Gold surges past $1800 on dollar weakness and omicron fears

Video section is only available for

PREMIUM MEMBERS

Both gold and silver had significant gains resulting from a combination of dollar weakness and continued fears regarding the economic effect of the Covid-19 variant omicron.

One simply needs to view both precious metals through the eyes of the KGX (Kitco Gold Index) to see the strong effect that dollar weakness had on the precious metals complex. As of 4:08 PM, EST spot gold is currently fixed at $1804.80, which is a net gain of $15.70 on the day. On closer inspection, we can see that dollar strength contributed approximately half of today’s price search. Dollar weakness accounted for net gains of $7.90, and normal trading added $7.80, which resulted in gold surging past $1800 per ounce.

Spot silver pricing also benefited from dollar weakness today. However, in the case of silver, normal trading accounted for two-thirds of today’s net gains. The KGX showed that silver gained a total of $0.31 today and is currently fixed at $22.80. Unlike gold, silver gained $0.10 as the direct result of dollar weakness and $0.21 as the result of normal trading.

Gold futures basis the most active February 2021 Comex contract is currently up $16.50, or 0.92%, and fixed at $1805.20. Gold prices are currently very close to the intraday high of $1806.30, well off the intraday low of $1785.80.

One interesting aspect of the financial markets over the last few days has been traders focusing on the Covid-19 variant, omicron. It’s almost as if equity traders and precious metal traders have been oscillating between concerns that the variant will result in major economic contractions during the trading session or completely disregard concerns which was the case today. Traders in the U.S. equity markets disregarded any concerns regarding the variant, and precious metals chose to focus upon it.

It must be noted that we are trading during a pre-holiday period, which will continue to create volatility due to the thin volume. Concern about the spiraling level of inflation continues to be a forefront concern. However, for the most part, traders and market participants in both the equities and precious metals markets have now baked the increased amount of rate hikes expected from the Federal Reserve. Currently, market participants have factored in a total of six rate hikes, three interest rate hikes in 2022 as well as three rate hikes in 2023.

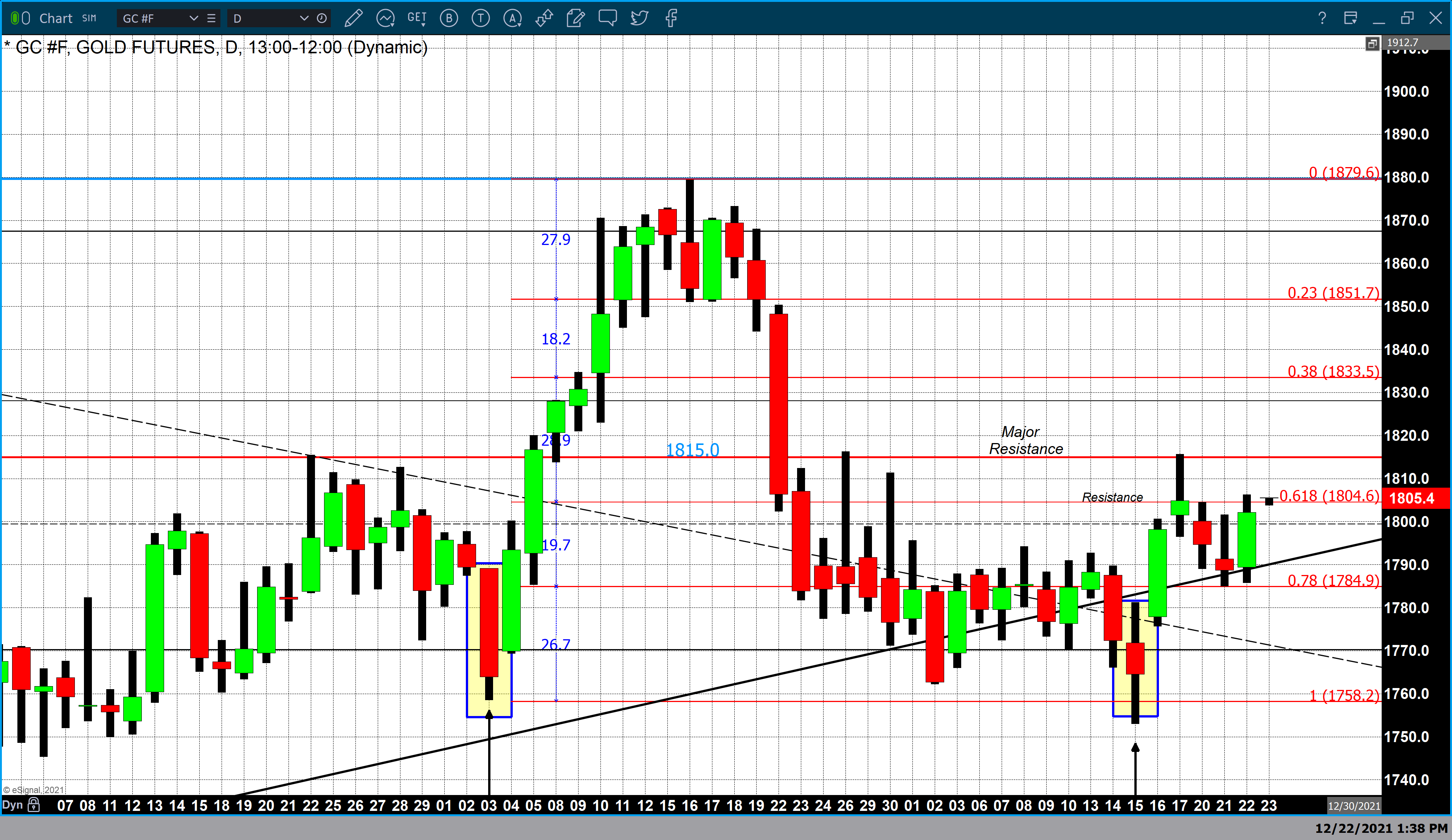

Our technical studies indicate that although gold solidly traded above the key psychological level of $1800, current pricing at $1804.70 puts it right at the 61.8% Fibonacci retracement level at $1804.60. Our studies also indicate major resistance that occurs at $1815. The first level of support is currently fixed at $1788.80 which is based upon a support trendline created from the compression triangle which occurred over the last three months (see gold chart). Below that the next support level occurs at $1784.90 which is based upon a 78% Fibonacci retracement. Major support currently resides at $1770.30 which is the 38% Fibonacci retracement based upon the longest data set used in our studies. This data set begins at the highs of $1920 that occurred during the first week of June down to $1678, the low that occurred the first week of August.

Wishing you as always good trading and good health,

Gary S. Wagner - Executive Producer