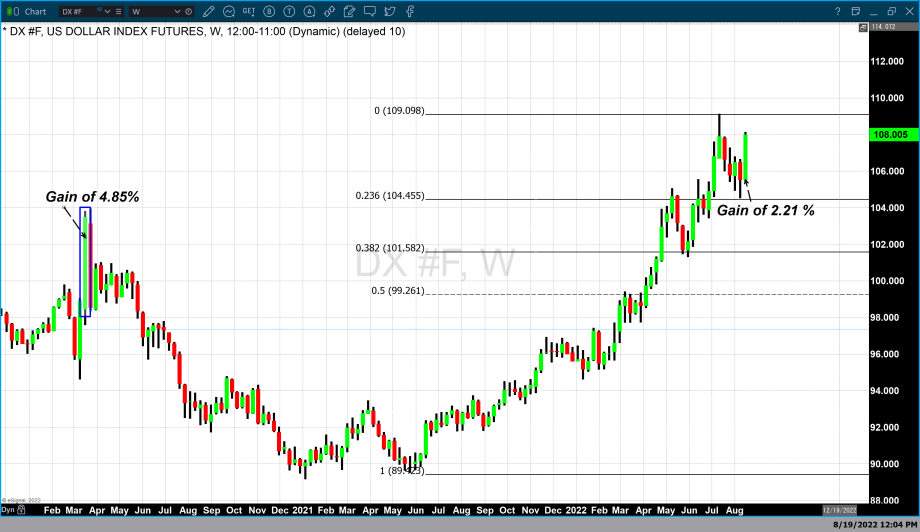

Dollar strength results in the largest single weekly advance since March 2020

Video section is only available for

PREMIUM MEMBERS

Yes, gold has declined for the last five consecutive days. On Monday, August 15 gold opened at approximately $1816 per ounce and scored strong price declines over the last five consecutive days, characterized by four lower highs, and four lower lows taking the most active December contract of gold futures to $1760 with under a half hour of trading before closing for the weekend. In a single week, gold lost $56 in value. Gold sustained a price decline of approximately 3.083% over the last five trading days.

This is significant but certainly not extremely rare. Historically speaking we can easily identify weeks in which gold had a significant drawdown greater than this week’s price decline. Only five weeks ago, during the week of July 4 gold sustained a weekly drawdown of $71. This represents a weekly price decline of 3.861%.

On the other hand, the gains this week in the dollar index are rare and I believe extremely significant. In terms of percentage advance, gold did experience a larger percentage drop than the dollar gained. The weekly advance for the dollar index is 2.217%. However, to identify the last instance the dollar declined this deep in a single week occurred during the week of March 16, 2020, well over two years ago. In a single week, the dollar index opened at 98.46 and closed at 103.48, a strong price advance of 502 points which is a weekly gain of 4.851% more than double this week’s gain.

Gold prices are based on two primary underlying factors. The first is dollar strength or weakness, and the second is traders bidding the precious metal higher or lower. Simple math tells us that gold’s decline of 3.86% compared to a 2.21% gain in the dollar index is the net result of 1.65% of this week’s decline attributable to market participants actively selling gold with the remaining 2.21% directly attributable to dollar strength.

It is an accepted fact that both gold and the dollar are in direct competition as a haven asset in times of economic uncertainty. When economic uncertainty is coupled with the certainty that the Federal Reserve will continue to raise rates it places the dollar in a stronger position as higher U. S. Treasury yields directly support the dollar.

Add to the fact that gold does not yield any interest the scales are certainly tipped to favor the dollar for as long as monetary tightening is the guiding principle of the Federal Reserve as it tries to reduce the level of inflation.

At least for this week, it is obvious that market participants are laser-focused on further interest rate hikes rather than on the current level of inflation. Market participants have shifted their focus between concern about rising rates over concern about inflationary levels on more occasions than I can count. This tug-of-war will most certainly continue until it is perceived that the Federal Reserve has completed its monetary tightening and interest rate hikes.

For those who would like more information simply link below

Wishing you as always good trading,

Gary S. Wagner - Executive Producer