Differences between BTC and a CBDC, how centralized are cryptos?

With a lot of talk surrounding the libertarian rights of everyday Russians and their access to cryptocurrency exchanges, I think this is an appropriate time to highlight the distinctions between a decentralized digital currency and a centralized one.

This topic has become more relevant recently with all of the world’s superpowers in pursuit of their own “Central Bank Digital Currency” a task that socialist regimes have so far been leading the way in. In affect they are counties are trying to create the next world currency, a title that currently belongs to the U.S. dollar. China began researching into this topic back in 2014, and during the start of the 2022 Winter Olympics held in Beijing, the e-CNY or ‘digital yuan’ was on display. However, the digital yuan accounts for a mere fraction of Chinese commerce and has yet to be widely accepted outside of its own borders.

Basically, every major economy in the world is looking seriously into their own CBDC. The largest capitalist countries include the U.S. Federal Reserve, the European Central Bank, the Bank of Japan, and the Bank of England. Fed chairman Jerome Powell thinks that they can replace digital assets like Bitcoin that are not upheld by a central authority saying back in 2021 “you wouldn’t need stablecoins, you wouldn’t need cryptocurrencies if you had a digital U.S. currency. I think that’s one of the stronger arguments in its favor.” This statement leads me to conclude that he has yet to grasp why Bitcoin is so revolutionary, there is a lot more to it than simply being “digital”.

Decentralized or not?

The Nakamoto coefficient is one metric used to quantify the decentralization of a blockchain or other decentralized system. The degree of effective Decentralization can be estimated by determining how many entities in each subsystem one needs to compromise at least one essential subsystem. The higher the value, the more decentralization is present in a network. In essence it gives a value based on how difficult it would be to control 51% of the hash rate, by doing so one could make changes to pre-existing blocks and perform double spending attacks. The actual calculation of the Nakamoto coefficient is based on the Lorenz Curve and the Gini coefficient.

The Lorenz Curve is a way to measure the concentration of wealth across a population. The value given for how dispersed income and wealth are is known as the Gini coefficient. The Gini coefficient ranges from 0 (0%) to 1 (100%), with 0 representing perfect equality and 1 representing perfect inequality. The United States Gini coefficient for 2021 is 0.485.

Using this simple method for determining how concentrated the power creating the currency is Bitcoin’s Nakamoto coefficient is 7,349 with a total of 14,409 validators (according to crosstower.com). While Binance Smart Chain (BNC) and Terra (UST, LUNA) has a score of only 7. With the Federal Reserve having complete and outright authority concerning issuance of new capital into circulation, we can give the U.S. dollar a score of 1 using this simple metric.

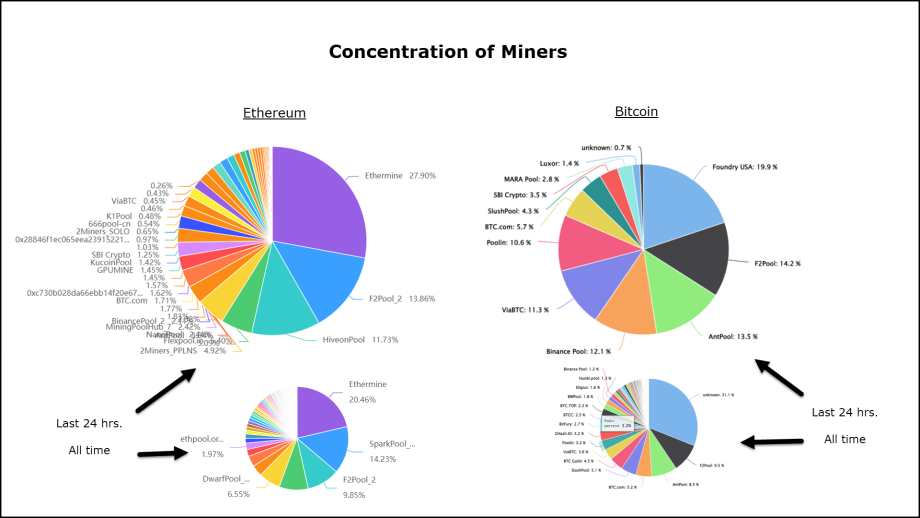

Over the years Bitcoin’s actual Nakamoto coefficient has been argued. Back in 2019, there were proponents claiming Bitcoin’s actual N.C. was actually only 4 due to the concentration of miners into large mining pools. A fact that is still true to this day, not only in Bitcoin but in Ethereum as well.

In 2017 Balaji S. Srinivasan and Leland Lee took it a step further citing that there are in fact six different subsystems one can use to gauge to reveal how decentralized a digital asset truly is they include,

- Mining (by reward)

- Client (by codebase)

- Developers (by commit)

- Exchanges (by volume)

- Nodes (by count)

- Ownership (by addresses)

Let’s take a look at these metrics and compare which cryptocurrency is more centralized. This is not the only metric one can use but it is the one we will discuss in this article.

Mining

One could argue that although the four largest pools account for over 51% of the hash rate, therefore the Nakamoto coefficient should be seen as only 4. However, each pool is actually comprised of dozens if not hundreds of miners so each pool cannot be viewed as a single entity.

Codebase

With Ethereum switching to proof-of-stake “sometime” in the near future let’s take an extremely brief look at which consensus mechanism is inherently more likely to be centralized.

First off let’s start of by highlighting the fact that PoW (proof of work) is inherently more decentralized than PoS (proof of stake), Bitcoin’s decentralization has decreased with the evolution of its network after the introduction of ASIC miners and has been declining ever since. On the other hand, Ethereum’s proposed PoS will likely become less centralized over the evolution of its network as more stakers come into being.

