Jobs report strengthens Fed confidence that rate hikes will not lead to recession

Video section is only available for

PREMIUM MEMBERS

Although trading this week was limited to four trading days due to a holiday weekend gold had a deep and severe price decline. Gold lost approximately $74 in trading this week opening at approximately $1814 on Tuesday and settling at $1741 today. This week’s price decline resulted in gold devaluing by 4%.

Last Friday gold opened above and closed below a support trendline that was created from two higher lows. The first low occurs at $1679 the intraday low of the flash crash that occurred in mid-August 2021. The second low used for this trendline occurred in the middle of May when gold bottomed at $1787.

Gold closed just below that trendline exactly one week ago, however it was Tuesday's exceedingly strong price decline of $50 that accounted for two-thirds of this week’s price decline and resulted in major technical chart damage.

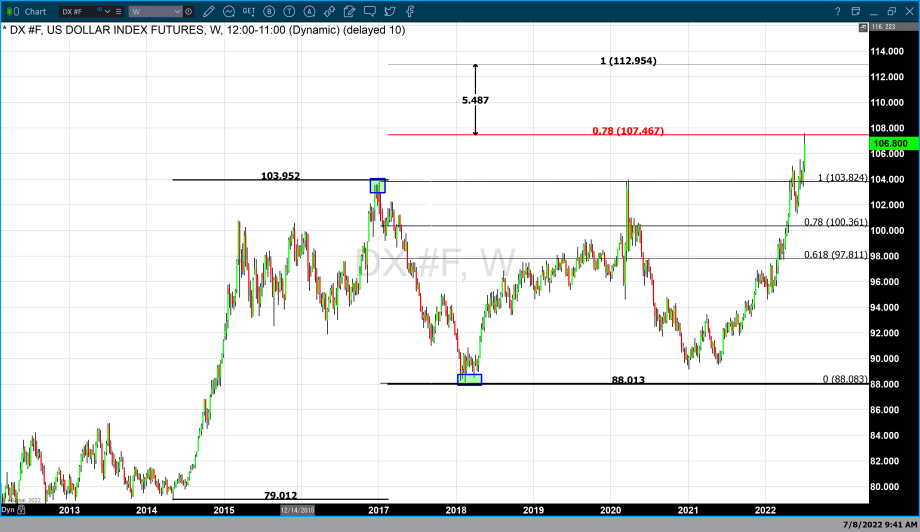

The primary force that moved gold substantially lower this week was dollar strength. The dollar index gained well over 2% this week accounting for over half of the price decline in gold. Dollar strength was a result of traders and investors focusing on recent and future interest rate hikes by the Federal Reserve. Since March the Federal Reserve has raised rates on three occasions with each rate hike having a higher percentage increase than the last. The Fed raised rates by 25 basis points in March, 50 basis points in May, and 75 basis points in June.

Today’s jobs report was forecasted to show that 250,000 jobs were added to payrolls last month. The actual numbers came in well above expectations with 327,000 jobs added last month. The unemployment level remained at 3.6%. The fact that the actual jobs report came in above expectations strengthened the hand of the Federal Reserve to continue to raise interest rates substantially this month.

It is highly anticipated that the Federal Reserve will enact another 75-point rate hike at the July FOMC meeting. Before the Federal Reserve raised interest rates in March the fed funds rate was just ¼% or 25 basis points. Currently, the interest rate set by the Federal Reserve is at 1 ½ % to 1 ¾. This would take the interest level set by the Federal Reserve to 2 ¼% to 2 ½%.

According to the CME’s FedWatch tool, there is a 93% probability that the Federal Reserve will raise rates once again by 75 basis points this month. However, there are three more times that members of the Federal Reserve will convene for an open market committee meeting which leaves the door open for additional rate hikes. Because the Federal Reserve is data-dependent the number and size of the rate hikes will be based upon whether or not there is a substantial decrease in inflationary pressures.

That being said, it is most likely that next week’s CPI report will not have a dramatic impact on the Federal Reserve’s decision to raise rates as Chairman Powell and other Fed members have stated that the Federal Reserve will aggressively raise rates at the July FOMC meeting.

Wishing you as always good trading,

Gary S. Wagner - Executive Producer