This week is packed with possibilities

Bitcoin and ETH gained ground on the first day of the Federal Reserve’s FOMC meeting. The meeting will conclude on Wednesday when a second consecutive rate hike of 75 basis points is expected to be announced. This will likely drag down the prices of a lot of things including cryptocurrencies. However, while we expect a mid-week slump due to the almost guaranteed fourth interest rate hike in a row, by the end of the week the focus will likely change when we find out for sure if we are indeed in a rescission. I think the likelihood of another contraction in GDP is high and this will certainly shift investor focus and will be a net positive for crypto. So, I expect a slump tomorrow but a likely spike higher by Friday.

Bitcoin and Ethereum prices hold onto gains made last week

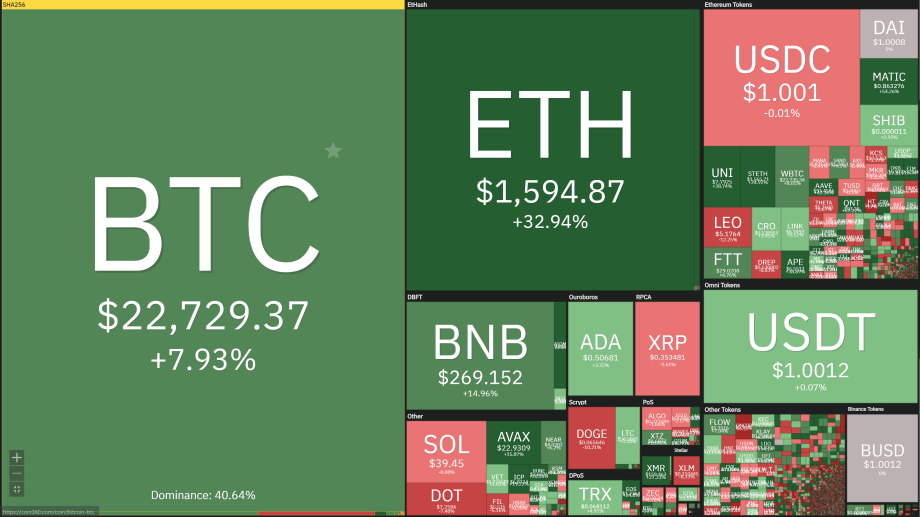

BTC and ETH while down on Monday and Tuesday are up decently over the last month, BTC +7.93% and ETH +32.94% over the last 30 days.

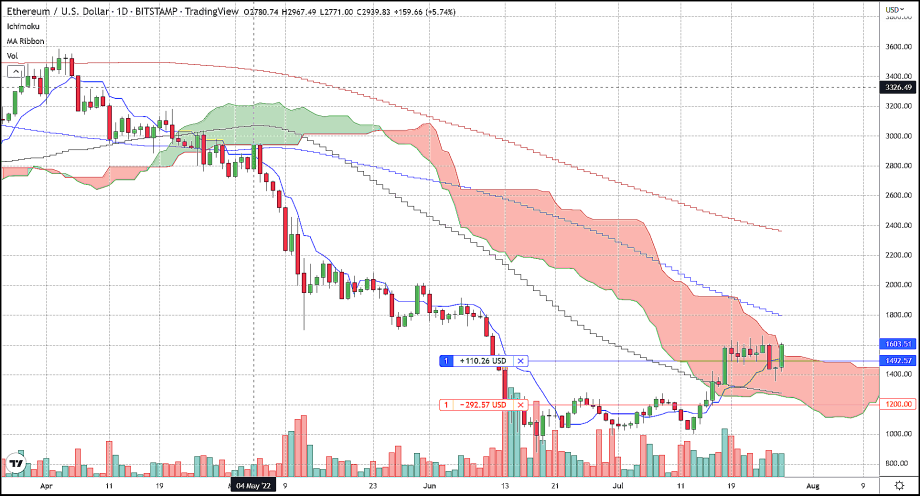

Overall, the slips in Bitcoin were minor as currently, the price has regained its footing ab above the 50-day SMA (simple moving average) as of 4:20 ET, and is trading at $22,720. Like Bitcoin, Ethereum is clawing back from the slight dip earlier in trading this week and is trading back above the base that is forming in ETH at around $1,500. Ethereum is still well above its 50-day SMA and is consolidating above $1,500 which can be perceived as bullish for the world’s second-largest cryptocurrency especially since there is support now likely at the 50-day M.A. sitting at around $1,300.

Traders who took our call on Ethereum last week and bought at roughly $1,492 should continue to hold onto their long positions with protective stops at $1,200. For Bitcoin, we are recommending a wait-and-see attitude until after the impending rate hike tomorrow. If tomorrow does bring us a dip in BTC we would be happy to enter into a long position in the belief that Friday’s GDP report will give BTC a boost to the upside and confirm a recession is occurring in the U.S. which we believe will shift investors focus to the out-of-control levels of inflation.

Clouded sentiment in Cryptos?

Another possibly bullish technical trait of the top two cryptos is the fact that they both have entered into the ‘clouds’ on their daily Ichimoku cloud indicators. While BTC has just re-entered into cloud territory ETH has remained in its own cloud on a daily chart for over 10 days and has actually begun to move above the clouds during today’s session. A market inside its own Ichimoku cloud signals that a pivot could be occurring, while pricing below or above indicates lower or higher pricing is the most likely path forward.