Dollar weakness has been the force moving gold higher over the last 3 days

Video section is only available for

PREMIUM MEMBERS

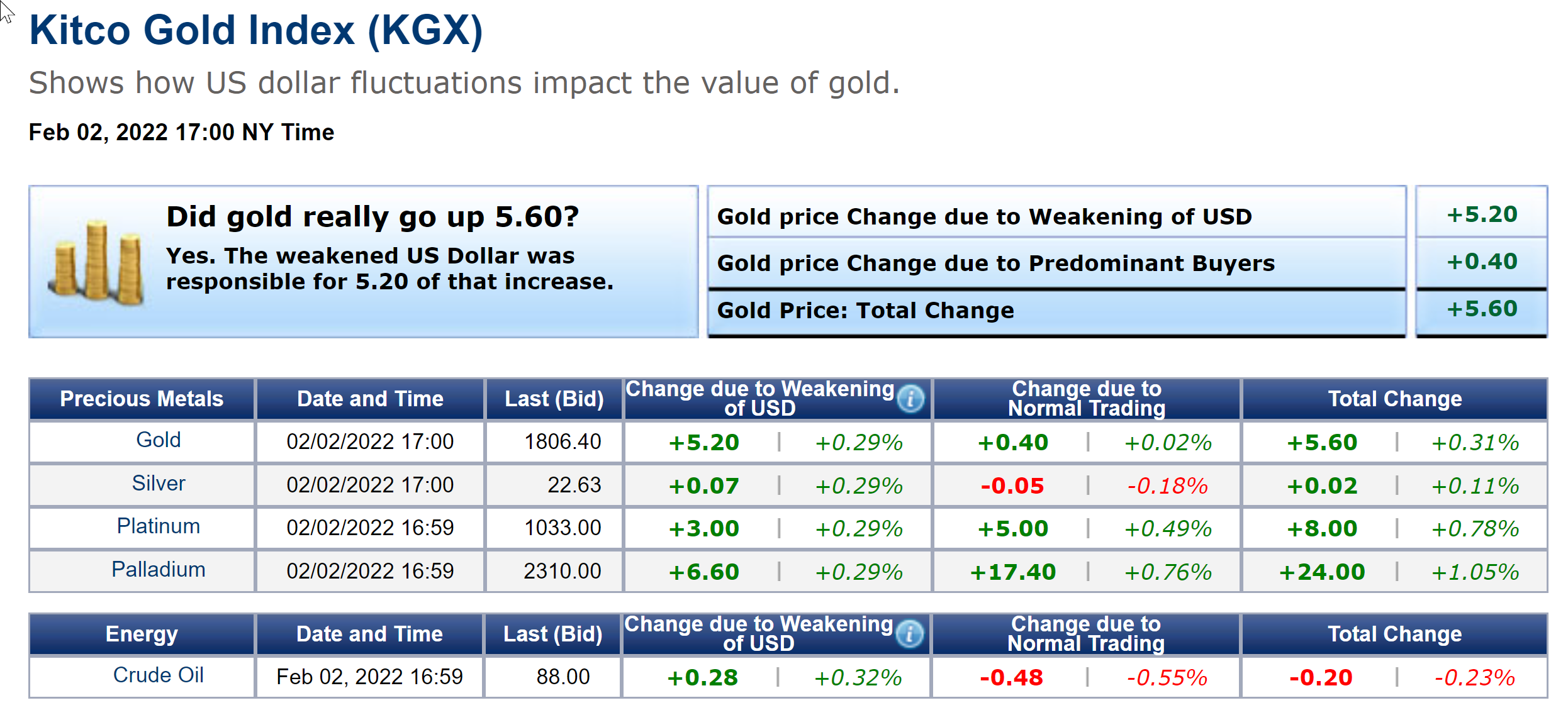

Over the last three trading days, the vast majority of price advances in gold can be directly attributable to dollar weakness with only fractional gains due to market participants bidding the precious yellow metal higher. The KGX (Kitco gold index) clearly illustrates this point. Today for example spot gold gained $5.60, with only $0.40 added from trading activity. The remaining gain of $5.20 was a direct result of dollar weakness.

Gold futures basis the most active April 2022 contract had a net gain today of $5.70 which is an increase of 0.32%. This occurred as the dollar declined giving up 0.39%. The dollar index is currently fixed at 95.995.

Yesterday April gold gained $4.90 closing at $1801.30 which is a net increase of 0.27%. Concurrently, the dollar index lost 0.29%. On Monday, April gold gained $11.10 and closed at $1797.70, which is a net gain of 0.62%. Simultaneously the dollar declined by 0.63%. The overwhelming majority of gains witnessed since Monday have been the direct result of the dollar losing almost the exact percentage drawdown as the percentage gain in gold.

While it’s not unusual for dollar strength or weakness to be a component of gold’s price change, it is unusual to see the dollar be the overwhelming majority of gold’s net change. Dollar strength was a strong component of gold prices from the middle of January up until January 28 when the dollar hit its highest trading value (97.375) since November of last year. However, during that time period gold prices remained stable with the largest daily gain of $31 occurring on January 19. Many days in January contained both dollar strength and higher gold pricing concurrently.

An unexpected jobs report from ADP today

Today’s ADP jobs report was estimated to come in indicating an additional 200,000 jobs were added to the private sector last month. This is according to a poll conducted by the Wall Street Journal. However, for the first time since December 2020, today's jobs report revealed a loss of jobs during that period. Today’s ADP report showed that private payrolls fell by 301,000. Approximately half of the 300,000 jobs decrease was due to the pandemic’s effect on the leisure and hospitality sector with a loss of 154,000 jobs.

According to CNBC, the vast majority of companies cut jobs in January as a result of the spread of the omicron variant. On Friday the US Labor Department will release the nonfarm payroll jobs report for January which is currently estimated to come in with an additional 150,000 jobs being added last month. However, based upon the ADP numbers today we could be in for quite a surprise.

Wishing you as always good trading and good health,

Gary S. Wagner - Executive Producer