Reading between the lines; FOMC statement and Powell’s Press conference

Video section is only available for

PREMIUM MEMBERS

The Federal Reserve concluded the May FOMC meeting and, as expected, announced that it will raise its Fed funds rate by 50 basis points (1/2%). While much of their monetary policy’s forward guidance remained straightforward and transparent there were subtle changes in the statement released as well as Chairman Powell’s words he used during the press conference. As always with the Federal Reserve, the devil is in the details, and sometimes the details are ambiguous at best.

There were a couple of very subtle changes in Chairman Powell's words. One of the major changes was that he spoke about the Federal Reserve’s ability to raise interest rates and have the economy experience a soft landing. Today he replaced the word soft landing with “softish landing” acknowledging the potential economic fallout because of the number of rate hikes needed to have an impact on inflation. Another subtle change was when he addressed the primary cause of inflation, which is supply chain issues, acknowledging that the Federal Reserve cannot impact those issues, which makes reducing inflation by the Federal Reserve very “challenging.”

There were some major details revealed in the statement and press conference. During the press conference Chairman Powell addressed the possibility of larger rate hikes than a 50-basis point hike, saying that a rate hike of ”75 basis points is off the table”. That statement created bullish market sentiment for both gold and U.S. equities.

However, Chairman Powell also said that rate hikes of 50 basis points over the next “couple” of FOMC meetings. By adding the word “couple” Chairman Powell acknowledged the high probability that we can expect the Fed to announce and implement 50-point rate hikes at both the June and July FOMC meetings.

The FOMC statement also contained more detailed information about the Federal Reserve’s plan to reduce the assets of its balance sheet which is now about $8.7 trillion. “The Committee intends to reduce the Federal Reserve’s securities holdings over time in a predictable manner primarily by adjusting the amounts reinvested of principal payments received from securities held in the System Open Market Account (SOMA). Beginning on June 1, principal payments from securities held in the SOMA will be reinvested to the extent that they exceed monthly caps.”

The statement laid out the details about amounts and the timeline to reduce their assets. “For Treasury securities, the cap will initially be set at $30 billion per month and after three months will increase to $60 billion per month … For agency debt and agency mortgage-backed securities, the cap will initially be set at $17.5 billion per month and after three months will increase to $35 billion per month.”

The statement did not address their endgame with a specific amount. They plan to reduce the $8.7 trillion balance sheet to only saying, “Over time, the Committee intends to maintain securities holdings in amounts needed to implement monetary policy efficiently and effectively in its ample reserves regime.”

The net result of today’s FOMC meeting, the statement, and the press conference were extremely positive market sentiment for both U.S. equities and gold. As of 5:20 PM EDT gold futures basis, the most active June 2022 contract is up $11.70 or 0.63% and fixed at $1882.30. Gold futures are now trading back above the 100-day moving average.

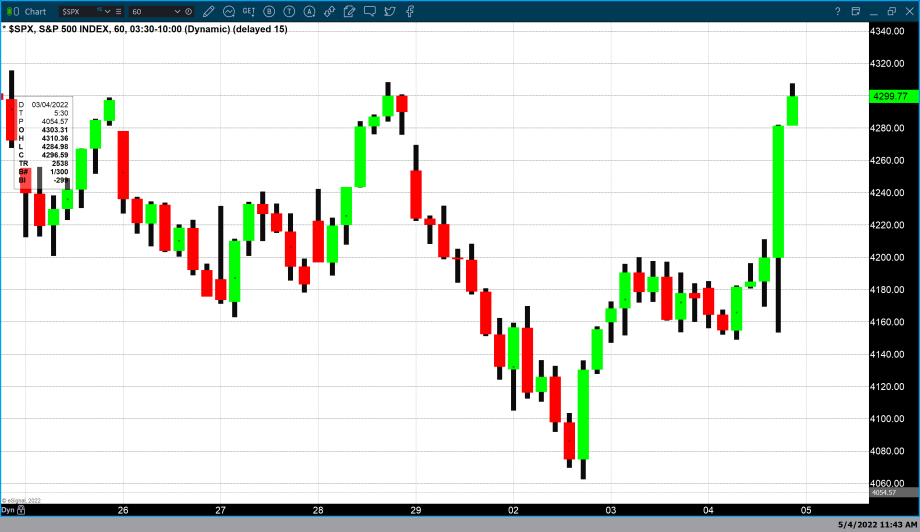

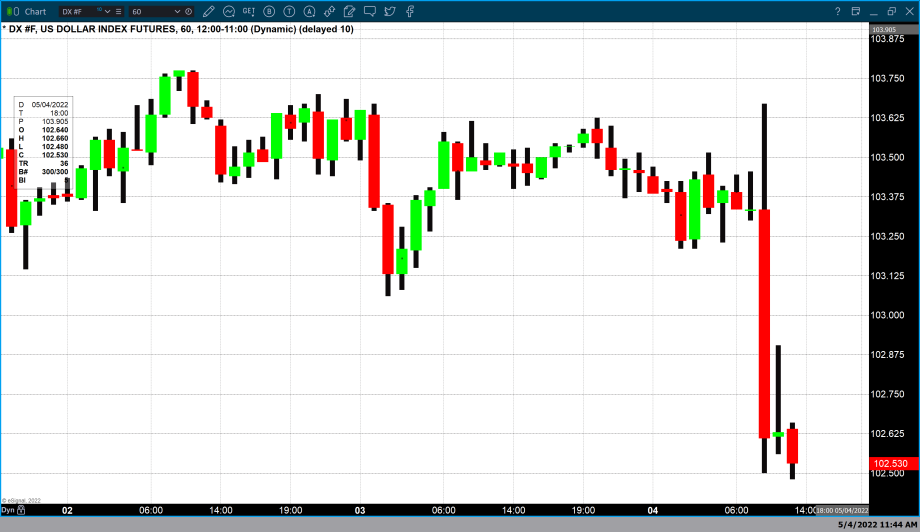

U.S. equities had an exceedingly strong rally resulting in 95% of the stocks contained in the S&P 500 gaining value on the day. The S&P 500 gained almost 3% which is the biggest daily gain in two years. This was the best Fed-day return for stocks overall since 2011. Today’s FOMC meeting had a negative impact on the U.S. dollar taking it as well as U.S. Treasuries and bond yields lower.

Wishing you as always good trading,

Gary S. Wagner - Executive Producer