Bitcoin Holds Support, Will the Levy Break?

The Price of BTC moved back above the critical support level of $29,000 last Friday (May 13th) after dipping as low as $25,500 on the previous day. While BTC has yet to show signs that a recovery is on its way, the pause in the major selling pressure after an extended low seems to mirror the action seen exactly one year ago.

Last year in mid-May, Bitcoin fell roughly $30,000 in just two weeks, losing about 50% of its value in that short, brutal time frame. What followed two months of loose consolidation at prices comparable to the current market print before rallying to a new ATH. While it is indeed much too early to say that a base has formed at the $29,000 - $30,000 level, the price action is shockingly similar to what we saw precisely one year ago.

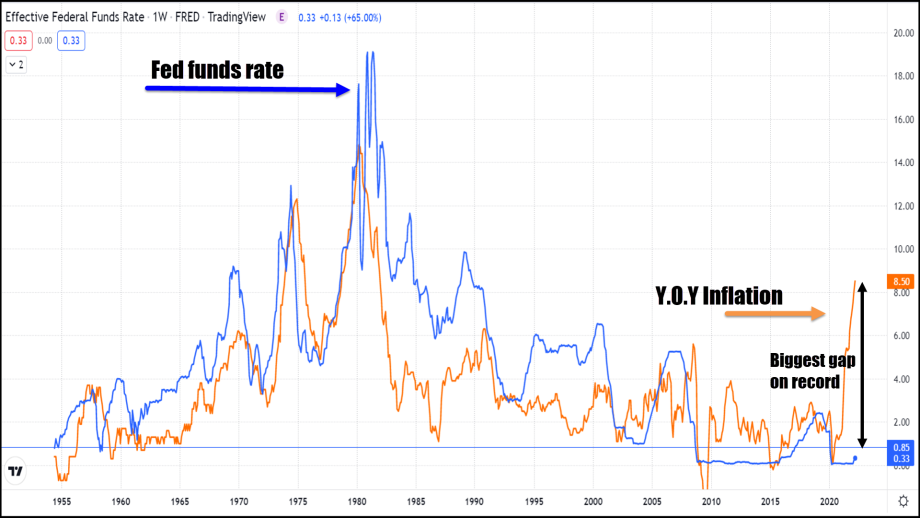

The big difference between then and now is that the underlying macro fundamentals in markets with a strong correlation have changed. As such, those markets, mainly big tech which can be viewed through the Nasdaq Composite, have an uphill battle with the Fed’s monetary tightening already straining the industry. This is happening when the Fed funds rate still remains historically low. The effective Fed funds rate currently at 0.83% is still lower than any other time than the recent pandemic over the last 64 years, matching the lowest rate pre-pandemic on record from May 1958.

If we look back over the past 70 years and compare what the Fed funds rate climbed to in order to battle the many rises in inflation, you will notice that nearly every period of rampant inflation required a Fed funds rate that was equal to or greater than the year over the year inflation rate. We are a very long way away from reaching that threshold. In fact, over the past seventy-plus years, has the difference between those two metrics been farther apart. Inflation on a yearly basis still outweighs the Fed funds rate by nearly 7%.

What does this mean for BTC?

Unfortunately, it is this fundamental difference that will likely be the cement shoes that drag Bitcoin down to the depths of the economic ocean. The Nasdaq will likely only continue to fall, and with it a lot of institutional investment dollars will be moved out of Bitcoin and big tech or simply mass liquidated by institutional investors. The same investors that we all praised for helping Bitcoin’s previous rallies are the same investors who will bring about a new extended bear market. So unlike the previous two times bitcoin was trading at this price level (January and Summer of 2021) Bitcoin will likely not have a major rally from this point, but instead this is likely a stopping point on the way down.

For now, Bitcoin is holding on precariously above $29,000 support but with the equities sell-off likely just beginning how long will it last? Bellow $29k, the next support level is $24,500, below that major support lies at $18k, which is where I believe this correction could lead us to over the next six to twelve months. Current resistance is at $32k and above that major resistance at $37,500.