Financial markets including precious metals continue to recalibrate

Video section is only available for

PREMIUM MEMBERS

Precious metals, U.S. equities, U.S. debt instruments, and the dollar continue a major recalibration as market participants factor in interest rates moving much higher for longer than anticipated before Jerome Powell’s Keynote speech on Friday of last week. Chairman Powell’s keynote speech at Jackson Hole outlined and redefined the Federal Reserve’s monetary policy as it pertains to lowering inflation.

Currently, inflation is running at its highest level in 40 years. The Federal Reserve’s target for an acceptable level of inflation is 2%. In July the CPI (Consumer Price Index) was at 8.5%, declining from 9.1% in June. The Federal Reserve prefers to use the PCE (Personal Consumption Expenditures Price Index) which strips out food and energy costs. The PCE is currently fixed at 6.3% declining from 6.8% in June. By any standard inflation is currently 3 times the acceptable level when gauged against the PCE, and 4 ½ times when gauged against the CPI.

Historical perspective of inflation and interest rates in the United States

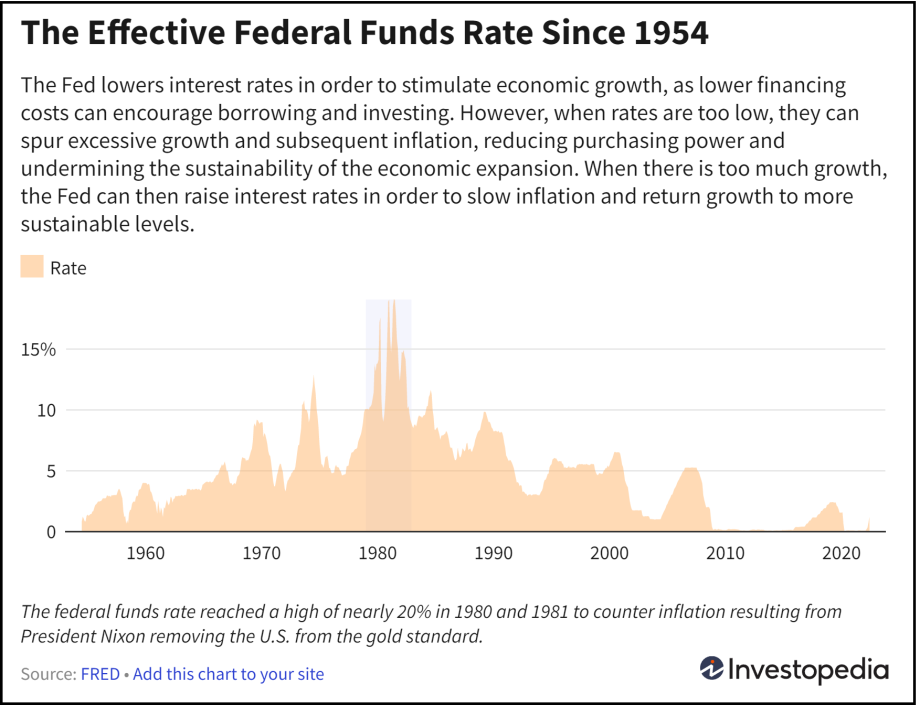

Jerome Powell is certainly not the first chairman of the Federal Reserve to tackle high levels of inflation. Multiple Federal Reserve Chairmans have been faced with the task of bringing inflation to its target level. In all cases, they used the same tool to lower inflation; the fed funds rate. The fed funds rate is the key borrowing benchmark set by the Federal Reserve.

The Federal Reserve Chairman in the 1980s was Paul Volcker. He led the Federal Reserve until Chairman Alan Greenspan took over the position in 1987. Volcker was tasked to reduce inflation which was at its highest level on record at 14.6%. From 1981 through 1990 the Federal Reserve raised the fed funds rates to their highest level ever to combat the “Great Inflation”.

In January 1980 the fed funds rate was at 14%. On December 5, 1980, the Federal Reserve concluded a conference call and raised interest rates to their highest level in history between 19 and 20%. Rates began to drift lower falling back to 13% and then 11 ½ -12 % in 1982. The “effective” fed funds rate averaged 9.97% during these ten years. By January 1991 the Federal Reserve had reduced rates to 6.75%.

Over the last 40 years, the Federal Reserve has had to deal with different financial crises such as the examples cited above. There was the “Dotcom” bust at the start of the century, the 9/11 terrorist attacks as well as the financial banking crisis of 2008.

Looking at how the Federal Reserve dealt with times of financial uncertainty in the past one thing is clear. Inflation reduction has never been accomplished without raising interest rates to levels near or above the inflation rate. Chairman Powell’s keynote speech last week was a wake-up call. There has never been a time in history when the Federal Reserve fought inflation without taking rates close to or above the inflation rate. Powell's statement that the Fed will do whatever it takes to reduce inflation signals that interest rates will most likely move to 4% by the end of the year and possibly higher in 2023.

As of 5:40 PM EDT gold futures basis, the most active December contract is currently fixed at $1708.80 declining today by $17.40. Last Friday gold opened at $1771 before Chairman Powell delivered his keynote speech at the Jackson Hole Economic Symposium. Gold has dropped almost $70 since Powell delivered his keynote speech. All asset classes in the United States began the process to recalibrate their value as factored in much higher interest rates in the future.

Wishing you as always good trading and good health,

Gary S. Wagner - Executive Producer