Bitcoin breaks through bottom at long-term 78% Fib. Level

The bottom in Bitcoin that held for two years was taken out as prices eroded to new lows starting on November 8th. From the open on Nov.8th to the low on Nov. 9th Bitcoin’s price declined by $5,000, nearly 25% in two days. On the following day, Bitcoin had a slight recovery but was unable to close back above the 78% retracement at $17,800 and We felt it prudent to issue our first trade alert in months. Anyone who has signed up with us at Thegoldforecast.com/bitcoin got a trade alert to sell Bitcoin at $17,600 traders taking the call likely experienced entry prices within a few hundred dollars of here, we placed protective stops at $18,883. We initially targeted $14,000 but succumbing to reason another email was sent out yesterday to move both our stops lower from $18,883 down to $18,400 and revised our exit to $16,400. As of now, traders should have exited the trade at $16,400 earlier today for a profit of $1,200 per Bitcoin. Anyone still active can exist at current prices.

Everyone seems to know for sure what caused this massive downturn but I’m not so sure they do. One thing is certain the 78% retracement from the march 2020 lows up to the all-time high is no longer support and has seemingly become resistance.

Can the FTX liquidity or lack thereof explain BTC's downside?

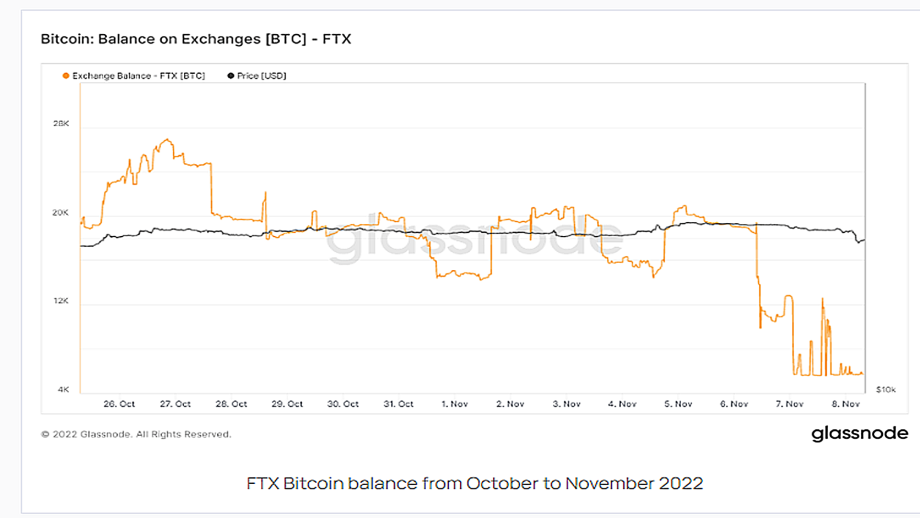

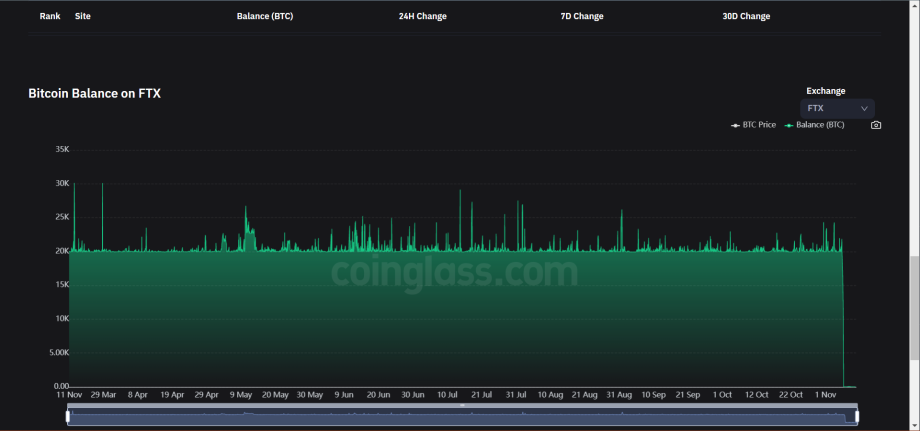

The massive weakness seen in Bitcoin and across other cryptocurrencies alike over the past week has been chalked up to nothing more than a liquidity crunch at what is now a failed or soon-to-be failed crypto exchange FTX. FTX held almost 120,000 Bitcoin at its peak in June 2022 (Glassnode). In August their holding dropped below 40,000 Bitcoin and in November they held less than 20,000.

