Will $1700 become a sustainable support level for gold?

Video section is only available for

PREMIUM MEMBERS

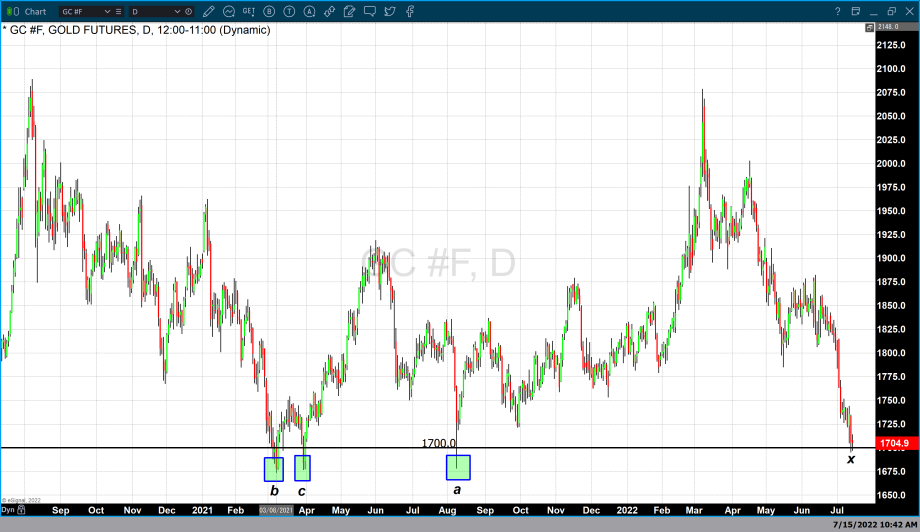

Over the two trading days gold futures have traded below $1700 (marked X) and, on both occasions, recovered closing above that case psychological level. So, it is not illogical to wonder whether or not this price point will become a sustainable level of support or simply a pause before gold heads to lower prices.

Historically speaking the last time gold traded below $1700 occurred on August 9, 2021, the day of the “flash crash”. On Monday, August 9, 2021(marked a) gold opened at $1765 traded to a low of $1678, and closed at $1726. In this instance, $1700 played little technical importance within that one-hundred-dollar trading range. Before that gold traded below $1700 on two occasions in March 2021.

In both instances, gold traded to a low of approximately $1678. At the beginning of March 2021(marked b) gold traded below $1700 for three consecutive days before it moved above that price point. During the second instance that occurred at the end of March (marked c) gold broke below 1700 and then on the following day open below 1700 but closed well above that price point.

While historical studies can reveal many aspects and identify technical support and resistance levels, each identified example was caused by underlying fundamental events based on a unique set of factors and therefore may only offer fractional insight. More so, in each example over the last two years in which gold traded below $1700, it resulted in much lower prices before concluding and trading back above that price point. In fact, in all three examples highlighted on the chart, the price decline resulted in gold quickly moving below $1700 and trading to approximately $1680 before finding support.

The chart above (chart 2) is also a daily chart of gold futures. It references the same instances when gold broke below $1700 per ounce on three occasions. However, it highlights those lows which indicate that on each occasion gold broke through $1700 and did not find any price support until approximately $1780 per ounce.

Given that during each instance different fundamental events resulted in gold’s price decline. However, on each occasion, gold found support technical or otherwise at $1680.

As of 5:23 PM EDT gold futures basis, the most active August contract is currently trading up $0.70 or 0.04% and fixed at $1706.50. Like yesterday gold broke below $1700 and effectively closed above that price point. However, if past studies result in any real insight it seems more likely that gold prices will not hold at $1700 only based on technical indicators. There would have to be a fundamental event that resulted in a dynamic pivot or shift in the current bearish market sentiment that has been prevalent in gold. With the latest CPI and PPI report this week indicating that inflationary pressures have increased since last month and remain persistent, the possibility that the Federal Reserve will raise rates by a full percentage point at this month’s FOMC meeting is real. This fact could certainly move gold lower.

Wishing you as always good trading,

Gary S. Wagner - Executive Producer