means for customers to create wealth and save for things like their children’s education or housing at a time when inflation is on the rise, and savings account interest rates hover just over zero.

A common saying for traders is “follow the smart money.” With the “smart money” continually changing over to Bitcoin’s side, holdouts like the Warren Buffets and Jamie Dimons of the world are becoming the minority. But I believe if one was to follow any investor’s beliefs and profit from those beliefs, I recommend a new more apt saying “follow the visionary money.”

What can we glean from traders who used BTC to become uber-wealthy?

Let’s change the topic slightly by studying the trading patterns of individuals who have become uber-wealthy or greatly increased their net worth through trading Bitcoin. A topic readers will likely connect with on a real-world level.

On-chain metric data sources are invaluable in following any and all money. Websites such as Coin metrics, Glassnode and others allow investors to see the growth, adoption and trading strategies that have proven extremely profitable over short and long-term time cycles.

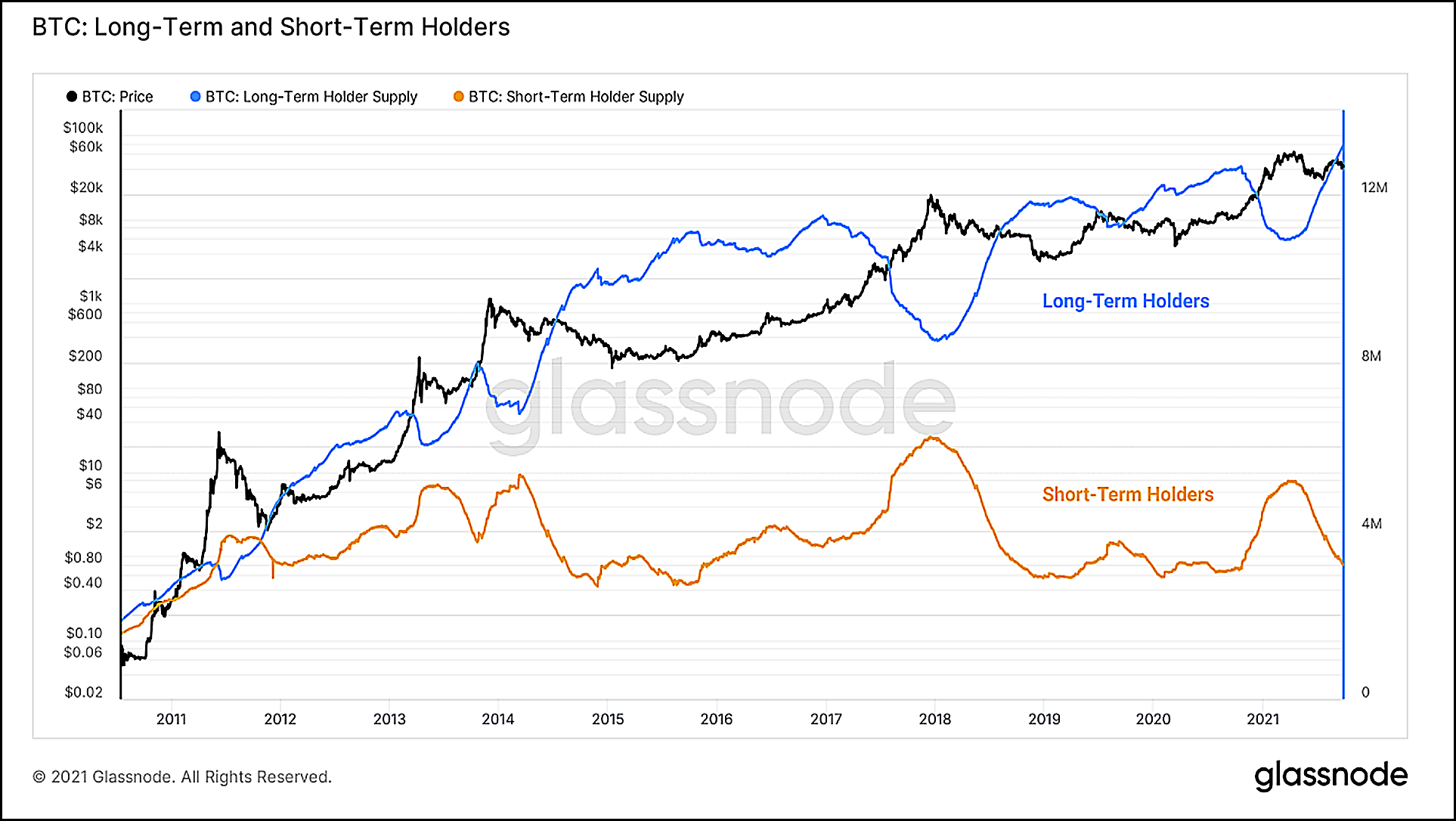

What is evident in this chart is that the “smart money” accumulates holdings of Bitcoin heavily during bear market conditions and are long-term holders rather than short-term. We can visibly see how the opposite is true for short-term holders who tend to buy at the tops and sell at the lows. The long-term holder is not the same as hodlers who have the conviction not to sell their coins any time in the near future.