Another source (Coinglass) shows FTX never having more than 20,000 Bitcoin for any extended period going back to March 2022.

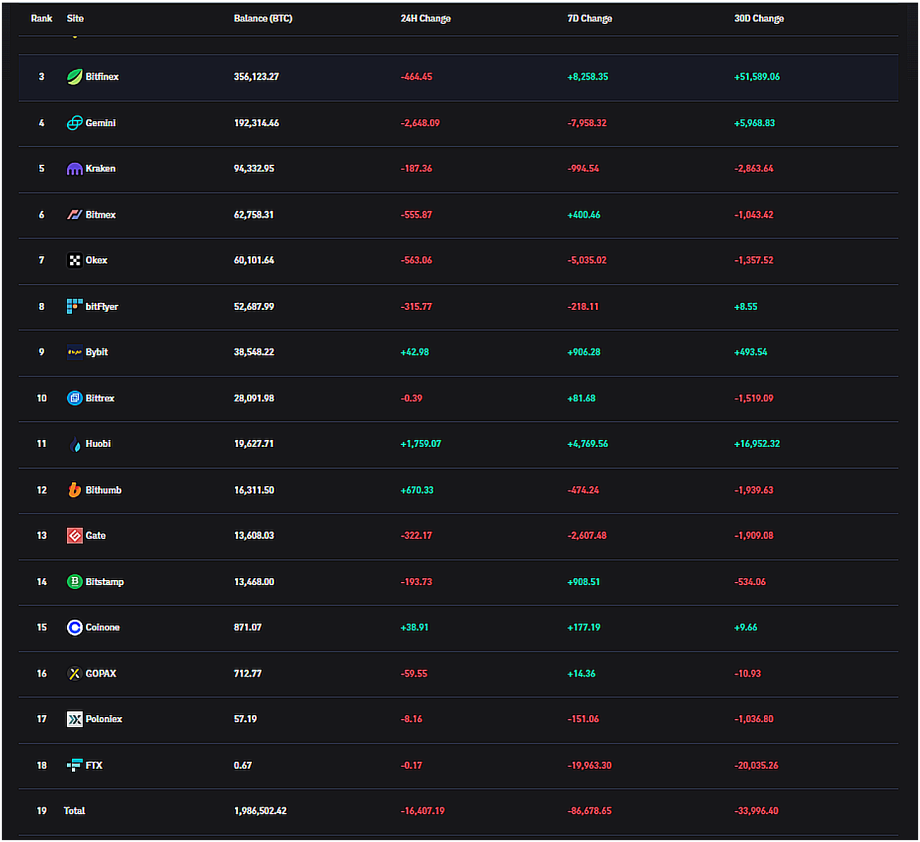

Now compare that to the nearly 2 million Bitcoin held on exchanges around the world or the rest of the 19 million coins that have been mined over the years (minus the ones that have been lost) and all this massive weakness stemming from an exchange that Reuters reported was in the hole for $8 billion doesn’t quite add up.

Even after the massive sell-off over the last few days Bitcoin’s circulating supply (including coins that may have been lost) still stands at $325 billion. An exchange with around $10 billion in liabilities having this drastic effect on the crypto markets that have a total capitalization of nearly $850 billion doesn’t add up.

One way to explain this is that the sell-off was destined and traders were simply waiting for a catalyst to act on. Or this another event similar to Voyager Capital, Three Arrows, or Terra Luna where the damage done to cryptos reputation and appeal was the real blow and not a liquidity crunch.

After this fiasco at FTX, a lot more people are putting their coins in hard wallets and withdrawing their coins from centralized exchanges altogether. This is the only silver lining on this dark cloudy week.