Bitcoin enters top ten assets globally after making new 20-month high

Bitcoin traded higher this weekend as well as on Monday, up over 7.6% in that period. This created this first weekly gap in the CME’s Bitcoin futures’ chart since January, when pricing topped $20,000 for the first time in 2023. This gap to the upside occurs at the highest price point of any bullish gap on the weekly CME futures’ chart in history and brought BTC futures above $42,000.

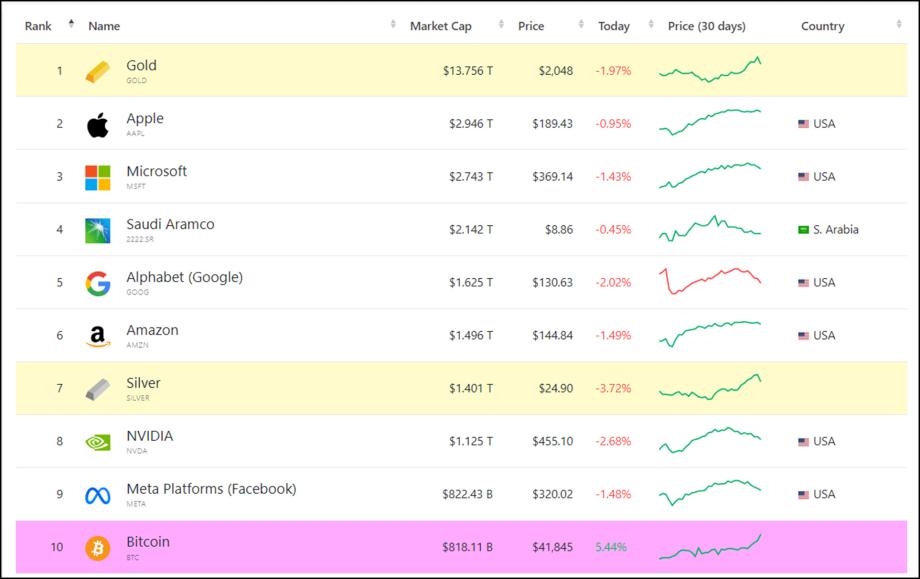

Recently, the bulls took pricing in both spot and futures to a new 20-month high. Notably this brings Bitcoin into the top ten assets globally according to Compainiesmarketcap.com, beating out the likes of Berkshire Hathaway and Tesla with a reported market cap north of $800 billion.

New ATH on horizon?

With this recent rise in Bitcoin’s price, many analysts have begun making their calls for the next peak in BTC. My predictions are in line with theirs in that a new ATH will diffidently be reached in 2024, however the path it takes to get there is debatable. My equation to predict Bitcoin’s price at the next halving event puts Bitcoin’s price at the next halving event (currently scheduled for April 2024) at around $58k. This estimate based on my equation still seems like a probable price point for the date of the next block reward halving, after which we will most surely see a new all-time high be reached.

Likely window for Bitcoin ETF approval brings bullishness back

Recent articles published by Bloomberg analyst James Seyffart highlights January 5-10, 2024, as a crucial period for the awaited ETF approval. Founder of Edelman Financial Services, Ric Edelman, predicts a 90% likelihood of approval by January 10. What this means for Bitcoin to me is that the next month will likely contain more rallies for the asset and result in Bitcoin at a higher price.

I believe that the approval of a spot Bitcoin ETF has a similar probability to approved in the window of time mentioned by those prominent analysts and after the almost certain historical breakthrough for BTC adoption, it will make acquiring real Bitcoin a possibility to so many new investors that it will likely bring Bitcoin as high as its 61.8% retracement at $48,555.

Conclusion

In other words, in under 5 weeks Bitcoin has a 90% chance of reaching as high as around $48k, and my call for the price in around 4-months’ time (as called for by my equation) is around $58k. So not only has Bitcoin bean on a tear of recent, but I believe it will continue to do so for the foreseeable future.