Bitcoin gets adopted by another payment service

As far as payment portals go it has been roughly two years since a large-scale payment solutions company hopped on the Bitcoin bullet train. Yesterday MoneyGram announced a new cryptocurrency service that allows customers to buy and sell Bitcoin (BTC), Litecoin (LTC), and Ethereum (ETH) on the company’s mobile app.

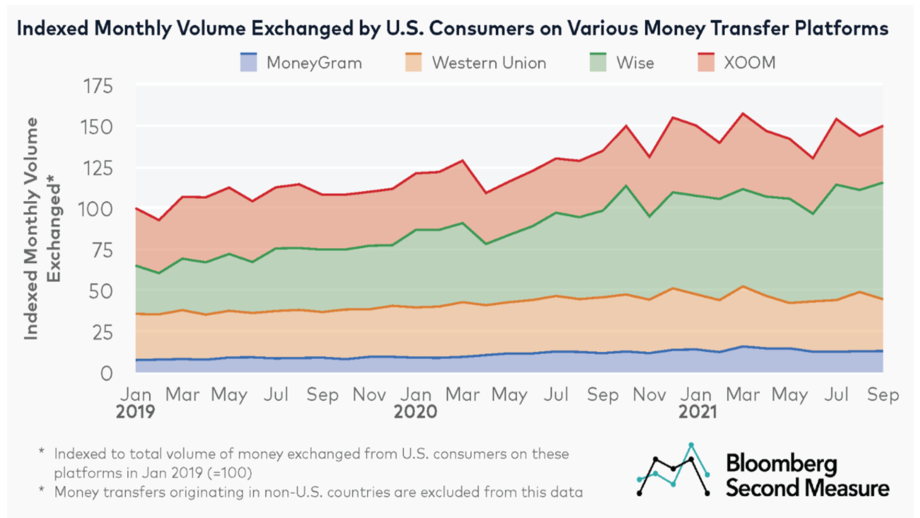

This has the potential to trigger another attempt to reclaim the $25,000 range. This would have been more influential on price if MoneyGram had the volume of PayPal and Cash app that help to spur the bull run in 2020.

Back in 2019 when Bitcoin was at its lowest value since becoming a household name in 2017 at roughly $3,000. This price bottom has remained intact and I believe will never be broken. In February 2019 Bitcoin got adopted by its first and most pro BTC payment portal provider Square (Cash app). What followed was the 2019 rally to $14,000 hit six months after the announcement by BTC maximalist Jack Dorsey.

However, BTC failed to hold onto price advances from that time and there was real resistance at approximately $12,500, a price only breached on two days since falling below it at the start of 2018. Bitcoin would not break above this price ceiling until the next big payment service provider by the name of Paypal integrated Bitcoin along with Ethereum and Litecoin into its online application in October 2020. On the very day, Paypal made its announcement BTC broke above the $12,500 price ceiling and didn’t look back. From there BTC went onto its largest rally ever in terms of dollar value hitting $65,000 less than six months later.

Although I don’t expect the same explosive rally that was brought on by Paypal largely because it is used much less and the fact that their crypto service is only being released for use inside the U.S. although the company claims that they will look to possibly expand this service outside the U.S. in 2023. It is hard to say how much traction that would gain them if they did offer cross border transfers as the fees and taxes that they would have to tack on would make direct payments on the blockchain itself more attractive. Still any adoption news is good news.