Ethereum price drop, “What does the wave count say?”

Today risky assets took a plunge with the Nasdaq losing over 4% and the S&P 500 down by over 3% on the day. Crypto also took a plunge but Bitcoin faired much better than most cryptos posting a loss of over 4% as of 4 PM ET. Ethereum was hit much harder posting a loss of over 8%, so with the merge expected to come next month can Ethereum really trade any lower?

Jerome Powell’s speech today at the Jackson Hole Economic Symposium gave a bleak outlook for riskier assets as he signaled that aggressive rate hikes were going to continue until “the job is done”. He was referring to the job of lowering inflation to acceptable levels. This makes me believe that Ethereum can trade lower even with the bullish momentum from the upcoming merge.

At the time of writing Ethereum is trading at around $1,560 and there is tentative support at around $1,530 comprised of the 100-day moving average. This was exactly were the low came in today, if this lower trend continues were might ETH fall to?

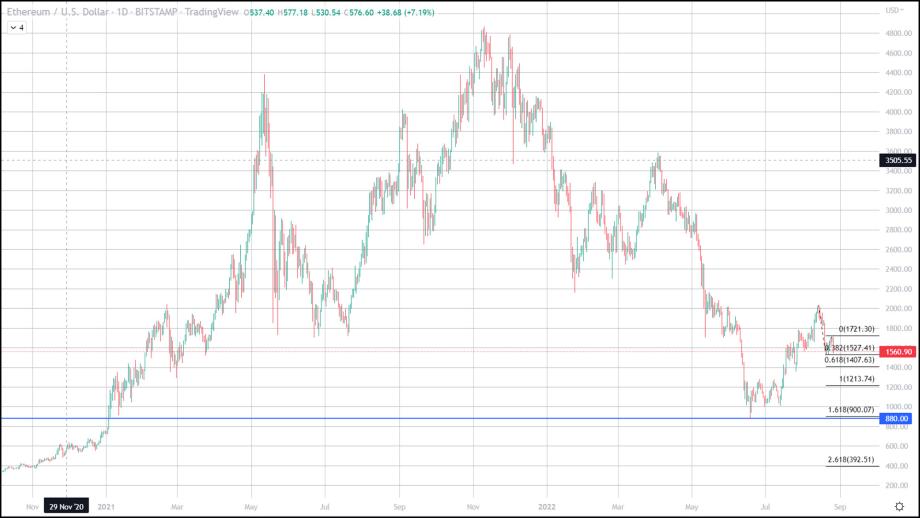

To answer that question lets turn to Elliot wave, and the current wave count for Ethereum. The most current wave count puts us in the beginning of a wave C and Elliot wave states the most plausible distance of wave C is a distance equal to wave A or 1.618 times that of wave A.

When we put in the trend-based Fibonacci retracement comparing Wave A to the start of wave C we end up with the more bearish scenario (Wave C equaling 1.618 of wave A) would take us back down to the lows of the past few years.

The lowest price Ethereum has seen in over a year and a half was $880 on June 18th which is the start of the Wave 1 of our current count. That is the more bearish case for Wave C, if Wave C comes in equal to that of wave A, then we might see a bottom at around $1,200 which is extremely bearish also.

So, if one is to believe either Jerome Powell or Ralph Nelson Elliot than they should also expect Ethereum to move to one of these targets ($1,200 or $900) in the coming weeks.