When could Bitcoin find a bottom?

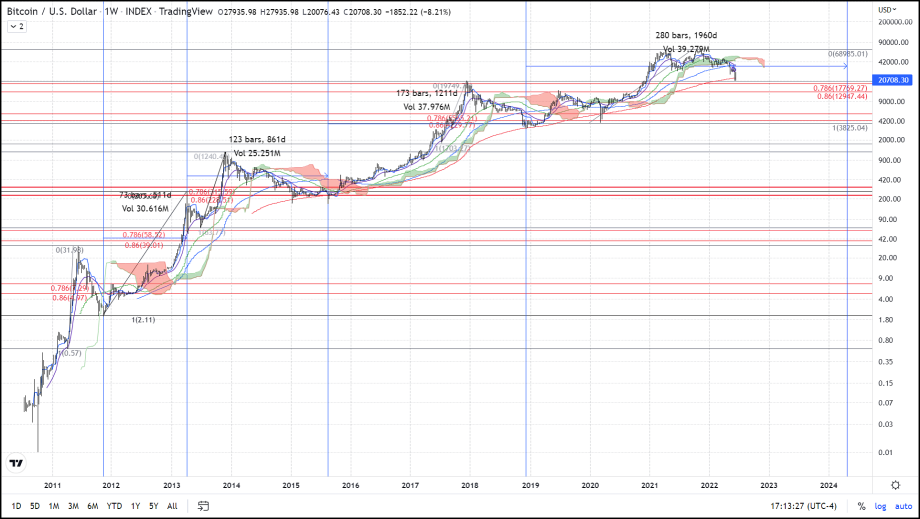

Bitcoin is simply doing what it has always done, after every parabolic rally going back to 2011 when BTC shot up from roughly $0.50 to $32, there was a correction that followed which wiped out at least 78% - 86% of the gains before another bull cycle began.

One interesting aspect of this behavior is that each time Bitcoin did this it took longer to reach a bottom. If you look at the time it took for Bitcoin to reach this level of a correction and multiply it by 1.618 you get a number that is very close to how long it took for the next parabolic rally to hit this zone. For instance, if you look at the date when the 78% - 86% retracement was hit after the first parabolic rally (August 1st, 2011) and mark the distance in time for the next occurrence you get a total distance of 511 days. If you multiply 511 by 1.618 you get 826 which is within 40 days of how long bitcoin took to bottom out after the next parabolic rally. However, this equation gets sloppier the further you go for instance the next time frame for this occurrence is 1,211 days but the equation used above would give you an answer of 1,393 which is 182 days off of the actual number.

When we do this equation to try and determine when Bitcoin will find a bottom in this current correction, we get 1,959 days which puts the bottom occurring in April 2024 close to the time of the next halving event. Regardless of if this is the date for Bitcoin finding a bottom, the one thing we can say for sure is that each time it took Bitcoin longer to find a bottom, and we have surpassed the last time frame from bottom to bottom which was 1,211 days. I do not think we have reached a bottom since we haven’t hit that critical retracement area of 78% - 86% which in dollars is $17,769 - $12,947.

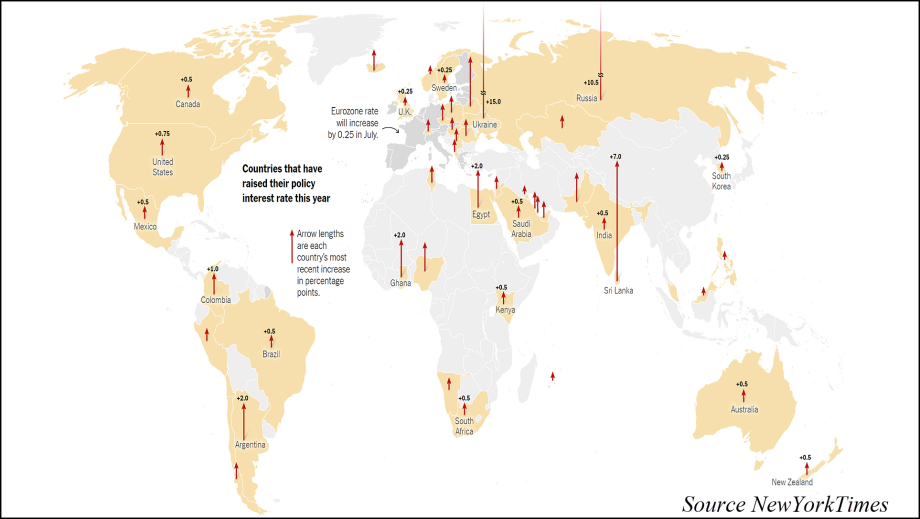

Although we may easily find some temporary support at current pricing as it matches up to the tops of the previous cycle reached at the end of 2017 at $20,000 but I do not believe it is where we will truly bottom out at. The macroeconomic factors which are pointing to a possible recession not only in the United States but worldwide and with central banks globally racing to try to gain a handle inflation by raising rates. According to The New York Times, “Within hours of the Fed’s move, Brazil, Saudi Arabia and others announced rate changes. Switzerland and Britain followed suit on Thursday morning. So far in 2022, at least 45 countries have lifted rates, data from FactSet shows, with more moves to come.”

With lower GDPs across the globe equities are going to follow suit and the correlation between equities and Bitcoin means that it too will be dragged down in price. This “cleansing” will wash out a lot of the weak hands and institutions who will pull their capital out of Bitcoin leaving only the true believers to withstand the storm and profit from the next bull cycle which we are predicting to occur in Spring or Summer 2024.