Dollar strength reverses modest gains from traders bidding gold higher

Video section is only available for

PREMIUM MEMBERS

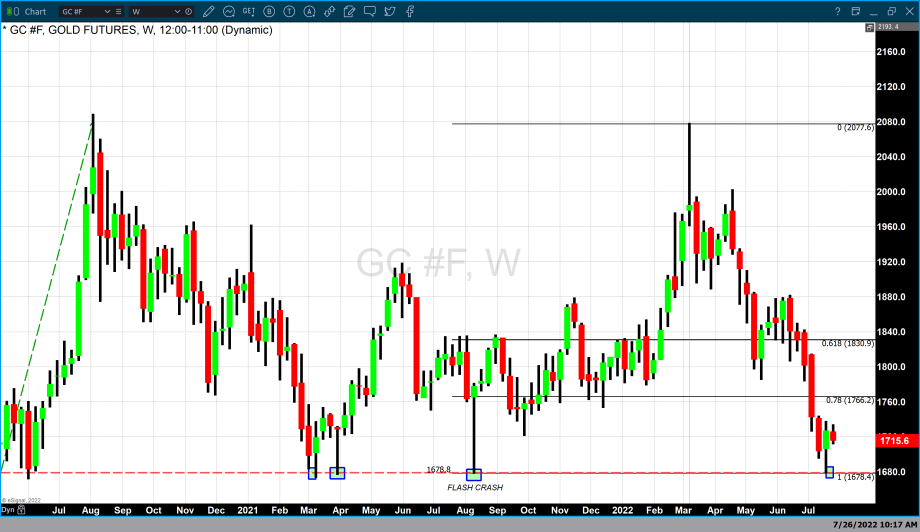

Currently both spot gold and futures are trading fractionally lower on the day. However, this is deceiving as market participants have been actively moving gold higher. It is dollar strength that is moving gold prices negative as dollar strength has outweighed any modest gains from normal trading.

As of 3:40 PM EDT gold futures basis, the most active August contract is fractionally lower by 0.19% or $3.30 and fixed at $1715.80. At the same time, spot gold is also fractionally lower down 0.10% or $1.70 and fixed at $1717.76.

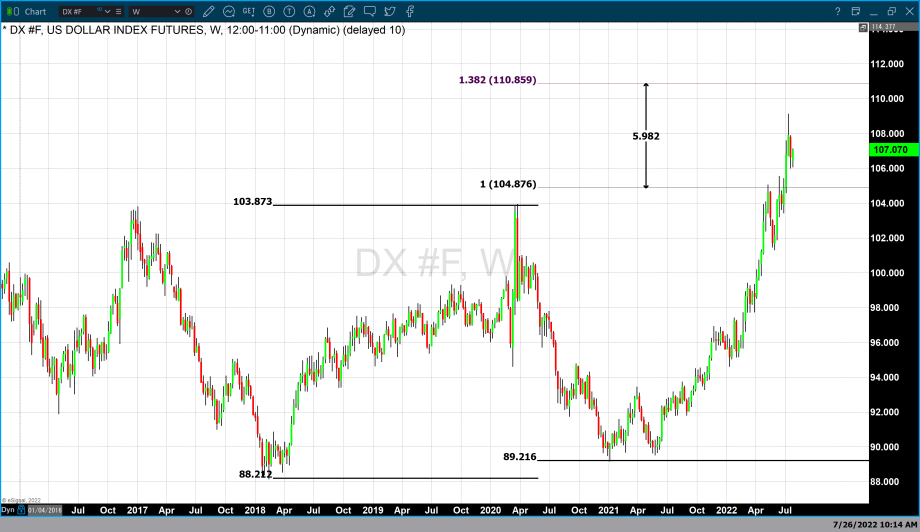

What is keeping gold from closing positive on the day is dollar strength. The dollar index is currently back over 107. After factoring in today’s gain of 0.67% the index is currently fixed at 107.065. An easy way to illustrate this is through the eyes of the KGX (Kitco Gold Index). The KGX screen capture above was taken at 3:38 PM EDT fixing an ounce of spot gold at $1718. Dollar strength was the strongest force as it moved gold an $11.20 lower. Market participants bid the precious yellow metal higher by $9.20 and tempered the effect of a strong dollar. This resulted in only a two-dollar decline in the net change in gold.

Gold has been tempered and kept in a narrow and defined trading range as market participants await the Fed decision after tomorrow’s conclusion of the July FOMC meeting. It is still widely anticipated that the Federal Reserve will raise rates by 75 basis points, the fourth consecutive rate hike over the last four FOMC meetings. Beginning in March the Federal Reserve began to raise rates first by 25 basis points, then 50 basis points in May. This was followed by a 75-basis point hike in June and most likely another 75-basis point hike tomorrow.

According to the CME’s FedWatch tool, the probability of a 75-basis point rate hike has remained fairly consistent over the last week with the probability of a 75-basis point rate hike at 75.1% in the probability of a 100-basis point rate hike at 24.9%. So, the question becomes what the Federal Reserve will do at the September FOMC meeting. In the case of the September FOMC meeting, the FedWatch tool is indicating uncertainty as to the extent of another rate hike. Currently it predicts a 49.6% probability that they will raise rates by 50 basis points, a 42% probability that they will raise rates by 75 basis points, and an 8.5% probability that they will raise rates by 100-basis points.

The uncertainty is based on a multitude of parameters that will come into play as the data-dependent Fed analyzes the most recent economic reports. Possibly one of the most important reports that will feed into their decision in September will be the second quarter GDP that will be released on Thursday, July 28. Although advanced estimates differ it makes sense to focus on the Federal Reserve’s anticipated numbers. According to the Atlanta Fed GDP Now, its latest data is suggesting a decline of 1.6% for the second quarter.

Their assessment is in line with the dire outlook presented by the IMF (international monetary fund) which is anticipating a contraction of global growth in the second quarter of 2022. They are basing their projections upon diminishing production outputs from both Russia and China.

Both assessments of GDP contraction in the United States and globally suggest that a “soft landing” will be exceedingly difficult if it is at all possible.

Wishing you as always good trading,

Gary S. Wagner - Executive Producer