BTC seems destined for lower prices

At the time of writing BTC is trading at $37,222 after breaking through support at $37,500 representing the 78% retracement. The retracement uses a data set that stretches from the bottom at $28,000 up to the ATH at $69,000.

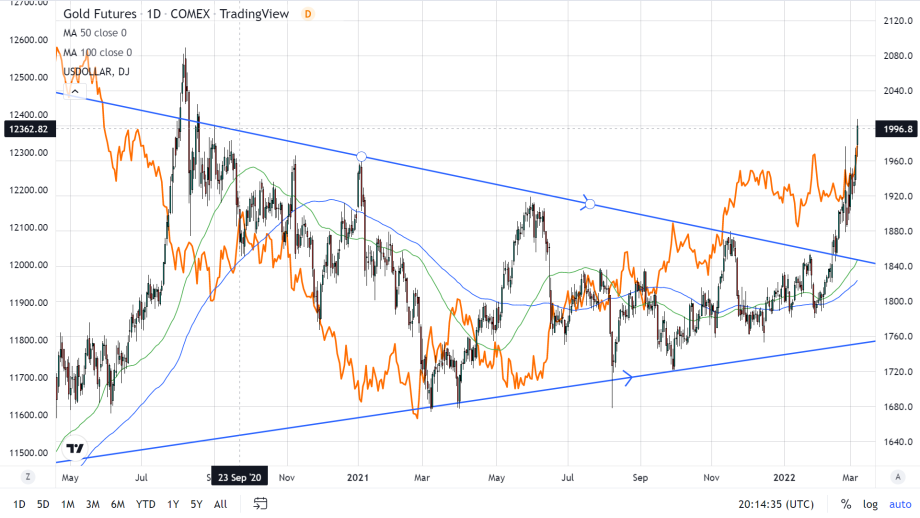

The “free money” narrative that brought about bullish sentiment last week seems to have dwindled and a gloom and doom narrative is present amongst traders. Commodities are surging to the upside with the U.S. dollar, oil, and gold all reaching multi-year highs.

The risk-on assets continued lower with the Nasdaq Composite losing 2.5% leading the way lower for U.S. equities across the board. Last week there was a brief period when the Nasdaq Composite and Bitcoin had shown signs they could be decoupling. However, this was merely a pipe dream and for now the correlation couldn’t be stronger as both the Nasdaq and Bitcoin down roughly 2.6% on the day.

This is a bad sign for Bitcoin’s future price direction as both the Conflict in Europe and the upcoming tightening by the Federal Reserve will certainly continue to weigh down on the riskier assets. Bitcoin will hit a bottom and eventually move higher, but the bottom is far from here and as hypothesized before could go as low as $18,000 in order to complete a 78% retracement from $4,000 to the ATH at $69,000.

The 78% retracement has been hit after every long-term parabolic rally except the most recent that started in March 2020.