The Once in a lifetime reason to buy Ethereum right now

Ethereum is about to undergo a once-in-a-lifetime metamorphosis that will be remembered for decades. My conservative estimate is that Ethereum prices will 2x over the next month and continue to climb higher and possibly faster than it ever has or will. I am not alone in my stance on the world’s largest decentralized finance ecosystem, and (for the time being) the number two crypto asset.

I am not going to say that it will be greater than Bitcoin, honestly, they are two different coins with two entirely different purposes and use cases. Bitcoin will always be Bitcoin and no coin, not even Ether can take its place. Bitcoin is the most decentralized, unstoppable, un hackable, and most importantly uninflatable place to safeguard your purchasing power which will never exceed a maximum of 21 million BTC.

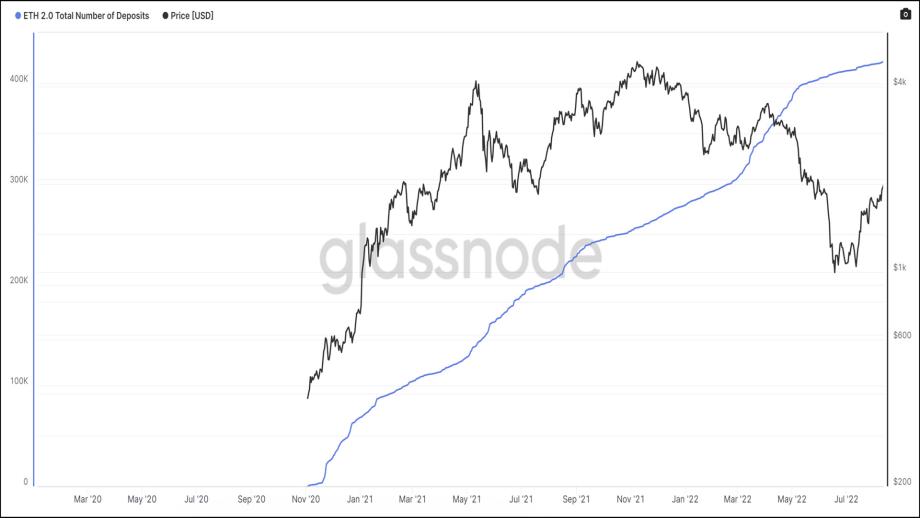

While the argument for or against PoS vs PoW is a topic that deserves its own report if not dozens, the following that PoS has gained is undeniable and will help Ethereum flourish in the future due to its eco-friendly consensus mechanism. The chart below shows the total number of Ethereum staked already in Ethereum 2.0, illustrating that regardless of price action interest in Eth 2.0 has grown at a steady rate since 2020.

Ethereum on the other hand is a virtual machine, an engine “or brain” of sorts powering the latest and greatest things crypto has to offer, a list that is always growing. Holding Ethereum is not so much an asset used to hedge against inflation rather it is a bet on the future of finance and the endless use cases that have grown to support Ethereum’s ecosystem. This includes NFTs, yield farming, smart contracts, decentralized finance, and inspired countless similar layer-1 competing chains such as Avalanche, Cardano, and Solana. Not to mention the many layer-2 chains such as Polygon, Arbitrum, and Loopring AND the countless ERC-20 tokens that run on Ethereum, such as Shiba Inu, USDC, Chainlink, and over 4,000 others.

It shouldn’t be understated what this will likely do to Ethereum. Following the merge creation of new Ethereum coins “Ether” which is currently 2 Ether per block. Last month issuance of newly created coins paid to PoW miners averaged 13,000 per day, this equates to a 4.5% increase in Ethereum’s total supply every year. After the merge, only stakers will be rewarded with new coins and the issuance will decrease by 90% down to only 1,600 per day! This has the real possibility of making Ether a deflationary asset. Assuming that its usage does not decrease, the gas fees paid to the network which are burned thereafter could easily exceed the newly minted Ether issued to stakers.

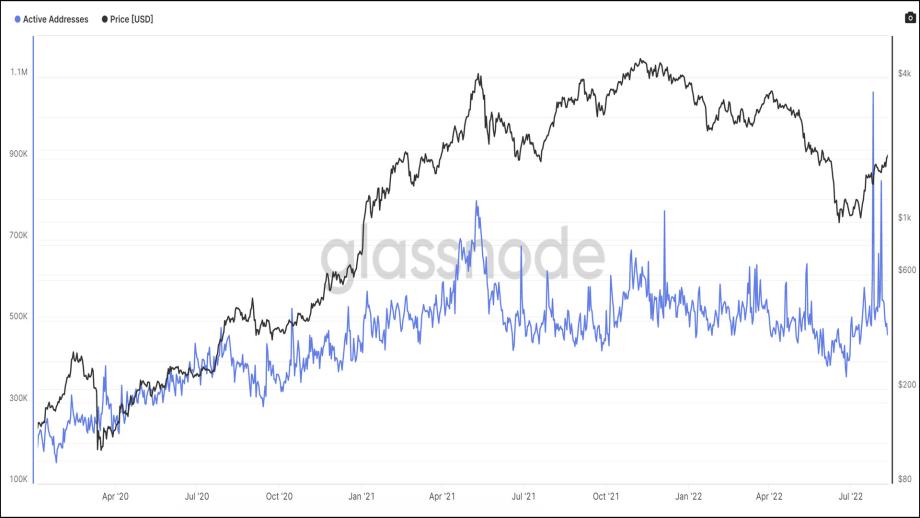

The creation of Eth 2.0 will also increase its throughput for transactions at a much higher multiple while also solving a lot of the scaling issues Ethereum has faced throughout its seven-year history. I will end this piece with a chart that shows the number of active Ethereum addresses on a per-day basis, notice the rapid increase of transactions on the network since 2020 which includes the massive spike in July that almost hit 1 million transactions on a single day! This clearly shows the support and momentum that has been building in anticipation of this once-in-a-lifetime event.