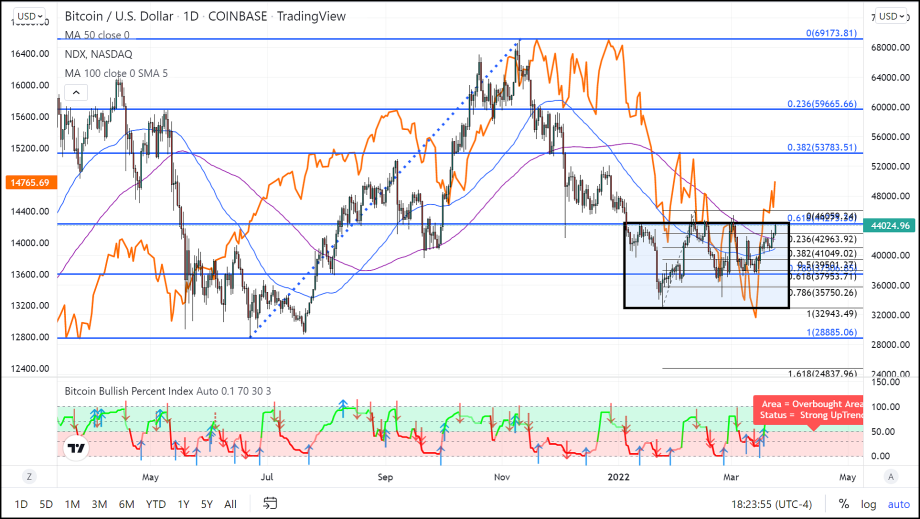

Can Bitcoin finally break out of its range?

Bitcoin has been trapped inside a trading range of $33,000 - $44,500 for the last 75 days. As of 4:45 PM EDT, Bitcoin is trading at approximately $44,000. Around four hours ago, it touched upon the key resistance level at around $44,500, an area that has stifled the movement of the past two rallies. Can the third time be the charm?

The key, I believe, is how Bitcoin traded up to this point and how it differs from the first two failed attempts on February 10th and March 2nd. The path that BTC took to get to $44,000 this time around is unique in that it moved up over a two-week period in a defined upward channel compared to the last two rallies in which most of the price gains occurred in a single day. This steadier increase in price is more sustainable and certainly more bullish than a one-day wonder. Another technical aspect that supports the bullish scenario is that not only did BTC have a bounce off of the 50-day moving average, but for the first time in 2022, we got a bounce off of the 100-day moving average as well.

Possibly more convincing of further price ascent is the fact that this time, unlike the last two, The Nasdaq has been trading higher as well. Most traders are aware of the correlation between the tech-heavy index and Bitcoin. The positive correlation has been strong throughout Bitcoin’s rise on both occasions above $60,000.

Both Nasdaq and BTC hit their all-time highs at the end of 2021 and were on the decline until recently. Just like the tops in these markets, in which BTC topped out prior to the Nasdaq, BTC made its bottom first as well. The Nasdaq has just recently come off a double bottom near 12,570 that was hit on February 24th and more recently just last week on March 14th. This brings a whole new fundamentally bullish undertone to this recent run-up that was absent in the last two.

Will this be enough for Bitcoin to finally break out of its trading range? Only time will tell, but it certainly is more plausible on this most recent rally than it had been on the previous run-ups.