Bitcoin benefits from inferences drawn out of Powell’s Q & A

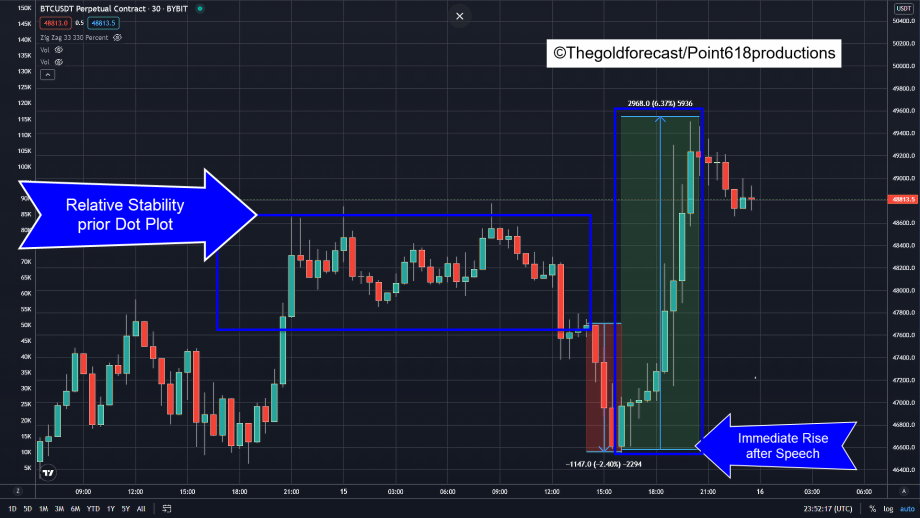

Following the revised dot plot from the Federal Reserve, bitcoin’s price fell by approximately $1000 in the course of fewer than two hours. But as Powell’s Q&A session began following his statement traders got a much more dovish picture of the Fed’s current outlook.

At precisely 9:30 Eastern standard Time bitcoin ended a short period of stability and consolidation and entered into a steep and swift price decline lasting an hour and ½ and taking the asset to a low of $46,500, almost matching the lows hit over the last ten days.

After investors had a few minutes to digest everything that was said by the chairman, they began to view the entirety of his statements through more accommodative rosy lenses. Over the next four hours bitcoin would rally by nearly $3000 equivalent to 6.37% in just two hours. This brought the digital asset to the highest trading point this week.

Whether or not the rally today in crypto was tied to the Fed’s outlook is easy to answer; it certainly was. But were they piggybacking on the rally in U.S. equities? And were crypto traders more intuitive in forecasting the outcome today? The answers are clearly shown in the charts themselves.

For instance, during the release of the dot plot and the consequent press conference, the NASDAQ declined by only 0.62%. It went on to trade lower hitting it slow for the day hours after completing the FOMC statement and press conference taking prices over a full percentage point lower than before the release of the new dot plot. So, equities markets were under the assumption that it would be worse than it actually was. Just as in bitcoin the NASDAQ made its intraday low at a price point not seen over the past ten trading days, but they were hit hours after the conference ended.

It was not until hours after the meeting had concluded that the tech-heavy U.S. index began to rally. At the time of writing (approximately 6:40 EST), the NASDAQ continues to rally and is now 4.2% higher from its intraday low.

So as to the answer to the question I posed above, clearly bitcoin did not ride on the coattails of the U.S. equity rally today. Instead, bitcoin either led the way or was the first to react, this is not to say that the two markets are intertwined and benefits from the same market forces and catalysts, it either means that crypto traders were quicker to react or, or better in predicting the statements and policy changes that were to come out of today’s FOMC meeting. This can be clearly viewed through daily charts of bitcoin and the NASDAQ composite. Even when panning out the charts show the constant decline in equity pricing over the days leading up to the meeting compared to bitcoin’s relatively stable price within that period.