The argument of PoS vs PoW is a subject that can be argued by both sides, and is a topic worthy of its own article entirely.

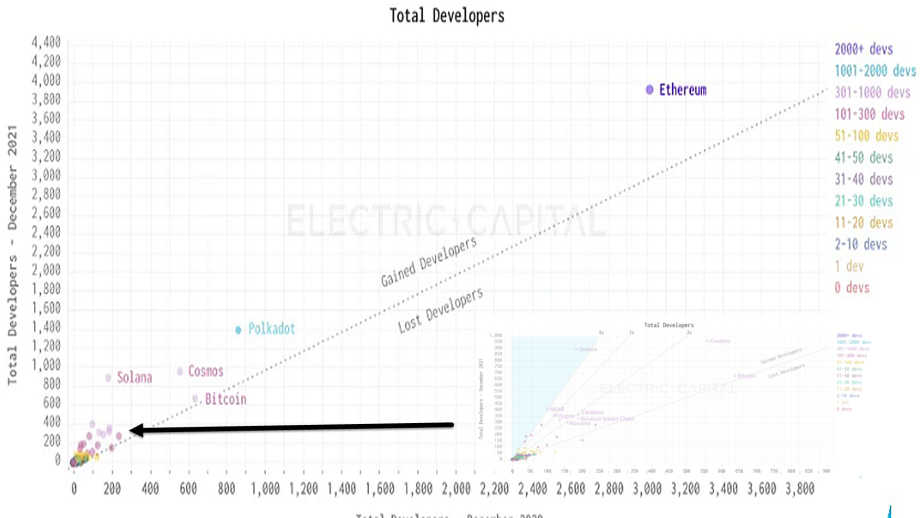

Developers

The blockchain boasting the highest number of developers is Ethereum. According to a report released by Electric capital in 2021 of the 18,000 monthly active developers committing code in open source crypto and web 3.0 projects Ethereum had over 4,000 developers compared to Bitcoin’s 680 at the time. At the time Solana (SOL) was growing its pool of active developers the fastest, currently that title is held by Cardano (ADA).

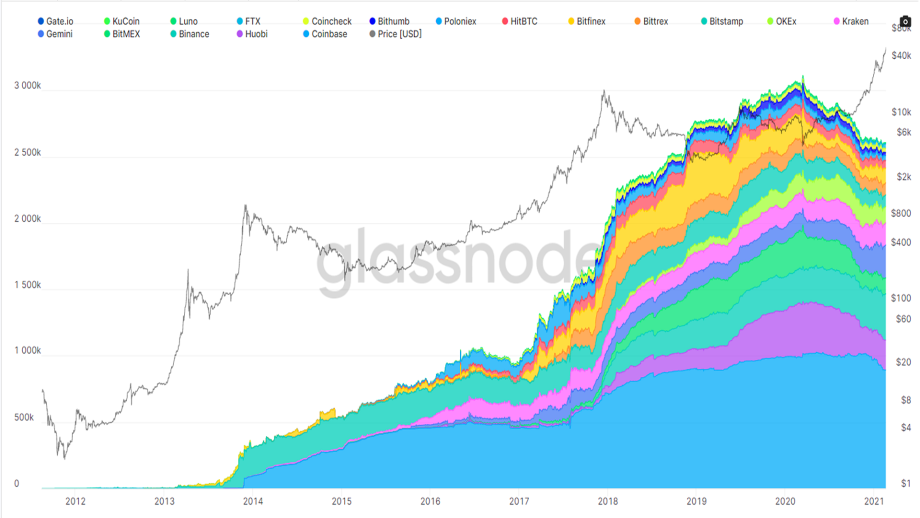

Exchanges

As shown by the chart above Bitcoin’s volume on exchanges fluctuates but overall has been on the rise and is somewhat inversely corelated to price.

Nodes

At the time of writing Bitcoin has 7,826 nodes that are active. When Ethereum switches to PoS it will hand over the job ounce delegated to nodes to “validators”. The number of validators for Ethereum has reached around 300,000. Although we cannot compare nodes with validators directly because in PoS validators are more likely to be chosen if they hold more coins, something that hurts decentralization of the underlying asset.

Addresses

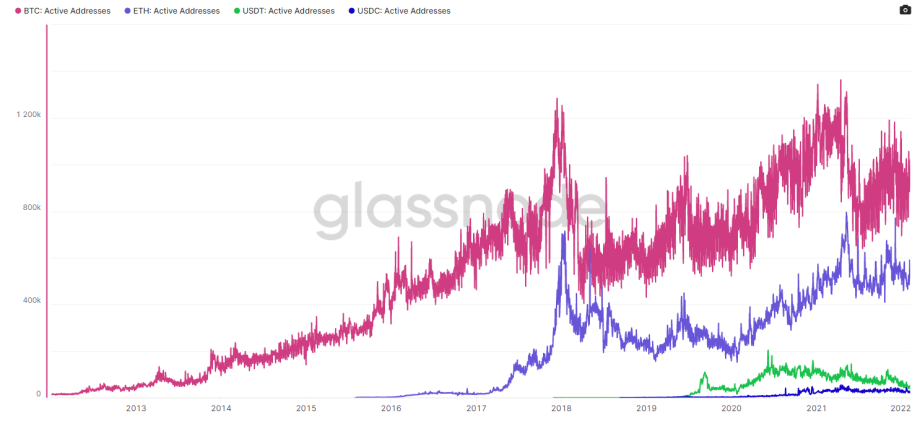

As for the number of active addresses we can see in the chart below comparing BTC, ETH and the top two stable coins USDT (Tether) and USDC.