CPI report reveals lower inflation and yields extreme volatility in gold and the dollar

Video section is only available for

PREMIUM MEMBERS

The Bureau of Labor Statistics released the Consumer Price Index for July indicating that inflation came in below forecasts by economists polled by Reuters and the Wall Street Journal. Economists polled by various News services predicted a slight decline in inflation from 9.1% in June to 8.8% in July. However, the economist polled overestimated as the actual numbers for July revealed that inflation is running at 8.5% YoY.

Overall inflation details with changes for various goods in July

“The Consumer Price Index for All Urban Consumers (CPI-U) was unchanged in July on a seasonally adjusted basis after rising 1.3 percent in June, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, all items index increased 8.5 percent before seasonal adjustment.

The gasoline index fell 7.7 percent in July and offset increases in the food and shelter indexes, resulting in all items index being unchanged over the month. The energy index fell 4.6 percent over the month as the indexes for gasoline and natural gas declined, but the index for electricity increased. The food index continued to rise, increasing 1.1 percent over the month as the food at home index rose 1.3 percent.”

Today’s report created extreme volatility in both the dollar and gold during the first twenty minutes immediately following its release. The knee-jerk reaction moved gold extremely higher. Gold futures opened at $1811.50 in New York, the exact time that the report was released. Fifteen minutes later gold would trade to $1824.60 today’s high. However, those gains were short-lived and as of 4:37 PM EDT, the December contract is currently down $4.70 and fixed at $1807.60, $3.90 below today’s New York open. The chart above is a five-minute candlestick chart of gold futures that clearly shows the extreme volatility during the first twenty minutes, and the methodical price decline evident during the remainder of the trading session in New York and Globex.

The dollar also had an extremely volatile knee-jerk reaction to today’s report. The dollar index opened at 106.22 and traded to today’s daily low of 104.515 by 11:30 AM EDT. As of 4:52 PM EDT, the dollar index is currently at 105.12 after factoring in today’s decline of 1.07%.

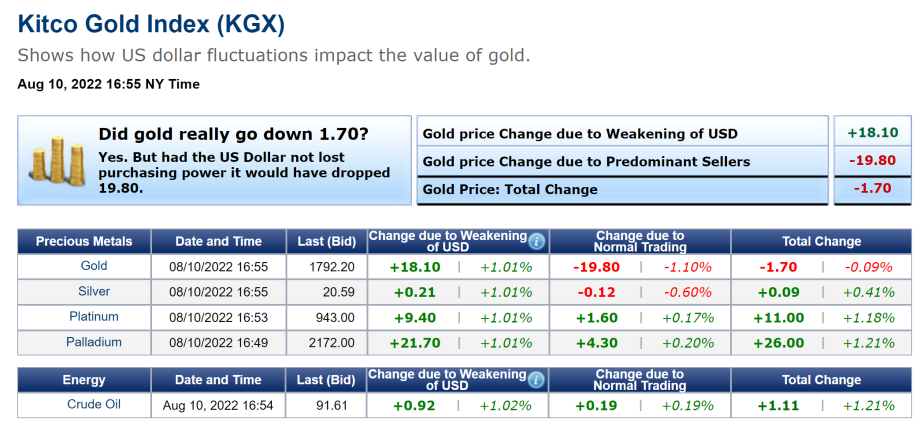

Physical gold is currently fixed at $1792.20 which is a net decline of $1.70. However, selling pressure by market participants was extreme moving gold $19.80 lower in trading today. But because of extreme dollar weakness which resulted in gold gaining $18.10 the net result for spot gold was a fractional decline.

The chart above is a daily candlestick chart of gold futures. Based on our studies we still believe there is possible support for gold at $1800. Major support for gold occurs at $1789.50 based upon gold’s 50-day moving average. The first level of resistance occurs at $1831, with major resistance at $1880. It is also likely to see the dollar decline further based on the fact that today’s decline of 1% resulted in the dollar index closing below its 50-day moving average which is currently fixed at 105.40. However, the intraday low of the dollar index at 104.515 represents the first level of potential support.

Wishing you as always good trading,

Gary S. Wagner - Executive Producer