Why economists, analysts, and market participants are focused on October 27

Video section is only available for

PREMIUM MEMBERS

On Thursday, October 27 the government will release its most recent numbers on Q3 GDP and the most updated numbers on our national debt. Economists and investors will be looking to see how deep of an economic contraction has taken place between Q2 and Q3. The Federal Reserve has been aggressively raising interest rates with the end goal of having an economic contraction. Their endgame is to lower the current level of inflation. Therefore, Q3 will almost certainly reveal a continuation of the economic contraction that is already taking place.

By definition, the United States has already begun a recession. If it is revealed that there has been a further contraction of GDP in the third quarter this would be the third quarter in a row in which the GDP in the United States has contracted.

The most recent numbers according to the US Debt Clock.org are indicating that our national debt is currently more than $31 trillion and growing. The most recent numbers from the Federal Reserve revealed that its balance sheet has only declined slightly from approximately $8.7 trillion at its peak to its current level of $8.3 trillion.

It is highly anticipated that the Federal Reserve will continue to raise rates at both the November and December FOMC meetings by a total of 150 basis points over the last two meetings of the year. This would take the Fed’s funds rate to between 450 and 475 basis points. However, interest rates at that level will have profound and negative implications on servicing our national debt. Currently, our national debt is greater than our annual GDP and higher interest rates will make servicing that national debt much more costly to the government.

This means that interest rates at 4 ½% to 5 ½% are unsustainable for any protracted length of time because it will increase the cost of servicing our federal debt. The question becomes will the Federal Reserve adjust its current extremely hawkish monetary policy or at least pause the interest rate hikes after December? More importantly, maintaining interest rates at that level for any sustained time will have extremely detrimental effects on our government’s ability to service the interest payments alone on the $30,000 trillion in debt.

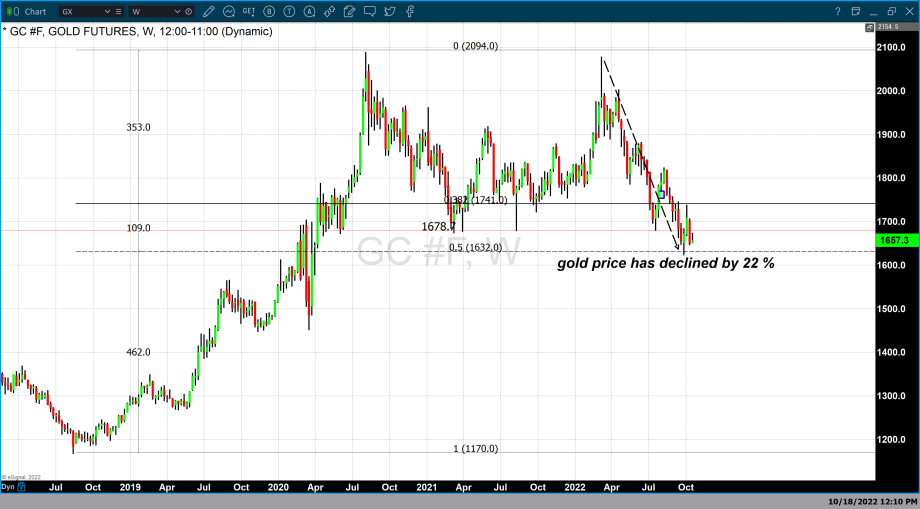

We have seen both gold and silver prices come under pressure since the Federal Reserve began raising rates in March of this year. Gold has traded from a high of $2078 in March to its recent low of just above $1620. In other words, gold has declined by just over 22% from the highs of March to the lows that occurred at the end of September.

Silver has sustained a much deeper drawdown from the highs in March of this year of $27.45 per ounce to current pricing at approximately $18.68. This is a price decline or loss in value of over 32% per ounce of silver. The short-term outlook for both gold and silver prices continues to have a bearish bias based on the upcoming interest rate hikes by the Federal Reserve in November and December.

The decline in gold and silver this year has been substantial and the question is whether or not next week’s government report on third-quarter GDP and updated national debt will affect market sentiment for the precious metals.

Wishing you as always good trading and good health,

Gary S. Wagner - Executive Producer