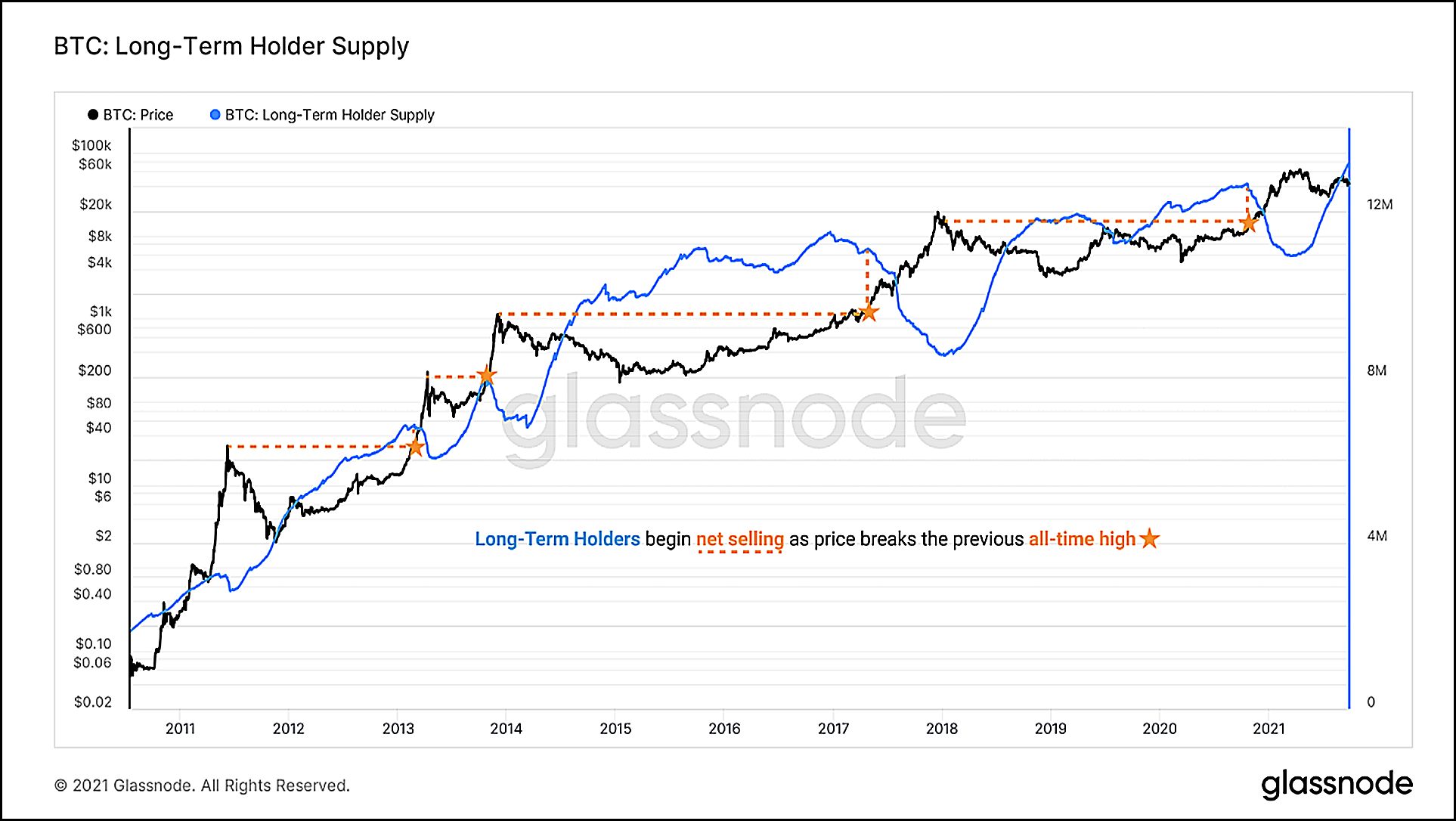

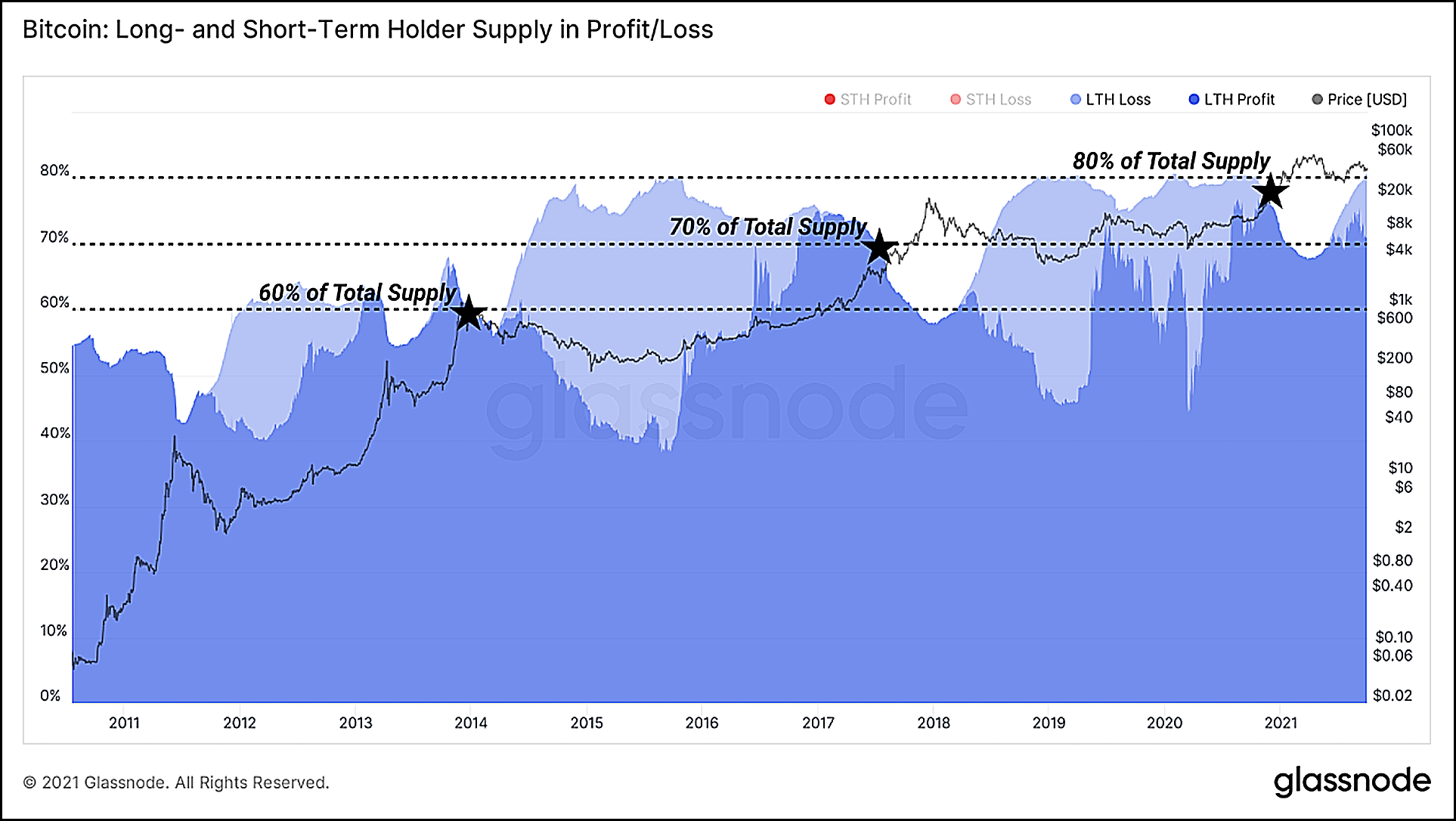

This second chart takes out the short-term holders and highlights that those long-term holders do sell their coins, but only after a new record high is achieved. Another aspect of this chart is how even during peak unloading periods the long-term holders still have collectively hold more coins than they did during the previous accumulation period.

So, in this era of ever-changing financial frontiers, the smart money is the same as visionary money or investors who are true Bitcoin believers. So the saying “follow the smart money” is an outdated expression to some extent. Although short-term buyers enter when wealthy investors start buying Bitcoin, they aren’t the ones turning huge profits from their positions. Maybe because those people who are and will continue to profit directly from their Bitcoin holdings aren’t followers at all Instead, they are visionaries leading the way to the future. The “smart money” simply has been following them.