CPI report leads to extreme volatility in gold’s first 15 minutes of NY trading

Video section is only available for

PREMIUM MEMBERS

Today’s CPI report revealed that inflation continues to run exceedingly hot at 9.1%, a level not seen since November 1981. According to the U.S. Bureau of Labor Statistics, “The Consumer Price Index for All Urban Consumers (CPI-U) increased 1.3 percent in June on a seasonally adjusted basis after rising 1.0 percent in May, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 9.1 percent before seasonal adjustment.”

The report said that the increase in inflation was broad-based and that the indexes for gasoline, shelter, and food were the largest contributors. Energy continued to be the number one commodity of most concern. The energy index increased by 7.5% over the month and 41.6% over the last year, the largest 12-month increase since the period ending in April 1980. Higher energy costs contributed to almost half of all items increase.

Headline inflation had a substantial increase well above forecasts from economists polled by the Wall Street Journal. The Wall Street Journal poll concluded that inflationary pressures last month would increase by 8.8% far below the actual numbers.

However, there was a fractional decline in the core CPI report which strips out food and energy costs. The index for all items excluding food and energy rose by 0.7% in June taking the CPI core inflation reading from 6% in May to 5.9% in June. This confirms the premise that the Federal Reserve can impact core inflation but not headline inflation.

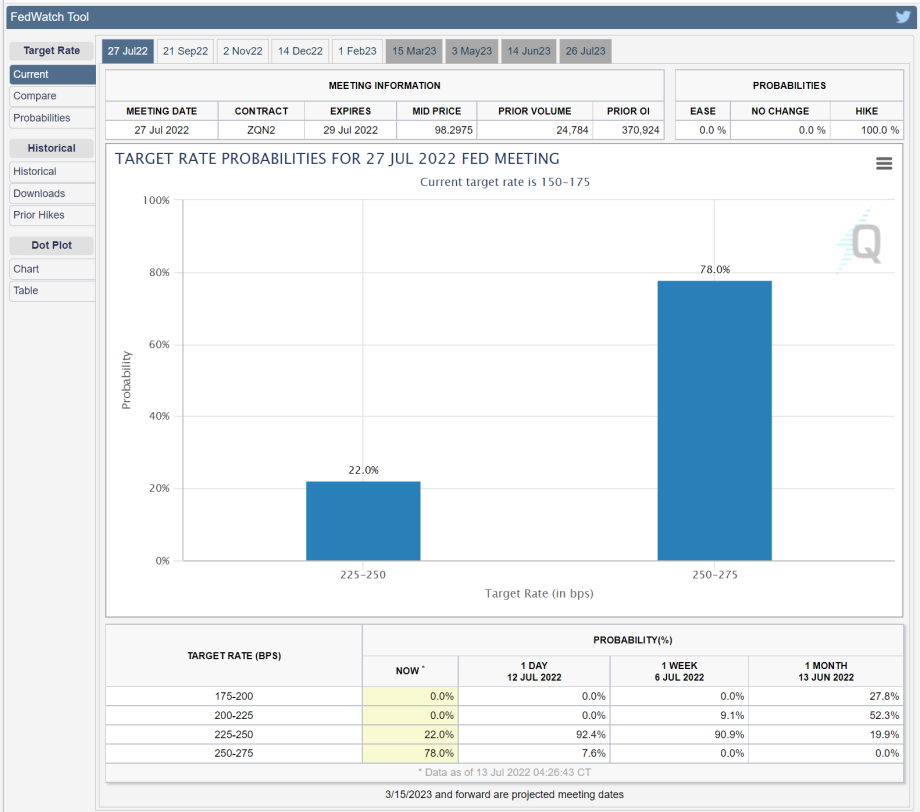

That being said, the Federal Reserve is on track for a much larger rate hike than anticipated yesterday. Yesterday the CME’s FedWatch tool said that there was a 92.4% probability that the Federal Reserve would raise rates by 75 basis points and a 7.6% probability that the Federal Reserve would raise rates by 100 basis points at the next FOMC meeting on July 26 -27. Today the FedWatch tool is predicting that the probability of a 75-basis points rate hike this month is 22%, with a 78% probability that they will raise rates a full percentage point or 100 basis points.

This created extreme volatility in both the dollar and gold. The chart above is a 15-minute candlestick chart of gold futures. The CPI report was released at the same time gold trading opens in New York at 8:30 AM EDT. Gold opened at $1723.60 and dropped to the intraday low of $1704.50 within the first 15 minutes of trading. It would take gold a full two and a half hours to reach today’s high of $1744.30 and then decline fractionally in price. As of 5:53 PM EDT gold futures basis, the most active August contract is fixed at $1733.80 after factoring in a nine-dollar gain.

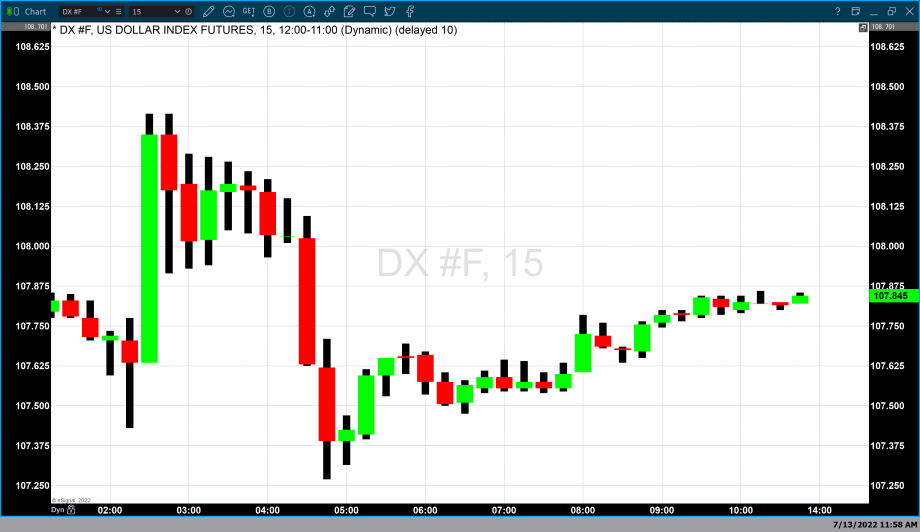

Extreme volatility was also seen in the dollar index which opened at 108.03 and within the first half hour of trading spiked to today’s high of 108.415 and within the following two and a half hours traded to today’s low of 107.27. Currently, the dollar index is fixed at 107.845 equating to a fractional decline of 0.06 %.

Wishing you as always good trading,

Gary S. Wagner - Executive Producer