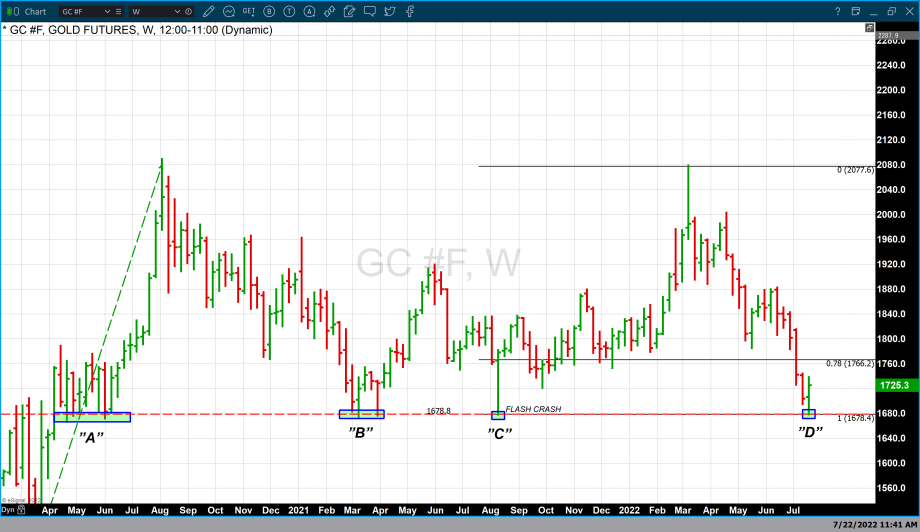

Gold at $1678 has demonstrated technical support on multiple instances

Video section is only available for

PREMIUM MEMBERS

On January 3 gold opened at $1800 and began a dynamic rally that concluded on March 9 when gold hit its highest value this year of $2077. In just over three months gold gained roughly $277 in value or 13.33%. On March 15 the Federal Reserve enacted its first interest rate hike since 2018 and marked the beginning of a major correction that continues to this day. During each of the last three FOMC meetings (March, May, and June) the Fed has raised rates.

The Fed raised rates in March by 25 basis points. Followed by a 50-basis point hike in May and a 75-basis point rate hike in June. It is widely anticipated that the Federal Reserve will raise rates another 75 basis points next week when the July FOMC meeting concludes.

These actions have led to a strong price demise in gold from $2077 on March 9 to yesterday’s low of $1678. In just under five months gold has lost just under $400 per ounce or a loss of -19.21%. The low achieved yesterday at $1678 is the lowest value this year and the last instance of gold trading at this level was on August 9, 2021, the day of the infamous “flash crash”. In yesterday’s article, we focused on the flash crash and compared it to yesterday’s low suggesting that it was a logical place where gold could find technical support.

On deeper inspection gold has found support at this price point on several occasions. Besides the flash crash on August 9, and yesterday’s low there are two other instances when this price point proved to be a technical level of support. The chart above is a weekly bar chart of gold futures. It highlights specific times that we can identify $1678 as a support level.

The rectangle labeled “A” identifies support at this level from approximately April through June 2020. The rectangle labeled “B” identifies support during March 2021. The rectangle labeled “C” identifies the low and support level of the flash crash on August 9, 2021, and finally the rectangle labeled “D" represents yesterday’s low.

As of 5:43 PM EDT gold futures basis, the most active August 2022 contract is currently fixed at $1725.30 after factoring in today’s price increase of $11.90 or 0.69%. While one day does not confirm that yesterday’s low represents the conclusion of the major price decline that began in March, or that it is even a short-term conclusion to the selling pressure. The fact that gold traded below $1700 for the first time this year and quickly moved back above it could signal the potential that at least temporarily the selling pressure has concluded.

Correction and apology: Yesterday I incorrectly named Theodore Roosevelt as the author of the quote, “a date which will live in infamy”. It was Franklin D. Roosevelt who made that statement. I should know better living 10 miles from Pearl Harbor.

Wishing you as always good trading,

Gary S. Wagner - Executive Producer