Recent reports confirm high inflation and rising rates have led to a recession

Video section is only available for

PREMIUM MEMBERS

Both gold and silver prices have spiked dramatically higher over the last two weeks and accelerated their upward momentum over the last two days. Gold and silver prices have moved to new multiweek highs in response to three major reports and events that have confirmed what the American public has been acutely aware of for some time. First, that inflation is running rampant and continues to spiral out of control to higher levels. Based on the latest CPI numbers inflation is running at a 41-year high of 9.1%.

This is despite dramatic and extremely hawkish action by the Federal Reserve which has raised interest rates over the last four consecutive FOMC meetings in higher increments. Beginning in March the Fed raise rates by 25 basis points. The following FOMC meeting in May resulted in the Fed raising rates by 50 basis points. This was followed by 75 basis point rate hikes at both the June and July FOMC meeting.

Despite their dramatic attempt to reduce inflation, the core CPI reported a few weeks ago had a fractional decline from 5.9% to 5.7%. However today the government reported that the core PCE price index increased by 0.5%. This means that PCE prices are expected to be up 6.6% YoY (Year-on-Year), and core PCE prices are up 4.7% YoY.

These latest reports indicate that the Federal Reserve’s aggressive rate hikes have been ineffective in reducing “headline” and core inflation. Recent rate hikes by the Federal Reserve have taken the Fed funds rate from near zero to 2.25% leading to only one major accomplishment if you can call it that. They have effectively contracted the U.S. economy for the last two consecutive quarters.

It is emphatically clear that the United States economy has met the definition of a recession regardless of what the government wants us to believe. Therefore, yesterday and today’s extremely robust move in both gold and silver are highly warranted and long overdue.

Whatever spin the president and other political entities are conveying to falsely express that the American economy is robust and growing is going against the grain of truth. GDP over the last two quarters by definition infers that we have entered or are in a recession.

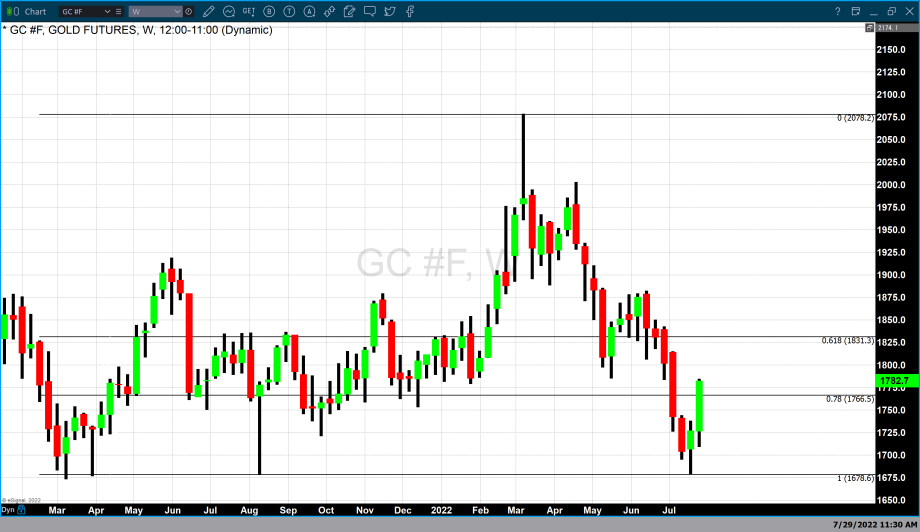

The dollar has had a significant decline in value. After hitting a high above 109 during the week of July 11, the dollar index is now below 106. This is a 3% decline in value in the last three weeks. At the same time, we have seen spot gold rise from a low of $1683 last week and gain approximately $102 as of the close of trading today.

As of 5:15 PM, EDT spot gold is currently trading up $9.14 or 0.52% and fixed at $1765.34. The August contract of gold futures is no longer the most active contract month, now the most active gold futures contract is December, currently trading at $13.50 higher and fixed at $1782.70.

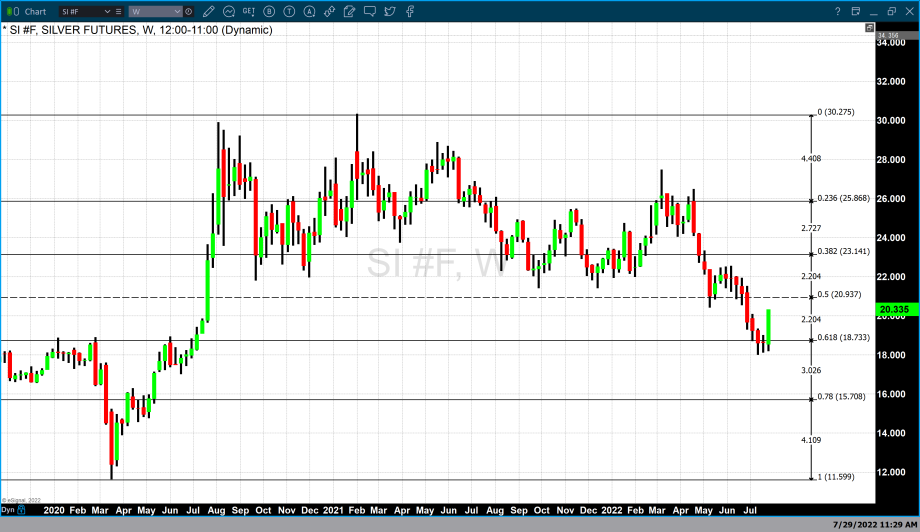

Silver has had a dramatic run over the last two days gaining 7.45% on Thursday and an additional 2.35% today taking the most active September silver contract to $20.335.

Traders and market participants have finally pivoted their primary focus from rising interest rates to rising inflation. The most recent data from the government clearly defines the utter failure of the Federal Reserve’s attempt to bring inflation to an acceptable level. Unquestionably, we most likely will see both gold and silver continue to run to higher pricing.

Wishing you as always good trading,

Gary S. Wagner - Executive Producer