The Battle of Mid-Way

At the start of the trading week Bitcoin plunged 6%, losing over $2,000 in value on Monday. This took Bitcoin below $40,000. It also took some traders by surprise, liquidating $439 million in long positions on Monday, according to Coinglass. But if we look back to the previous four-year cycles in Bitcoin and where we are now in the current cycle, the recent decline should not have come as a surprise, nor should a further decrease in pricing.

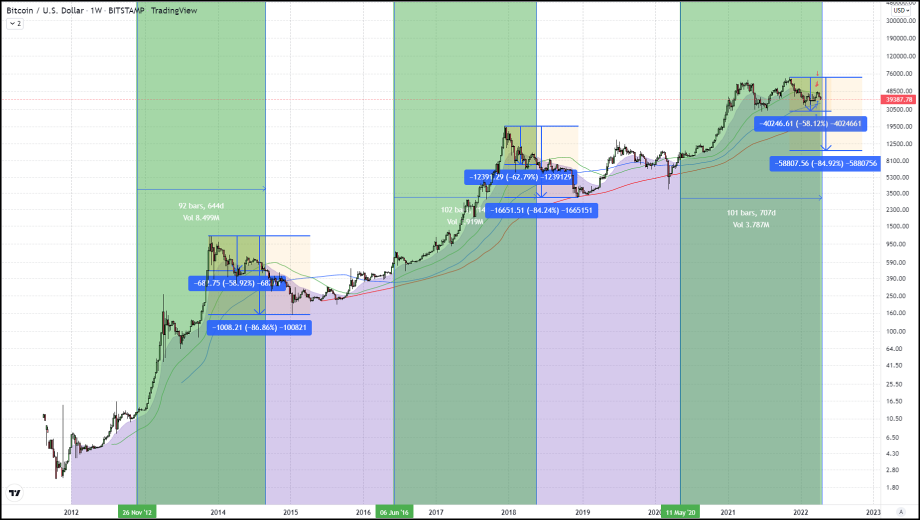

The cycles I am talking about center around the halving of block rewards which occur roughly every four years. Looking back to how Bitcoin’s price was affected by these halving periods, we can easily identify three stages that have followed each halving event so far. At the start of these cycles following a halving of rewards Bitcoin goes on to rally lasting a year to a year and a half. After hitting an apex, it enters a correction. Following the corrective period, we see consolidation lasting for approximately two years leading into the next cycle.

We are now very close to the mid-way point of the current cycle. History has taught us that at this point in the four-year trend, we should be in the midst of an extended correction. In the past two cycles, Bitcoin gave up around 85% of its value from the apex to the end of the correction. By the mid-halving point in the prior cycles, BTC had already shed about 60% of its value.

For us to reach that same level, we would have to revisit the lows of last summer at around $30,000. While that may be an outcome not foreseen by many traders, it would be no more drastic than the sharp decline witnessed in the Spring of 2018. Spring 2018 was the last mid-way point between halving.

Sadly, for the bulls, if this cycle repeats itself for a third time, we would see a further decline taking Bitcoin as low as $10,000. A price not seen since October 2020, before forming a base and starting the cycle over again in 2024.