Take away the support from dollar weakness and gold would have moved much lower

Video section is only available for

PREMIUM MEMBERS

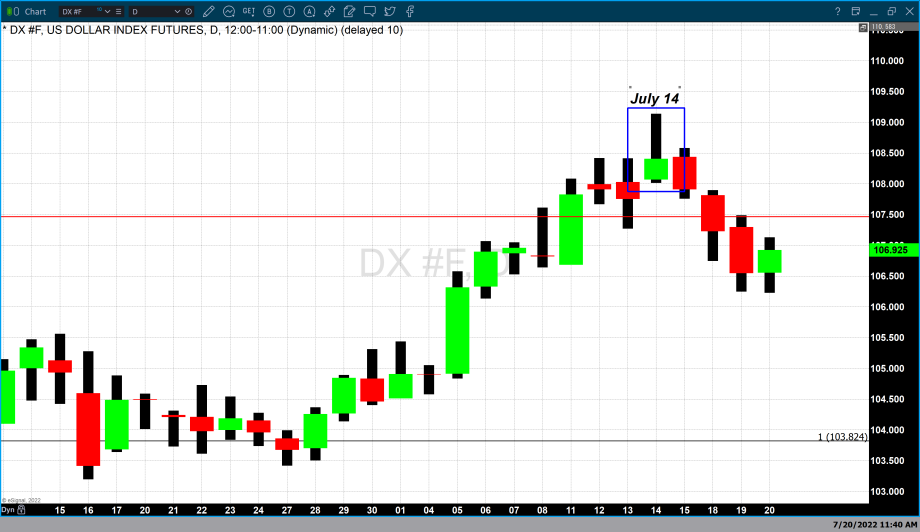

Since last Friday the U.S. dollar has traded under pressure losing value on Friday, Monday, and Tuesday. During the same period gold has been trading under mild selling pressure holding on to a price point just above $1700 per ounce. Recently the dollar hit a high just above 109 on Thursday, July 14 before trading lower for three consecutive days. However, even with dollar weakness for three of the four last trading days gold has not gained any significant value.

The decline in dollar value did very little to move gold prices higher. Rather they tempered gold from selling off significantly, keeping the precious yellow metal barely above $1700 per ounce. On Thursday and Friday of last week gold prices dipped below $1700 on an intraday basis, but on both occasions closed just above that key and important psychological price level.

Today the dollar had incremental price gains. As of 5:10 PM EDT, the dollar index is currently fixed at 106.925 after factoring in today’s gain of 0.35%. Concurrently, gold futures lost $16.40 or 0.96%. This clearly illustrates that today's dollar strength has been adding to the selling pressure of gold, but only by a percentage of the overall decline in gold today.

Spot gold is currently fixed at $1696.40 after factoring in today’s decline of $16.40. On closer inspection dollar strength resulted in a $5.50 decline, with the remaining decline of $10.90 directly attributable to selling pressure. This is according to the KGX (Kitco Gold Index).

Recent dollar strength and weakness in gold can be directly attributable to the Federal Reserve’s hawkish monetary policy which has raised rates at each consecutive FOMC meeting since March of this year. Gold traded to its highest level this year in March trading at $2078. This corresponds to the first interest rate hike by the Federal Reserve which also occurred in March. In the last four months, gold has dropped by $383 losing almost 18 ½% in value.

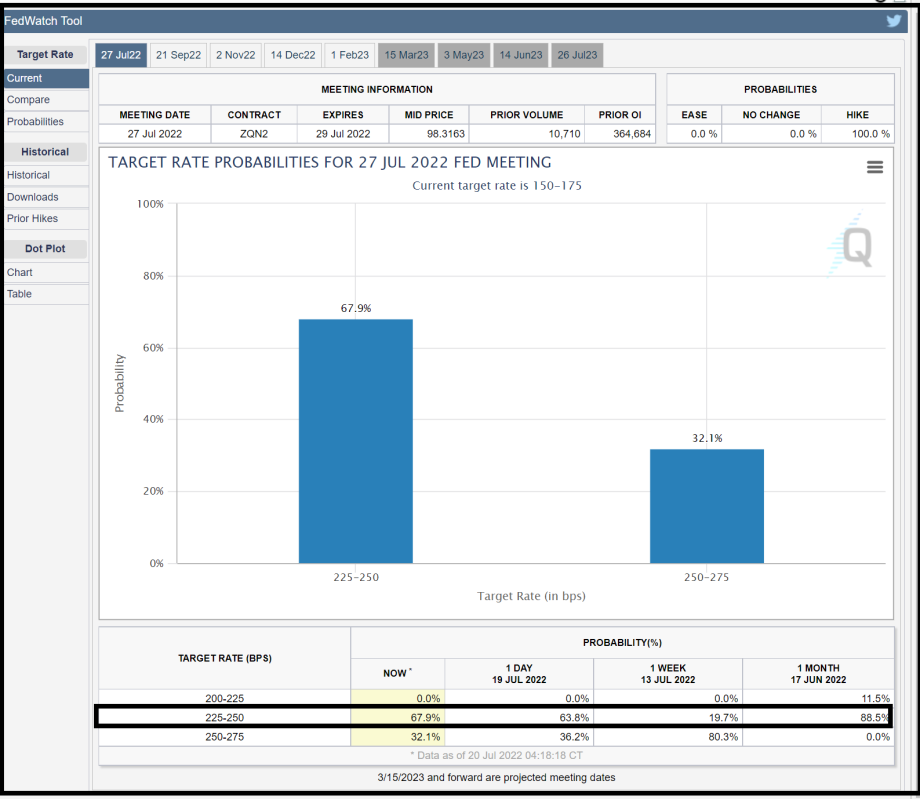

Exactly one week from today the Federal Reserve will conclude the July FOMC meeting and almost certainly will announce the fourth consecutive rate hike this year. It is widely anticipated that the Fed will raise rates again by 75 basis points. However, they could raise rates by 100 basis points although it is widely believed that is unlikely according to the CME’s FedWatch tool. Currently, this rate hike indicator is predicting that there is a 67.9% probability that the Fed will raise rates by 75 basis points next week and a 32.1% probability that they will raise rates by 100 basis points.

This rate hike indicator has had dramatic shifts in its predictions. One week ago on July 13, the fed watch tool predicted that there was an 80.3% probability of a 100% rate hike and a 19.7% probability of a 75-basis point rate hike. This clearly illustrates how market sentiment continues to shift and change as we get closer to the July FOMC meeting.

Wishing you as always good trading,

Gary S. Wagner - Executive Producer