Inflation fears remain elevated, traders await the CPI report on Wednesday

Video section is only available for

PREMIUM MEMBERS

Inflation remains one of the most prevalent issues on the minds of Americans. Last month the government reported that the Consumer Price Index rose to its highest level in 41 years coming in at 9.1% YoY.

Spiraling levels of inflation have been highly supportive of gold since the middle of July. On July 21 gold hit its lowest value ]of the year with August futures trading to a low of $1678 before strongly recovering and closing at $1713. In just over two weeks gold has risen substantially and recently broken above the key psychological level of $1800 per ounce.

As of 4:35 PM, EDT gold futures basis most active December contract is currently fixed at $1805 after factoring in today’s gain of $13.80 or 0.77%. Silver futures have also staged a strong upward move today gaining 4%. Basis the most active September silver contract is currently fixed at $20.65 with a gain of almost $0.81 on the day.

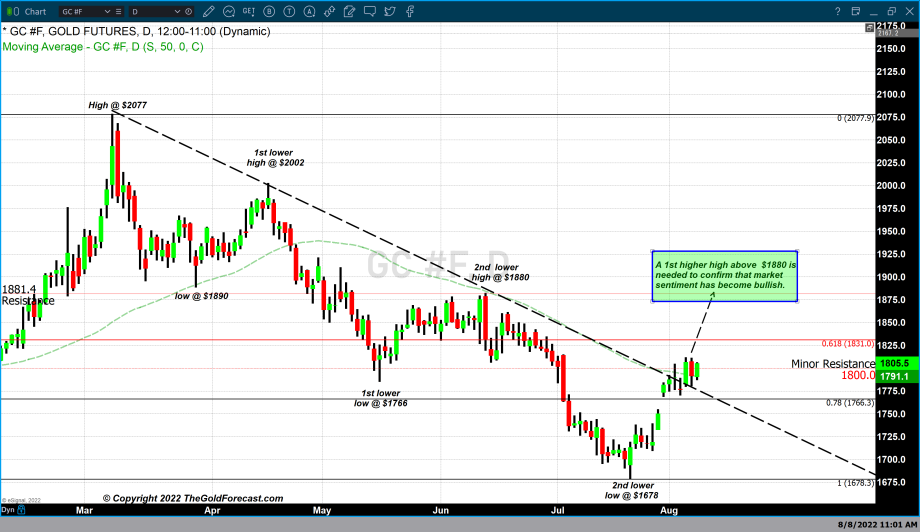

The chart above is a daily Japanese candlestick chart of the continuous contract of gold futures. In the last four months, gold has traded from this year’s high of $2077 to $1678. The net result of this multi-month correction took gold $399 lower which is a decline of 19.21%. Since the high in March gold has had consecutive lower highs. The first lower high occurred in mid-April at $2002. The second lower high occurred in mid-June when gold reached approximately $1880. We created an upper-level resistance line from the series of lower highs beginning at $2077, then $2002, and $1880.

On August 2 gold broke well above that resistance line trading to a high of $1804 and closing at $1789. However, it was not until last Thursday, August 4 that gold opened right at the resistance line and traded sharply higher above the 50-day moving average which was fixed at $1793 and closing at $1806.70. Gold declined to the 50-day moving average and closed at $1792 on Friday after the release of last month’s jobs report which came in at 528,000 new jobs added in July, well above estimates of economists. Today’s respectable $14 gain took December futures back above $1800 as it is currently fixed at $1805.

Market participants are looking at Wednesday’s CPI report for July which will act as a catalyst for the next strong move up or down in gold pricing. Early estimates are coming out indicating a slight decline from the 41-year high in June of 9.1% to between 8.7% to 8.8%, this slight difference is based on whether the poll was taken by Bloomberg news or the Wall Street Journal.

The fact that we have seen gold gain approximately $127 is substantial. This gain indicates that a bottom was formed at the end of July with market sentiment pivoting from bearish to bullish.

Our technical studies indicate that $1800 was a level of minor resistance. Above that, the next resistance level occurs at $1831 which corresponds to the 61.8% Fibonacci retracement, with major resistance at $1880 the high that gold reached in mid-June of this year.

Wishing you as always good trading,

Gary S. Wagner - Executive Producer