Inflation data released today rocks markets

At 8:30 AM ET, the U.S. Bureau of Labor released the consumer price index for the month of August. The report showed that inflation was still greatly elevated at 8.3% for all items over the last 12 months. Although this was a slight downtick from July’s CPI which came in at 8.5%, it wasn’t the decline economists were calling for as some forecasts predicted that the CPI would have fallen to 8% or lower.

This hit the markets extremely hard sparking a sell-off in U.S. equities with the Dow Jones declining by 3.9%, the S&P 500 losing 4.3%, and the Nasdaq Composite losing 5.4% on the day.

Cryptocurrencies didn’t fare any better with Bitcoin declining by 9.5%. Even Ethereum was down by 5% just days away from the merge. The one market that did exceptionally well was the U.S. dollar index which had its biggest daily gain since March 2020, gaining 1.46%, and is currently fixed at 109.58.

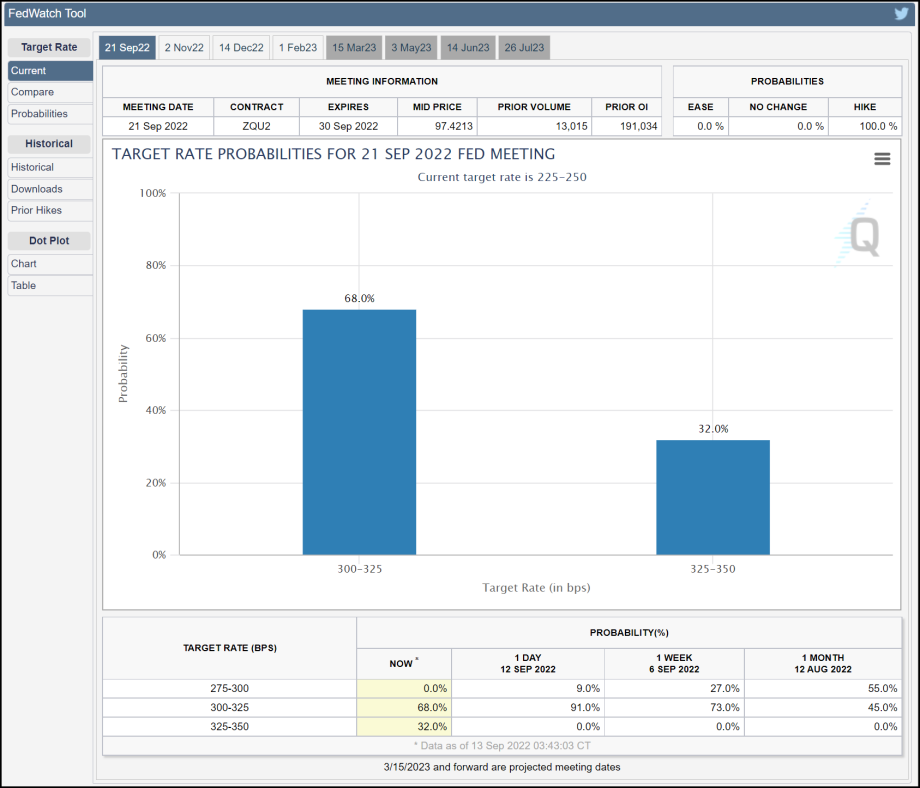

Today’s less than satisfactory CPI report brought about the biggest daily gain in the U.S. dollar in the last two years and the biggest daily decline in stocks for the same period. It is easy to see why when we take a look at the FedWatch tool.

The FedWatch tool is now predicting a 32% probability that the Federal Reserve will raise rates by a full percentage point at the Next FOMC meeting scheduled for September 21st. Just yesterday the FedWatch tool was giving the likelihood of a full percentage point rate increase at 0% and a half a percent or 50-basis hike at a 9% chance. Today’s numbers took a 50-basis point hike off the radar and put a 100-point rate hike on the table for the first time this month.

Long-term consequences for Bitcoin

This could be signaling that the bear market isn’t going anywhere yet. This goes for more than just crypto although crypto is likely to be hit the hardest. All of this supports our long-running thesis that Bitcoin’s next big move will not occur until Spring 2024, between then and now we forecast a period of rough consolidation and doesn’t rule out the possibility of making a new low.