Fed minutes reveal high inflation concern only one year too late

Video section is only available for

PREMIUM MEMBERS

The primary driver influencing pricing on multiple asset classes including gold is the fact that inflation remains persistent at a 40-year high. The circumstances that brought the global economy to its knees during the beginning of 2020 was a black swan event. It began as a global pandemic that effectively shut down the world’s economy and led to a major global recession.

By definition, a black swan event is an unpredictable event that is beyond what is normally expected and has potentially severe consequences. However, the actions following the event specifically by central banks and the Federal Reserve absolutely had a predictable effect and outcome.

While the Federal Reserve could not control what happened, its actions and policies exacerbated the problem. They created an environment that let us get to a level of inflation not seen in 40 years. The current level of inflation is so high that 30% of the world’s population (those 40 years are under) have never witnessed a diminished purchasing power of their wages to this extent. Currently, inflation has affected the entire global economy with the Consumer Price Index in the United States at 8.3%, and in the Eurozone at 10%.

Today the Federal Reserve released the minutes from last month’s FOMC meeting revealing the obvious; inflation is not falling as fast as they had expected. The minutes highlighted their concern that the current level of high inflation is unacceptable making their current aggressive monetary policy the best strategy which will contain less risk to the economy than doing too little.

“A sizable portion of the economic activity has yet to display much response,” the Fed minutes said. “Inflation had not yet responded appreciably to a policy tightening.”

Where were the minds of these economic geniuses running the Federal Reserve when they let interest rates get out of control beginning in the middle of 2020?

Inflation was steadily rising for some time hitting 8.5% when the Fed initiated its first interest rate hike in March 2022 of only ¼%.

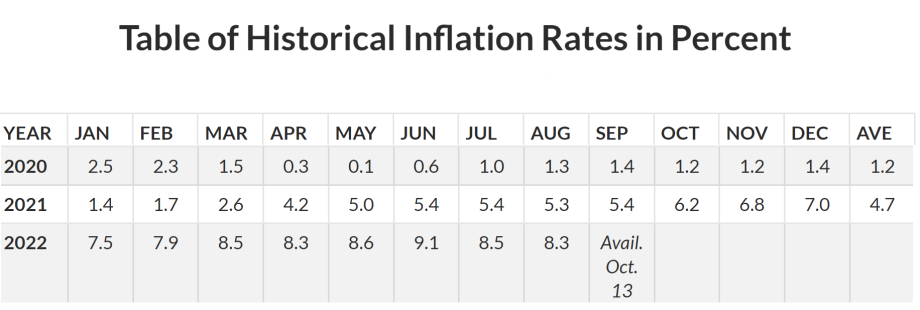

The image above is inflation levels from 2020 to August 2022. It clearly shows that when the pandemic first began to shut down economies around the world in March 2020 the level of inflation was at an acceptable 2.6% just slightly above the Federal Reserve’s target of 2%. Inflationary pressures remain low throughout the entire year, and it was not until 2021 when inflation began to become worrisome.

By April 2021 inflation had grown to double the Federal Reserve’s target rate coming in at 4.2%, then 5% in May, and 5.4% in June. Inflation levels would continue to rise reaching 7% in December 2021, and yet the Federal Reserve kept interest rates at ¼%.

In other words, the black swan event that led the world into a global crisis and recession were unavoidable. However, the high inflation that followed was. Had the Federal Reserve acted sooner with small incremental interest rate hikes in 2021 inflation would certainly not be as high as currently stand. Now the Federal Reserve is in a reactive posture and could easily make the same mistake by raising rates too quickly now.

Wishing you as always good trading,

Gary S. Wagner - Executive Producer