The Fed’s aggressive monetary policy begins but will it stop inflation from rising?

Video section is only available for

PREMIUM MEMBERS

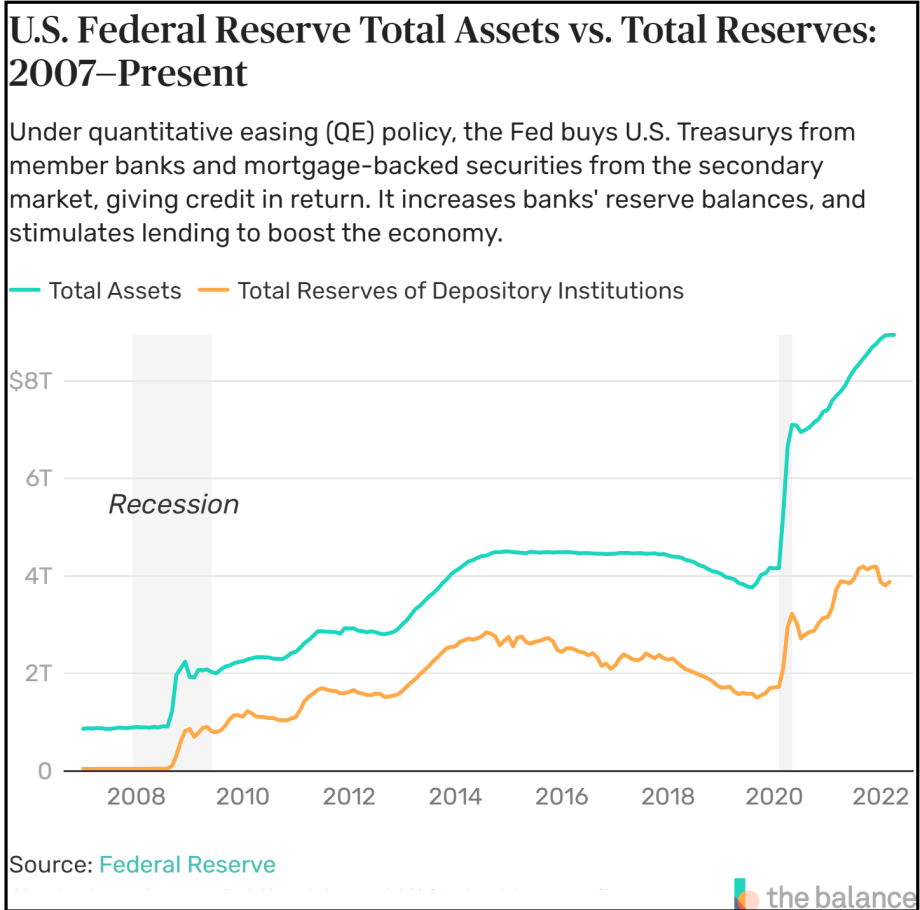

In March of 2020, members of the Federal Reserve held an emergency meeting in which they announced that they would reduce the benchmark interest rate (Fed funds rate) to between 0 and ¼%. They also began an aggressive round of quantitative easing by purchasing billions of dollars of Treasuries and mortgage-backed securities (MBS) to shelter the U.S. economy from a global pandemic. The Fed immediately began to purchase $80 billion of Treasuries and $40 billion of MBS, totaling $120 billion each month with no limit or timeline.

This process continued up until November 3, 2021, when the Federal Reserve announced that it would begin to reduce the pace of its asset purchases by reducing its $120 billion monthly asset purchases by $15 billion per month until the Federal Reserve purchases were reduced to zero by the middle of 2022. In March of this year, the Federal Reserve initiated its first interest rate hike since 2018 by raising rates by ¼%, taking the Fed funds rates to ¼% to ½ %.

During this process, they adjusted their dual mandate of maximum employment and inflation target range of 2%, focusing on maximum employment while letting inflation rise above their target rate. In 2020 inflation was running at 1.4% as the GDP contracted by 3/4%. That all changed in 2021 as inflation rose to 7% year-over-year.

The CPI (Consumer Price Index) for March 2022 has spiraled to 8.5%, a 40-year high, and the PCE, which is the preferred inflation index used by the Federal Reserve, rose to 6.6%. Now the Federal Reserve is attempting to reduce inflation by rapidly raising the Fed funds rate by a ½% this month, and most likely, another ½% hike at the June FOMC meeting.

The question becomes, will these actions by the Federal Reserve have any real impact on inflation?

Historically speaking, if we look back to years when inflation was running exceedingly high, it was also coupled with interest rates far above the Federal Reserve’s target interest rate of 3% to 3 ½%.

In 1979 inflation came in at an astounding 13.3%, and the Federal Reserve reacted by raising their fed funds interest rate to 12%. In 1980, inflation declined slightly to 12 ½%, and the Federal Reserve raised its Fed funds rate to 18%. In 1981 inflation had been reduced to 8.9% and the Federal Reserve reduced interest rates to 12%. It was not until 1982 that the recession ended, and inflationary pressures declined to 3.8%. However, the Federal Reserve’s benchmark interest rate was still exceedingly high at 8.5%.

Currently, the Federal Reserve is labeling its monetary tightening as extremely hawkish and aggressive to take the current level of inflation of 6.6%, as seen through the PCE, to an acceptable target level of 2% or 3%. Based on the historical data we have presented above; it seems highly unlikely that raising interest rates by 3% will significantly reduce inflationary pressures and take them back to their acceptable target level.

Another reason that the Fed is unlikely to achieve a dramatic dampening of the rising inflation levels is that current inflationary pressures are largely due to supply chain issues. Currently, the rising cost of energy, food, and housing are primary components of inflation levels at 8.5% (March CPI). While raising rates will result in an economic contraction, it will not address the demand for essential goods needed by individuals, such as food, energy, or housing costs.

The Federal Reserve let inflationary pressures run too hot before initiating any action to curtail its growth. With the Federal Reserve clearly behind the curve and a monetary policy that is not nearly as aggressive as past Federal Reserve actions have been to stave off the continued growth of inflation, it seems highly unlikely that their current course of action will have any major impact on inflationary pressures.

Wishing you as always good trading,

Gary S. Wagner - Executive Producer