Changing expectations of the Fed’s forward guidance pressure gold lower

Video section is only available for

PREMIUM MEMBERS

The Federal Reserve first spoke about its forward guidance at last year’s Jackson Hole Economic Symposium. Specifically, it was Chairman Powell’s keynote speech that delivered the blow to the American public about its intent to raise rates and keep those elevated rates in place until the Fed hits its 2% inflation target.

Tight Monetary Policy for Longer

After the December FOMC meeting the Federal Reserve released its economic projections for 2023 - 2025 including the most recent dot plot. The dot plot is the Fed’s mechanism for predicting future rates by calling on 17 Fed officials to vote on future monetary policy. In the case of the December dot plot, it revealed an overwhelming consensus that the Fed would raise rates to a target of just over 5%, and keep rates elevated for the entire calendar year of 2023.

Although the Federal Reserve has maintained its policy, it was market participants' expectations that have recently shifted from disbelief to an acceptance that the Fed will not likely back off its extremely hawkish monetary policy. This includes continued rate hikes and maintaining those elevated rates throughout the year.

Impact on Gold

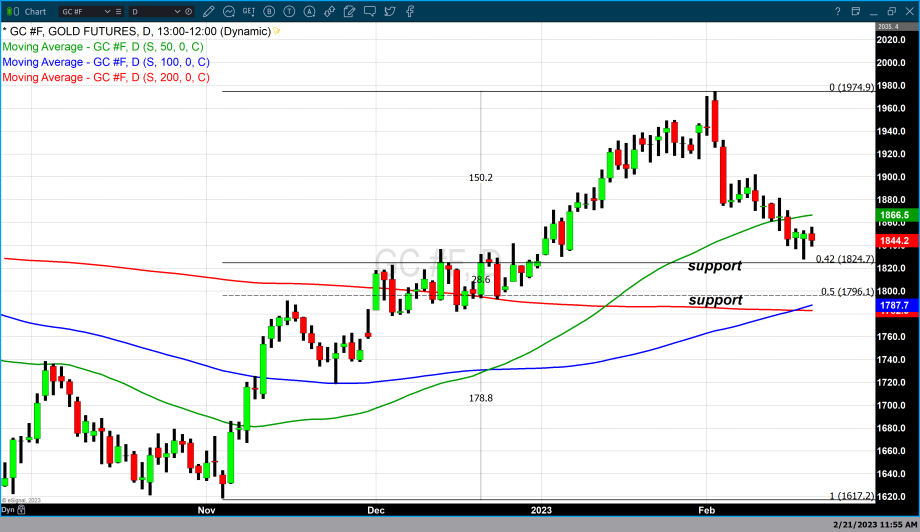

During February market sentiment regarding the forward guidance of the Federal Reserve shifted from uncertainty to acceptance. That resulted in gold trading under pressure for the last three consecutive weeks. On the first full trading day of the week (due to shortened trading hours yesterday on Presidents’ Day) gold is once again trading under pressure. As of 3:25 PM EST, the most active April futures contract is down $5.30 or 0.29% and fixed at $1844.80.

While it is true that inflation has been declining since the Federal Reserve began raising rates in March of last year, recent data suggests that inflation is not diminishing as quickly as the Federal Reserve had hoped. The jobs report for January coming in well over the forecast of 188,000 versus 517,000 combined with the most recent inflation reports suggests that inflation remains elevated and persistent in certain sectors.

The most recent data has cemented the idea that the Federal Reserve will maintain its hawkish monetary policy with a real possibility of two more rate hikes and most importantly maintain the new elevated rates throughout 2023.

Gary S. Wagner - Executive Producer